According to TGS in its previous article, oil price at $60/bbl has reduced rig counts, and declining production, but demand for natural gas has driven the Henry Hub spot price to 2-year highs in early 2025. TGS in the article will explore the positive developments in natural gas and some of the factors contributing to increased prices.

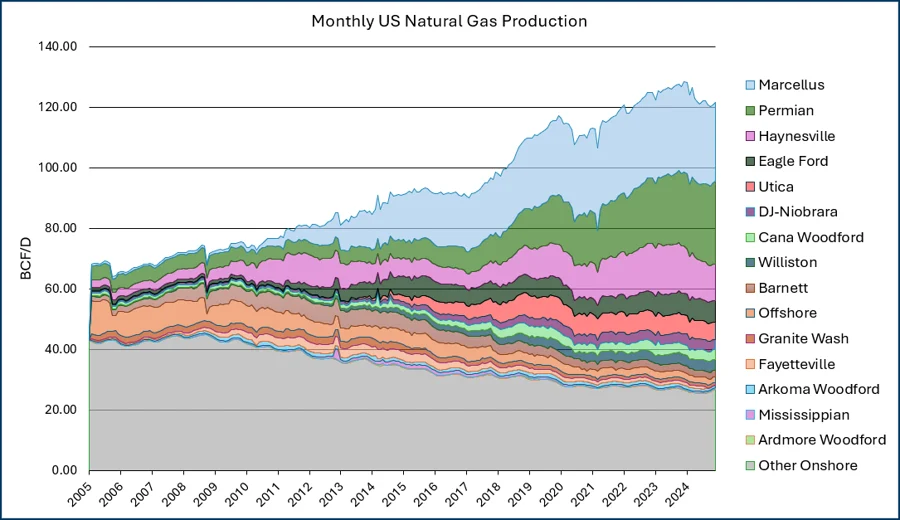

In 2024, US natural gas production was over 120Bcf/d, amounting to 43.8 Tcf/year (TGS data, Figure 1). This production was led by large gas basins, like the Marcellus and Haynesville, along with strong associated gas production in the Permian Basin and the Eagle Ford. In 2024, Henry Hub spot price averaged $2.19/MMbtu, but in 2025 gas prices have doubled, reaching a high of $4.49/MMbtu in March before coming back down to $3.50/MMbtu where they sit at the time of writing this article. So, let’s look at what is contributing to this price surge, and how companies have been maneuvering to take advantage of it.

Higher demand for natural gas is a result of several global factors, such as weather, growing data center needs, and geopolitical shifts. Colder than expected winters in North America and Europe have reduced underground storage levels below 5-year averages, reducing supply and increasing demand to replenish. Data center projects needed to feed the AI boom have been rapidly increasing, with high energy needs at each center. East Daley Analytics’ base case predicts up to 6 Bcf/d of natural gas demand from data centers in 2030, attributed to 290 projects across the US. Europe is seeking increased LNG exports from America as Russian gas flowing through Ukraine was halted at the beginning of the year.

Record LNG exports have tightened domestic supply, and facilities projects continue to increase export capacity for this growing demand. Freeport LNG’s export plant, capable of converting 2.1 Bcf/d into LNG, is back up and running after a brief outage on May 6. Floating LNG (FLNG) manufacturers are increasing scale, as Samsung Heavy Industries receives preliminary approval from the US, UK, and Norway at the Offshore Technology Conference (OTC) for their standardized FLNG model, MLF-O, with a cargo capacity of 220,000 cubic meters. The Federal Energy Regulatory Commission (FERC) has approved several LNG projects, including Venture Global’s Calcasieu Pass 2 LNG terminal, which has a planned capacity of 20 million tonnes per year (mtpa), and the EIA forecasts LNG exports to increase 22% in 2025 and 10% in 2026.

While the Henry Hub spot price has been volatile the past few months, currently sitting at $3.50/MMbtu, EIA projects the price to remain high averaging $4.10/MMbtu for 2025 and $4.80/MMbtu for 2026. Several companies have been positioning themselves to take advantage of higher gas prices. Citadel acquired Haynesville operator Paloma Natural Resources for $1 billion. EQT acquired upstream and midstream assets of Olympus for $1.8 billion to expand their assets in the gas-rich Marcellus region, and last year they acquired pipeline operator Equitrans Midstream for $14 billion. NRG is acquiring a fleet of natural gas power plants for $12 billion.

Using TGS Well Data Analytics production data, we can see the top gas producing regions in Figure 1 and infer which basins to keep an eye on for future deals and developments centered on natural gas. While the Permian and Eagle Ford aren’t pure gas plays, the sheer volume of hydrocarbons they produce and their proximity to natural gas pipelines and LNG infrastructure put them in an excellent position to benefit from higher gas prices. Haynesville and Appalachia plays have been targets for large acquisitions discussed in this article and will likely see more activity.