The Nigerian Upstream Petroleum Regulatory Commission (NUPRC) has issued an official clarification on the status of the TotalEnergies and Chappal Energies deal, which first received a ministerial consent on October 28, 2024.

The clarification has become imperative due to a series of media enquiries.

Recall that the NUPRC had, on October 28, 2024, conveyed a grant of ministerial consent to the transfer of TotalEnergies’ entire 10% participating interest in the Nigerian National Petroleum Company Limited (NNPCL) and Shell Petroleum Development Company (SPDC) Joint Venture – excluding OMLs 23, 28, and 77 – to Telema Energies Nigeria Limited (owned by Chappal Energies).

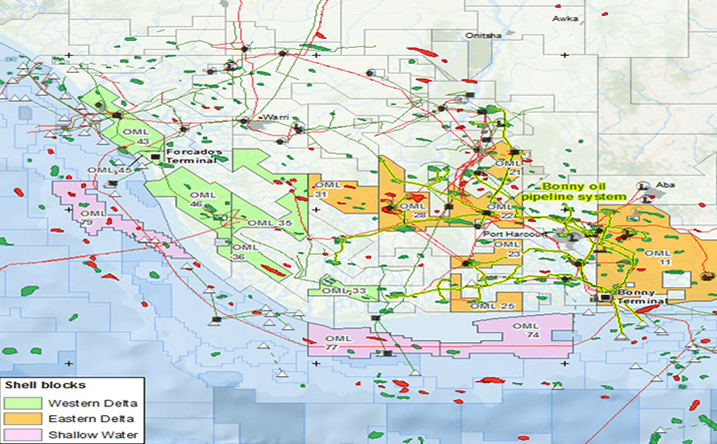

Specifically, this divestment involved TotalEnergies’ 10% participating interest in the following Oil Mining Leases (OMLs): 20, 21, 22, 23, 25, 27, 28, 31, 32, 33, 35, 36, 43, 45, 46, 74, 77, and 79.

The Nigerian regulatory body stated that months after the approval, Chappal Energies had failed to consummate the divestment deal. This was despite the Commission’s gracious extensions. Based on this, the ministerial consent was withdrawn on May 29, 2025.

The withdrawal of a ministerial consent does not in any way rule out the possibility of a future divestment by the interested parties, provided such an asset sale is in line with the Nigerian extant laws.

The NUPRC affirms that, in line with Section 6(h) of the Petroleum Industry Act, it remains committed to promoting an enabling environment for investments in upstream petroleum operations.

TotalEnergies announced on July 17, 2024, that its subsidiary TotalEnergies EP Nigeria signed a sale and purchase agreement (SPA) with Chappal Energies for the sale of its 10% interest in the SPDC JV licenses in Nigeria.

SPDC JV is an unincorporated joint venture between Nigerian National Petroleum Corporation Ltd (55%), Shell Petroleum Development Company of Nigeria (30%, operator), TotalEnergies EP Nigeria (10%) and NAOC (5%), which holds 18 licenses in the Niger Delta.

Under the SPA signed with Chappal Energies, TotalEnergies EP Nigeria will sell to Chappal Energies its 10% participating interest and all its rights and obligations in 15 licenses of SPDC JV, which are producing mainly oil. Production from these licenses represented approximately 14,000 barrels equivalent per day in the Company’s share in 2023.

TotalEnergies EP Nigeria also transferred to Chappal Energies its 10% participating interest in the three other licenses of SPDC JV, which are producing mainly gas (OML 23, OML 28, and OML 77), while retaining full economic interest in these licenses, which currently account for 40% of Nigeria LNG gas supply. The transaction was concluded for a firm consideration of USD 860 million.