Nigeria, traditionally Africa’s largest oil producer, has seen its oil and gas (O&G) production struggle to maintain its potential output for much of the last decade. For a country that boasts abundant O&G reserves of 37,100 mmbbls and 206 tcf, production remains well below the average of 3 mmboepd seen from 2010-2015. This is partly due to a reduction in upstream capex estimated to be 74% between 2014 and 2022, from US$27 billion (bn) to a mere US$6bn, as reported by the Nigerian Upstream Petroleum Regulatory Commission (NUPRC). Despite this, hopes are high for revitalising the country’s O&G sector, especially in offshore deep waters, as domestic reforms have been introduced to improve the country’s business environment and promote exploration.

Despite subdued exploration and production (E&P) activity over the past decade, there have been some successes in the Nigerian O&G sector. The most notable was the passage of the long-delayed Petroleum Industry Bill (PIB) in 2021. A vital bill mired in a political quagmire since it was initially proposed in 2008, which industry stakeholders stipulate will improve the fiscal attractiveness in the sector. This bill also paved the way for the privatisation of the Nigerian National Petroleum Corporation (NNPC) in July 2022. This is viewed as a win for upstream exploration as a clause in the PIB states that 30% of the NNPC’s profits are to be reinvested in the soon-to-be introduced Frontier Exploration Fund, permitting for a greater focus on exploration of the country’s main frontier basins. The government has also made progress in addressing security instability and oil theft, which have been a continuous bottleneck for the industry.

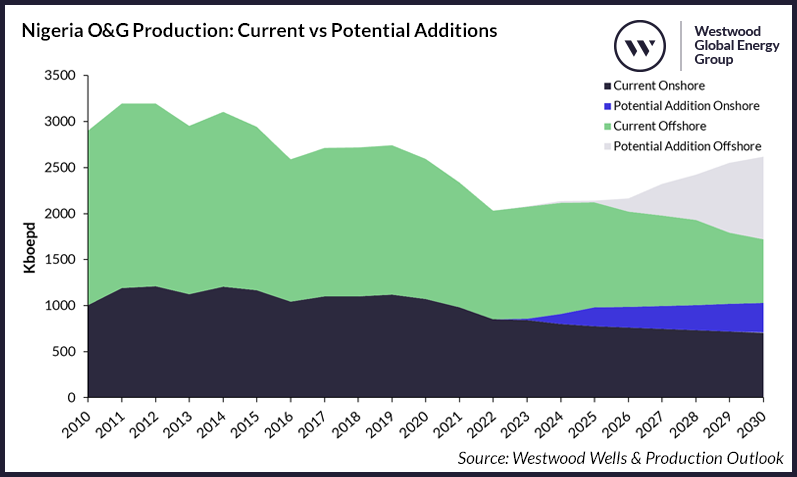

In the political sphere, the newly elected president has made public his administration’s intent to boost crude production from the 1.3 mmbpd produced in 2022 to 2.6 mmbpd by 2027. While Westwood expects there to be growth, this target appears to be overly ambitious. Given the projects on the horizon, Westwood forecasts oil production output of 1.9 mmbpd by 2030. It is pertinent to state that key projects expected to support production increase over the forecast have historically experienced delays, with any further delays potentially causing a permanent dent in Nigeria’s production ambitions. Notable near-term offshore projects include soon-to-be sanctioned TotalEnergies’ Preowei Phase I development, with a production output of 65 kbpd expected to commence in 2026. An additional 120 kbpd from Shell’s Bonga North is also expected in 2027. Furthermore, first oil from ExxonMobil’s Owowo and Bosi oil fields is currently estimated in 2029 and 2030, respectively. Likewise, gas production is expected to register a slight upturn with Shell’s HI and HA shallow water developments coming onstream in 2027 and 2029, respectively. Should they all progress on schedule, this influx of new projects will boost overall O&G production to 2.6 mmboepd by 2030.

SOURCE: WESTWOOD WELLS & PRODUCTION OUTLOOK

Furthermore, Westwood understands there is potential for production to increase beyond our expectations, given a raft of new exploration blocks opening up. In late 2022, the NNPC announced the advancement of a mini-exploratory bid round for seven ultradeep offshore blocks, and bidding took place in January 2023. This follows the 2020 marginal field bid round, where 57 marginal O&G fields were awarded to 24 indigenous players to develop dormant assets in land, swamp and shallow offshore terrains. 2020 also saw a drilling campaign spearheaded by the NNPC, which reportedly resulted in an onshore discovery of 1,000 mmbbls and 500 bcf of gas in the Kolmani area in Northern Nigeria. Geoplex, a local oil field services (OFS) company, has made public its plans to take up a development programme in the offshore Indibe field in OML 67, where it anticipates first oil in 2H 2023. Furthermore, May 2023 saw a slight upturn in onshore drilling carried out by the NNPC when it began the drilling of the Wadi-B appraisal well in the frontier Lake Chad basin targeting a prospect that has been abandoned since the 1980s. In the same month, the NNPC also spudded the Ebenyi-A exploration well in OPL 826 in Borno State.

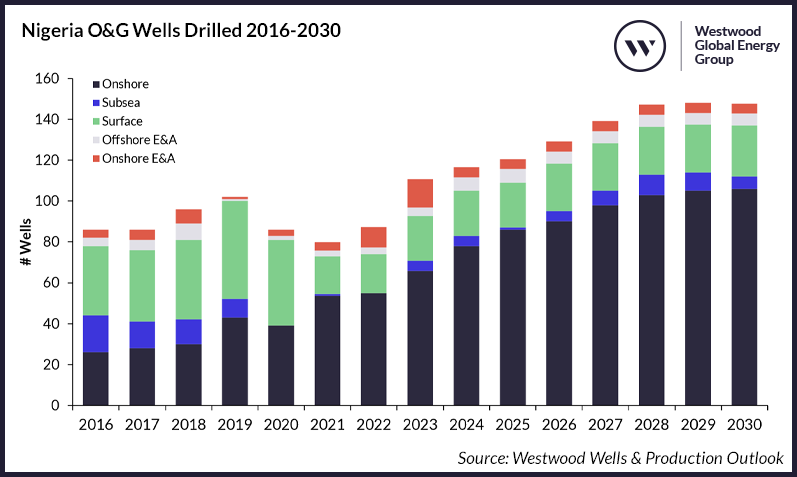

SOURCE: WESTWOOD WELLS & PRODUCTION OUTLOOK

From the development of these discoveries, Westwood anticipates an increase in drilling activities between 2023 and 2030, forecasting an average of 140 development wells to be drilled year-on-year until 2030. This will be driven by onshore activity through increased infill drilling to maintain current production levels in Nigeria’s ageing oil fields and development drilling from marginal fields resulting from the aforementioned leasing rounds. Likewise, offshore deepwater drilling will also see a slight upturn from 2026 onwards in preparation for the development of Shell’s Bonga Southwest-Aparo field, Chevron’s Nsiko, TotalEnergies’ Preowei Phase II development and ExxonMobil’s Uge oil fields, which are all set to start producing post-2030. Infill drilling in deepwater is likely to continue, with the most recent example being the drilling of up to eleven infill wells in TotalEnergies’ Egina and Akpo fields starting in 3Q 2023. In shallow waters, Westwood’s RigLogix states that the number of active jackup rigs has been stagnant, averaging 3.5 since 2021,

following nine active jackup rigs in 2019, which dropped to 7.5 in 2020. Westwood anticipates some gentle uplift in shallow water drilling activity over the forecast period but is not expected to return to pre-2021 levels.

It is pertinent to state that Nigeria is an OPEC member and has recently agreed to a production quota of 1.38 mmbpd in 2024. However, following the initial quota of 1.65 mmbpd set in October 2016, Nigeria has, since May 2020, produced below its quota, averaging just 1.3 mmbpd. The 2024 production quota could limit near-term growth, but crude production of >1.38 mmbpd by the end of 2024 is ambitious and highly unlikely, regardless of Nigeria’s production target. Albeit production quotas at current levels beyond 2024 could have a lasting impact on forecast production growth.

Overall, while Nigeria may not be in a position to hit its targets, the country is setting a solid foundation to capitalise on the energy deficit registered in European nations and hydrocarbon demand from industrialising nations such as China and India by the end of the forecast period. However, Nigeria must tackle its infrastructural and security problems and continue to create an attractive business environment to entice local players and encourage international energy companies to keep investing in assets they currently hold, especially offshore. Westwood anticipates that the coming years will pose an invaluable opportunity for domestic oil companies to take the front seat in onshore and shallow water exploration, with drilling and production expected to grow until at least 2030. All in all, significant strides have been made to transform the O&G industry, and if all aforementioned planned offshore projects move ahead within the current timeline, Nigeria’s upstream sector will experience an upturn in fortunes.