The Nigerian Content Development and Monitoring Board (NCDMB) have secured approval to launch a US$50 million fund for NOGAPS Manufacturing Product Line. This fund would be dedicated to companies that would operate in the Nigerian Oil and Gas Parks and engage in the manufacturing of equipment components used in the oil and gas industry and linkage sectors.

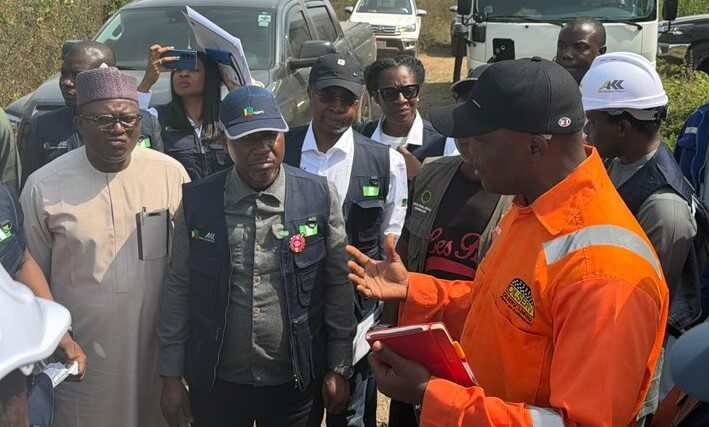

The Executive Secretary of NCDMB, Engr. Simbi Kesiye Wabote revealed this recently in Port Harcourt, Rivers State at the commissioning of the ultra-modern valves assembling facility established by Catobi Nigeria Enterprises Limited.

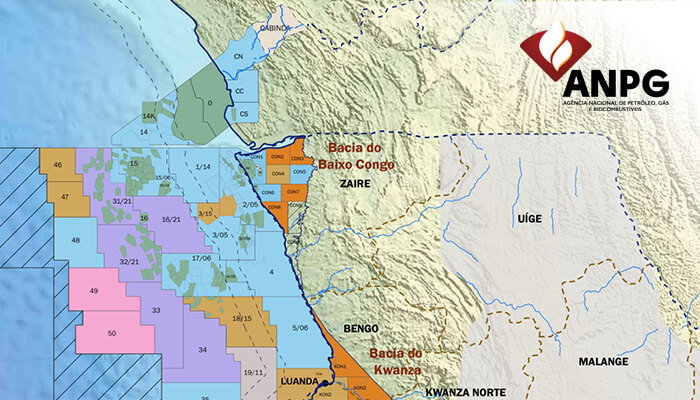

The fund would support oil and gas companies that would operate in the oil and gas parks developed by the Board in Bayelsa and Cross River State. The parks are expected to be commissioned and operational in the 4th quarter of 2022 and would incubate the manufacturing of equipment components utilized in the oil and gas industry and create an estimated 2000 jobs in each park.

In his words, “on Thursday, the Governing Council of the Board approved an additional $50m product in the Nigerian Content Intervention (NCI) Fund to support in-country manufacturing of components within the industrial parks currently being developed by the Board in Bayelsa and Cross River States.”

The Executive Secretary stated that NCDMB understands the challenge associated with manufacturing, especially the reluctance of banks to extend loans to manufacturers, because of the long repayment period for such facilities. He disclosed that the NOGAPS Manufacturing fund will soon be launched and will be managed by the Bank of Industry (BoI) to address the identified challenges.

The new fund would be a stand-alone product line with distinct fund allocation and special eligibility criteria and collateral structure. The decision of the Board to establish the product was informed by the peculiarities of the manufacturing sector, which include infrastructure challenges, long gestation, long lead time before returns, low margins on products, and high risk attached to the endeavor, in addition to the reluctance of commercial banks to lend to the sector and application of stiff collateral and eligibility criteria where loans are extended.

The Board established the NCI Fund in 2018 with the purpose of financing Oil and Gas companies to increase capacity and grow Nigerian Content in the Industry Presently, the NCI Fund has five product lines which are being managed by the Bank of Industry. They include – Manufacturing Finance -$10m; Asset Acquisition Finance -$10m; Contract Finance -$5m; Loan Refinance -$10m and Community Contractor Finance – N20 million.

The Board also has a US$30 million Working Capital Fund for oil and gas service companies andUS$20m Fund for Women in Oil and Gas Intervention Fund. Both facilities are administered by the Nexim Nigerian Export-Import Bank and the agreements were signed in mid-2021.

The Executive Secretary stressed that the manufacturing sector is central to the overall initiative of the Federal Government and NCDMB to develop the economy and create indigenous capacity in the supply chain. He underscored the linkage between access to manufacturing finance with the viability of the Nigerian Oil & Gas Parks when operational.

The NCDMB boss disclosed that the Nigerian Content Equipment Certificate (NCEC) was one of the important tools introduced by the Board to encourage local manufacturing, assembly, fabrication, threading, coating, repair/maintenance, calibration, and testing of equipment.

He reiterated that the NCEC has helped drive the establishment and development of facilities and infrastructure for local manufacturing and related activities in collaboration with Original Equipment Manufacturers (OEMs), investors and technical partners. He stated further that it has promoted the development and growth of human capital, especially local skilled manpower and industry/technology experts.