Africa Oil has taken note on the media disclosure recently made by TotalEnergies in ushering in of the renewal of Oil Mining License (OML) 130 for a period of 20 years which Africa Oil has an effective 8% interest in asset through its 50% shareholding in Prime Oil & Gas Coöperatief U.A. (Prime).

The company is welcoming the renewal of OML 130 which comprises of Akpo, Egina and Preowei fields as a new dawn in the Nigeria oil and gas sector as it will be now operate under the terms of the new Petroleum Industry Act (PIA), being the first assets to effectively benefit from the PIA fiscal terms.

This license renewal, a condition precedent to the closing of Prime’s debt refinancing, will allow Prime to enhance its debt capacity, reset its tenor to 6 years and materially increase its near-term liquidity capacity. Closing of the refinancing, expected in the next few days, will provide Prime with the scope to distribute dividends to its shareholders, including Africa Oil, during this year.

The renewal of OML 130 will also allow the Company to increase the available amount of its standby corporate credit facility to $200.0 million from $100.0 million currently, significantly increasing its liquidity. This facility, which is currently unutilised, is available to be drawn until October 20, 2023.

“The renewal of OML 130 is very good news for the Company and its shareholders. This license is the core of our Nigerian investment and accounts for most of Prime’s production and cashflows. It also includes attractive growth opportunities such as the undeveloped Preowei oil discovery, which we can now take forward towards a final investment decision. Additional opportunities include step-out exploration and appraisal drilling, that should support production rates over the coming years.

Africa Oil has a debt-free balance sheet with significant liquidity headroom and a balanced portfolio of production and development assets in Nigeria, plus the industry’s most exciting appraisal and exploration campaign in Namibia’s offshore Orange Basin. Drilling at the Venus-1A well is progressing well and we look forward to updates from the operator in the coming weeks,”Africa Oil President and CEO Keith Hill commented.

Background

Africa Oil completed the acquisition of a 50% shareholding in Prime in January 2020 for a cash consideration of $519.5 million. To date, the Company has received a total of $650.0 million in dividend payments from Prime and achieved payback of its Prime investment in under three years.

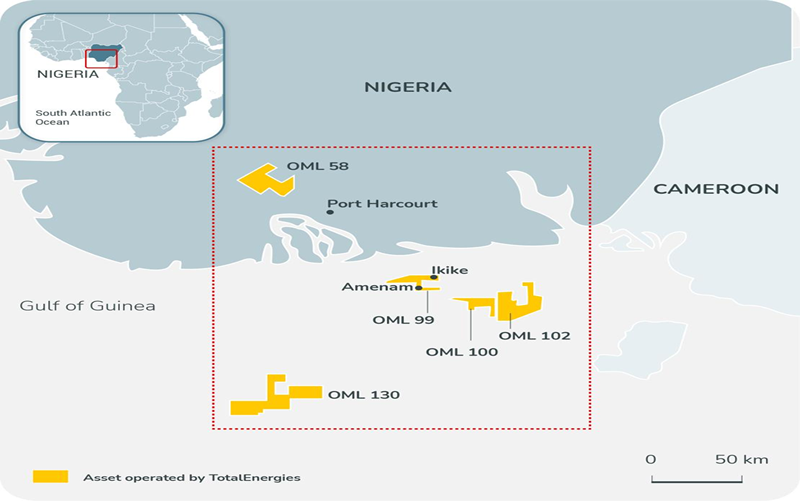

The main assets of Prime are an indirect 8% working interest (“WI”) in OML 127 (4% net to AOC) and an indirect 16% WI in OML 130 (8% net to AOC). OML 127 is operated by affiliates of Chevron and covers part of the producing Agbami field. OML 130 is operated by affiliates of TotalEnergies and contains the producing Akpo and Egina fields. The three fields in these two OMLs are located over 100 km offshore Nigeria. All three fields have high quality reservoirs and produce light to medium sweet crude oil through FPSO facilities. Akpo and Egina also export associated gas which feeds into the Nigerian liquified natural gas plant. OML 130 license area also covers the Preowei undeveloped oil discovery. This asset is expected to be developed through a satellite subsea tieback to the existing Egina FPSO facility.

At end of first quarter 2023 Prime had an outstanding reserves-based lending (“RBL”) facility and a pre-export finance facility with an aggregate outstanding debt amount of $720.3 million ($360.2 million net to AOC). Prime will now complete the refinancing of both these facilities through the closing of a new RBL facility. This new facility is for a principal amount of $1.0 billion ($0.5 billion net to AOC) with a 6-year tenor. Prime also reported a cash position of $396.9 million ($198.5 million net to AOC) at end of first quarter 2023.

At end of first quarter 2023, Africa Oil had a debt-free balance sheet and a cash position of $158.2 million. The Company’s standby credit facility is available until October 20, 2023, with an available amount of $200.0 million. This facility has a maturity of October, 20, 2025.

TotalEnergies, operator of OML130 in Nigeria, Located 150 kilometers off the Nigerian coast, the OML130 block contains the prolific Akpo and Egina fields which came into production in 2009 and 2018 respectively. In 2022, production amounted to 282,000 boe/d: nearly 30% was gas sent to the Nigeria LNG plant, notably contributing to Europe’s energy security. The production start-up from Akpo West, a short-cycle project, is expected by the end of 2023. In addition, OML130 contains the Preowei discovery, to be developed by tie-back to the Egina FPSO.

“Through the OML130 license renewal, TotalEnergies is pleased to continue its contribution to the development of Nigeria’s oil and gas sector. This 20-year extension will enable us to move forward with the FEED studies on the Preowei tie-back project which aims to valorize a discovery using existing facilities in line with Company’s strategy focusing on low-cost and low-emission assets”, said Henri-Max Ndong-Nzue, Senior Vice President Africa, Exploration and Production at TotalEnergies.

TotalEnergies Upstream Nigeria Limited operates OML 130 with a 24% interest, in partnership with CNOOC (45%), Sapetro (15%), Prime 130 (16%) and the Nigerian National Petroleum Company Ltd as the concessionaire of the PSC.