The arrival of the $2.5bn floating Coral South facility in Mozambique could help revive the country’s potentially transformative LNG sector, as the government assures oil and gas majors that the security situation is under control.

A floating plant for liquefying natural gas arrived in Mozambican waters on January 3 after a seven week maritime voyage from South Korea.

Constructed by Samsung Heavy Industries (SHI), it is the first offshore project to come online in the nation’s embattled gas industry. It is also the first floating LNG facility to be deployed in the deep waters of the African continent, and the third in the world.

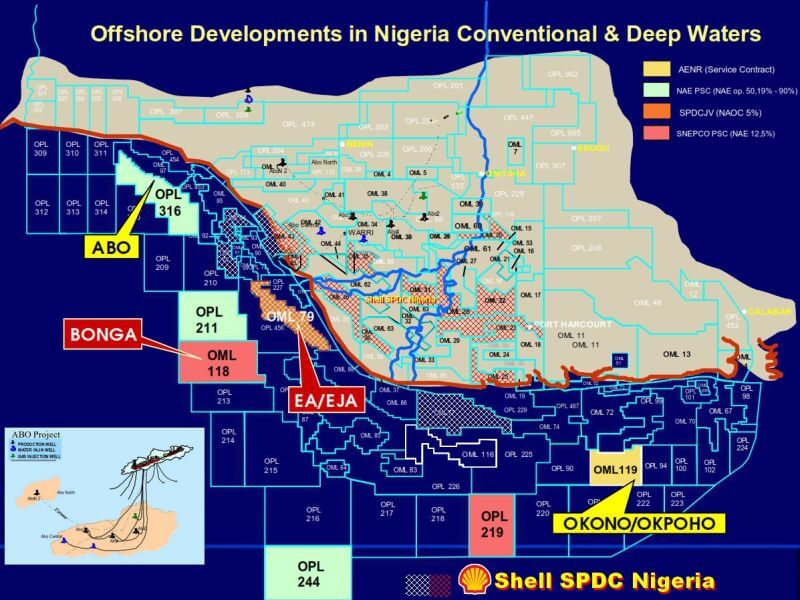

Lying above the 450 billion cubic meters (Bcm) of resources in the Coral field in Area 4 of the Rovuma Basin, the plant has the capacity to liquefy 3.4 million tons of natural gas per year from subsea gas producing wells per year.

MOZAMBIQUE PLANS FRESH OIL AND GAS BIDDING ROUND

Mozambiquecan is planning to launch the country’s 6th licence bid round for 16 new oil and gas blocs and the results are expected to be announced next October, the National Petroleum Institute (INP) said.

The anticipated announcement of Mozambique’s 6th oil and gas licensing round will promote exploration and production activities, and we have comprehensive data coverage from shallow to deep water that provides insight into the geology offshore Mozambique.

According to INP, the auction will focus on four regions, including the Rovuma Basin, off its northern coast, where the country discovered rich gas reserves and five new blocs will be open for bids.

Area 4 of the Rovuma Basin is operated by Italian oil and gas giant Eni, who signed a 20-year agreement to sell 100 per cent of LNG production to British Petroleum (BP) in 2016.

The plant will extract gas from Area 4 of the Rovuma basin, located off the shore of the Cabo Delgado province of northern Mozambique, starting in the second half of the year.

The Project and Security

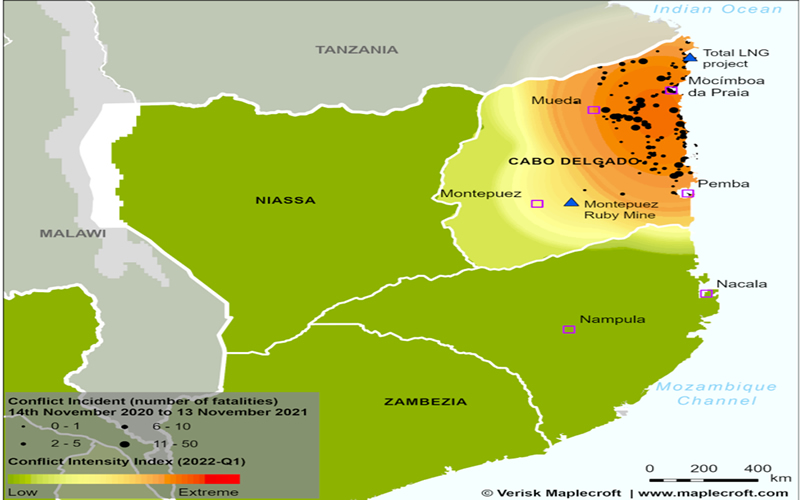

Mozambique’s fledgling oil and gas industry has the potential to produce more than 30 million mt of LNG a year. But the country’s ambitions to join the ranks of the world’s largest LNG exporters have been thwarted by a growing Islamist insurgency in the gas-rich Cabo Delgado province that began in October 2017.

The project comes as Mozambique’s government assures oil majors that the security situation in the Cabo Delgado region is under control after four years of disruption and halted projects.

Most of the gas from the various projects is piped onshore for processing at the port of Afungi, which is vulnerable to attacks from terrorist group AhluSunnahWa-Jamamah (ASWJ).

The ASWJ, originating in Cabo Delgado Province, launched violent attacks on villages before targeting the planned LNG scheme. More than 3,000 people have been killed and 820,000 have fled their homes.

In March, attacks close to gas sites prompted developer TotalEnergies – the new name for French firm Total – to suspend work on the LNG plant by declaring force majeure, which will process gas for both of the main offshore gas consortia in the area. Billions of dollars of investment are at stake in a project that could transform Mozambique’s economic prospects.

The deployment in August 2021 of Rwandan military forces and the SADC Mission in Mozambique (SAMIM) has allowed Mozambican security forces to make tactical successes.

In a State of the Nation address in December, President Filipe Nyusi assured investors that the government had made significant gains against the Islamic State affiliated Al-Sunnawa Jama’a (ASWJ) in the northern province of Cabo Delgado.

But an easing of security fears may be premature as ASWJ shifts its strategy and adopts more conventional guerrilla tactics, expanding westward towards the neighboring province of Niassa, says Alexandre Raymakers, a senior Africa analyst at Verisk Maplecroft.

“President Nyusi’s optimistic analysis of the situation in Cabo Delgado is primarily driven by his desire to portray recent tactical successes as evidence that the tide has turned in Maputo’s favour and that the government can guarantee the security of LNG projects. Indeed, Maputo is hoping that high profile successes will entice LNG operators to resume their work, which have been suspended since March 2021.”

Mozambique’s performance on Verisk Maplecroft’s conflict intensity Index: 2022 Q1.

Remote and sparsely populated, Niassa is an ideal rear base for the insurgents to reorganise and develop a new supply line through Malawi and Southern Tanzania.

“The presence of a 2,000-strong Rwandan contingent will however reduce the frequency of attacks in the district of Palma, where TotalEnergies’ Afungi LNG project is located. We expect Maputo to continue concentrating its most capable military forces in the district in order to reassure TotalEnergies that it can guarantee the security of its project,” says Raymakers.

TotalEnergies will likely resume work in the next six months to assure shareholders that the suspension was temporary, Raymakers says.

“However, the evolving threat posed by ASWJ means that the resumption of work at the project site remains outside the company’s control.”

The departure of regional forces would also likely lead to a rapid deterioration in the security situation, Raymakers adds. “Although, SAMIM’s mandate is likely to be renewed this month, it is unlikely to last longer than 12 months due to the SADC’s limited ability to fund the mission. We however expect the Rwandan contingent to remain in place, protecting key LNG sites in Palma district, for the next 12 months at least.”