Harvester Energy (UK) Ltd, a wholly owned subsidiary of Harvester Energy Pty Ltd, has been awarded two blocks in the North Sea with confirmed oil reserves ideally suited to the company’s patented small-field development system.

Offshore Aberdeen in the Central North Sea, Block 29/7b contains the undeveloped Curlew A oil field and Block 22/12b contains the Phoenix Discovery. Harvester Energy was awarded the blocks by the North Sea Transition Authority in the second tranche of the 33rd oil and gas licensing round.

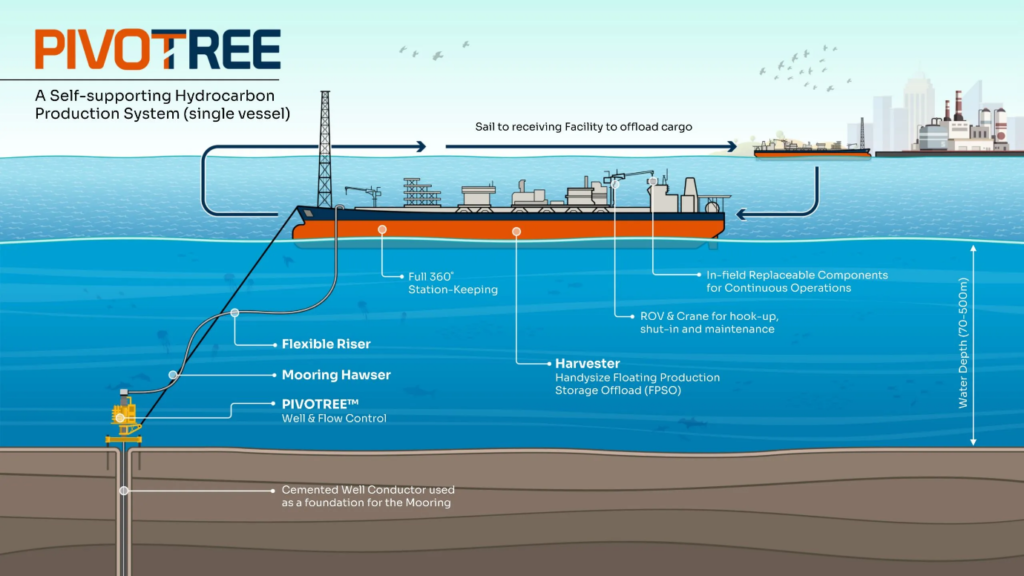

Harvester Energy Chair Andy Jacob said: “Harvester Energy’s mission is to identify discovered and appraised but undeveloped oil fields that can be rapidly and cost-effectively commercialised. We believe both Curlew A and Pheonix prospects are ideally suited to the patented “PivotreeTM/Harvester” small-field production system.”

Harvester Energy is targeting so-called stranded oil fields with confirmed discoveries that are considered too small to support standalone development and too far from existing offtake facilities to tie back.

The PivotreeTM/Harvester system consists of a single PivotreeTM subsea oil production Christmas tree that doubles as the station keeping (mooring) for a floating production, storage, and offload vessel (FPSO).

The first phase of development of the Curlew A and Pheonix oil fields is a review of existing 3D seismic data to better understand reservoir modelling to underpin the economic evaluation of the fields.

Harvester Energy and Pivotree Pty Ltd have signed an MOU under which the companies commit to work together through the development process, with Pivotree providing engineering and technical support for early study work. The companies will negotiate a more detailed procurement agreement based on the key terms agreed in the MOU.

Harvester Managing Director Chris Merrick said: “Harvester Energy will support society through the energy transition by operating short-duration, conventional hydrocarbon developments with reduced capital, operating, and abandonment costs, and lower environmental impact, opening a route to market for stranded resources.”

Posted by Dale Granger for PESA