With the recent shortlisting of 161 indigenous companies to advance to the next and final stage of the bid round process for 57 marginal oilfields in the country, the Nigerian oil and gas industry is expected to witness tremendous growth in no distant time a source from Nigeria regulatory body DPR reported..

The 161 successful companies were selected from the over 600 that applied for pre-qualification, again showing that the Federal Government is creating an enabling environment for investment.

A marginal oil field is any field that has reserves booked and reported annually to the Department of Petroleum Resources (DPR) and has remained undeveloped for over 10 years.

These fields are oil fields that have been discovered by major international oil companies (IOCs) in Nigeria in the course of exploring larger acreages.

The President, by the provisions of the Petroleum (Amendment) Act of 1996 has the power to declare a field as a marginal field where a discovery has been made but has been left unattended for 10 years.

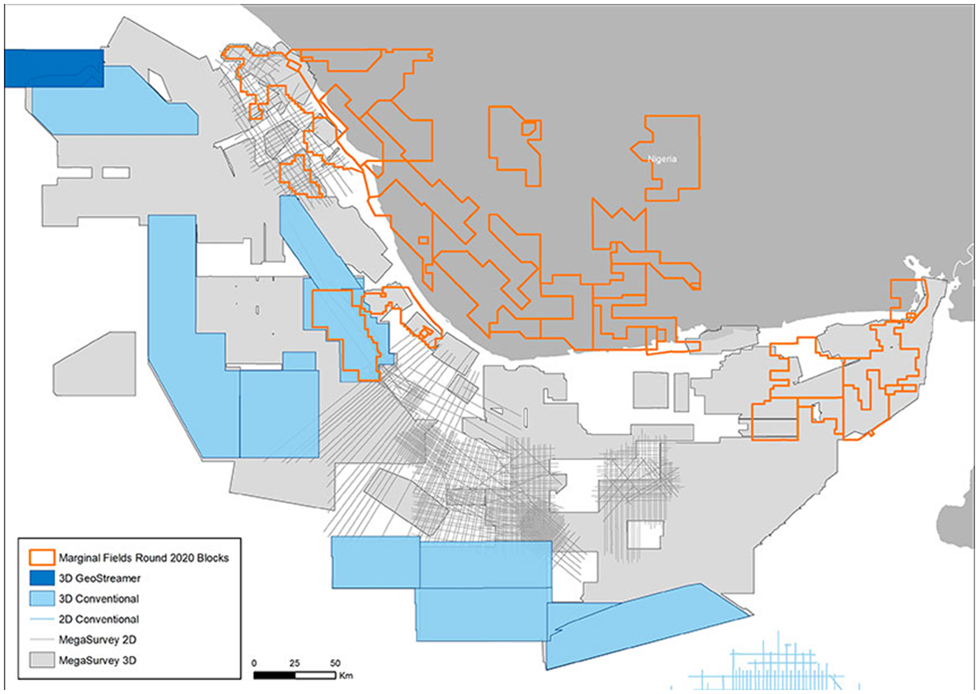

The major reasons for awarding marginal fields are to create new and diverse investment and boost reserves. Marginal fields in Nigeria are located onshore and in the shallow waters. There are about 178 marginal oil fields.

The last bid round conducted in 2003 was fraught with litigations and other challenges which hampered the development of some of the awarded 24 marginal oilfields to the detriment of the nation.

A similar exercise was attempted in 2013/2014 but it was suspended for myriads of reasons including lack of transparency in the bidding processes.

Thus, when the DPR announced on June 1, 2020, that it has opened bid rounds for 57 marginal oilfields in the country, some sceptics believed that the process would go the way previous exercises had gone in the past.

For instance, statistics show that nine out of the 24 marginal oilfields awarded in 2003 are productive while the others are under-utilised.

They also show that 67 per cent of marginal fields have not produced a single barrel of oil since they were issued licenses.

Faced with these daunting challenges, the DPR management under the able leadership of Mr Sarki Auwalu was determined to adopt a different and strategic approach for the 2020 marginal oilfield bid rounds.

The emergence of the COVID-19 pandemic and the crash in global crude oil prices left the regulatory agency with no option than to ensure that the exercise is successfully conducted in line with the anti-corruption mantra of the President Muhammadu Buhari administration and for the benefit of the country.

Auwalu says: “This time around the process will be automated unlike in the past. Our awardees will be credible investors with technical and financial capability.

“There is also the Post-General Award Conditions. This deals with the transfer of interest post-award. It means awardees cannot transfer more than 49 per cent interest to another party post-award.

“It also includes termination of rights of interest holder which gives the minister power to withdraw the interest of a party who fail to meet its obligations in terms of joint awardees.”

Auwalu says the conditions protect the interest of all investors, stressing that any disagreement arising among awardees and their partners post-award will first be referred to the Nigeria Oil and Gas Alternative Dispute Resolution Centre in DPR.

According to him, this will reduce the years spent in courts over disputes which usually lead to non-performance of the marginal fields, adding that such awards will henceforth be withdrawn by the government.

Commenting on the ongoing process, Mr Bank-Anthony Okoroafor, a former Chairman of Petroleum Technology Association of Nigeria (PETAN), says he is impressed with the way DPR has handled the bid rounds.

“I have to be honest with you. The way I have seen the exercise is that it went very well. It was transparent and apart from being transparent, it was detailed.

“There was, first of all, a pre-qualification stage where all the companies had to show technical and financial capacity. After that, those that were successful were now able to bid for the assets.

“And for once, there was no leakage. I think the DPR managed to keep the process very secret,” Okoroafor says.

Despite the shortcomings of previous exercises, awarding of marginal oilfield bid licenses remains a positive move for the nation’s oil and gas industry.

The DPR says the objective of the 2020 marginal field bid round is to deepen the participation of indigenous companies in the upstream segment of the industry and provide opportunities for technical and financial partnerships for investors.

According to the agency, the existing 16 marginal oilfields contribute two per cent to the national and gas reserves and their operations have brought peace and development to their host communities in the Niger Delta.

The agency says it will also expand the government’s revenue, which has dwindled due to the crash of crude oil prices at the international market and create jobs through Exploration and Production activities.

This will in turn expand the sector’s contribution to Nigeria’s Gross Domestic Product (GDP) which is only about 10 per cent.

It is also interesting to note that indigenous companies such as Seplat Petroleum Development Company, Waltersmith Petroman Oil Limited and Niger Delta Petroleum Resources all emerged from previous marginal oilfield bid rounds.

These companies have grown over the years to become key players in the oil and gas space and it is expected that the 2020 marginal oilfield bid rounds would produce similar companies who would help Nigeria to become a petroleum products refining hub in future.