Wentworth Resources and Maurel & Prom S.A. have reached agreement on the terms of a recommended acquisition of the entire issued and to be issued share capital of Wentworth by M&P. The Acquisition will be subject to the Conditions and certain further terms set out in the Scheme Document and each Wentworth Shareholders will be entitled to receive 32.5 pence in cash

The Acquisition values the entire issued and to be issued ordinary share capital of Wentworth at approximately £61.7 million and the business and non-cash net assets of Wentworth(1) at approximately £37.1 million. The Acquisition represents a material increase to the initial indicative offer price proposed by M&P on 23 September 2022.

Background to and reasons for the Acquisition

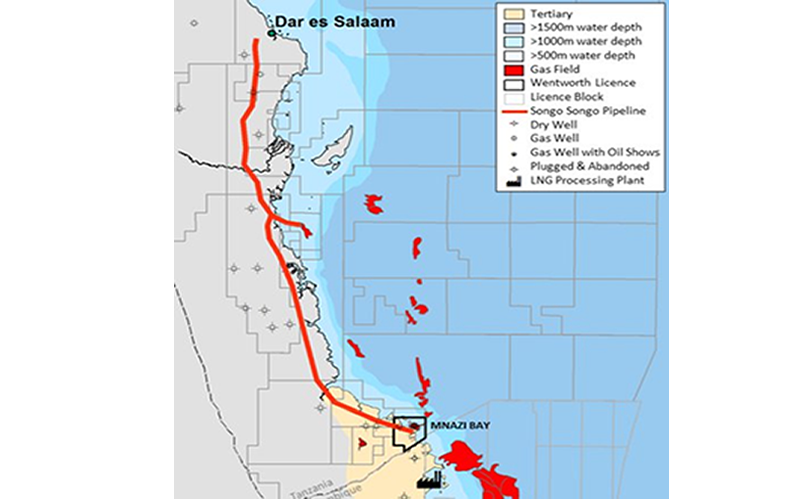

Wentworth’s sole non-cash asset is its non-operated 31.94% (direct and indirect) interest in the Mnazi Bay gas asset in Tanzania. As the majority owner and operator of the Mnazi Bay gas asset, M&P is familiar with and has a good understanding of the value of the Mnazi Bay asset and accordingly of Wentworth. As partners in the asset, M&P and Wentworth have an existing relationship which extends over a number of years.

The Acquisition will provide Wentworth Shareholders with an immediate upfront realisation of value in cash for their Wentworth Shares at a substantial premium to the market price, and an opportunity to realise this value despite the limited liquidity in Wentworth Shares. As M&P is a partner and the operator of the Mnazi Bay asset with existing in-country relationships this is expected to facilitate a timely implementation of the Acquisition and a smooth continuation of operations.

“As the operator of the Mnazi Bay gas field, increasing our stake through the acquisition of Wentworth is a logical step and reflects our stated strategy of maximising value from existing assets. Mnazi Bay is an important project to M&P and we look forward to ensuring it continues to make a positive impact, helping Tanzania meet its increasing energy demands and enabling local development. We are pleased to have agreed a fair value with Wentworth and will provide further updates on the acquisition process in due course,” Olivier de Langavant, Chief Executive Officer of M&P said.

“The Board of Wentworth is pleased to recommend the acquisition by M&P which represents a substantial premium to Wentworth’s prevailing share price and offers an opportunity for our shareholders to realise this value in the near term for cash.

Wentworth has created significant value for shareholders over recent years through share price appreciation alongside substantial capital return from both dividends and share buybacks. Having pursued the Company’s stated strategy of further growth in Tanzania in recent years, the Board believes the offer from M&P delivers immediate value to our shareholders at an opportune time. M&P is the operator and majority owner of our sole asset, Mnazi Bay, and this is a logical combination that we believe is in the best interests of our shareholders, wider stakeholders and of Tanzania. Wentworth will now work with its in-country stakeholders to assist M&P to achieve the required regulatory approvals in a timely manner and deliver this compelling outcome for our shareholders,” Tim Bushell, Chairman of Wentworth, said.

Oilfieldafricareview offers you reviews and news about the oil industry.

Get updates lastest happening in your industry.

©2025 Copyright - Oilfieldafricareview.com

Please wait....

Thank you for subscribing...