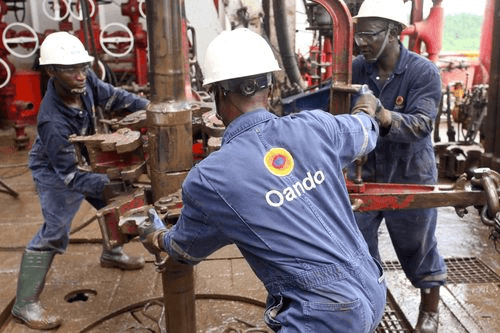

Oando PLC Nigeria’s leading indigenous energy solutions company with primary and secondary listings on the Nigerian and Johannesburg Stock Exchanges, today announced the successful upsizing of its Reserve Based Lending (RBL2) facility to $375 million. The refinancing, led by the African Export-Import Bank (Afreximbank) with the support of Mercuria, extends the final maturity date of the facility to January 30, 2029.

In recent years, financing arrangements for the acquisition, development, and operation of oil and gas assets have commonly been structured as Reserve-Based Loans (RBLs). Under this model, the amount a borrower, in this instance Oando, can access is directly tied to the size and value of their proven reserves, with Oando’s standing at 1.0Bnboe —referred to as the Borrowing Base.

This upsizing is a result of the Company’s significant progress in deleveraging, having substantially reduced the original $525 million RBL2 facility, signed in 2019, down to $100 million by the close of 2024. This proactive debt management has paved the way for successful refinancing.

Speaking on this strategic achievement, Mr. Wale Tinubu, Group Chief Executive, Oando PLC, commented: “We are pleased to have completed the upsizing of our RBL2 facility, a strategic milestone that reinforces our commitment as Operator of the Oando-NEPL JV to maximizing the value of our expanded asset portfolio. Our Joint Venture holds extensive reserves with the potential to generate over $11 billion in net cashflows to Oando over the assets’ life. This working capital facility is a critical enabler towards efficiently extracting and monetizing these resources. We appreciate the continued partnership of Afreximbank and Mercuria, whose unwavering support underscores their alignment with our long- term focus on maximizing production, optimizing asset performance, and delivering sustainable value to all stakeholders.”

This newly secured capital injection will be strategically deployed to aggressively pursue key growth initiatives, including accelerated drilling campaigns, critical infrastructure upgrades across its operations, and the implementation of advanced operational efficiencies throughout its portfolio. These strategic investments directly support the Company’s stated ambition to significantly increase its production levels to 100,000 barrels of oil per day (bopd) and 1.5 billion cubic feet (Bcf) of gas per day by the end of 2029.

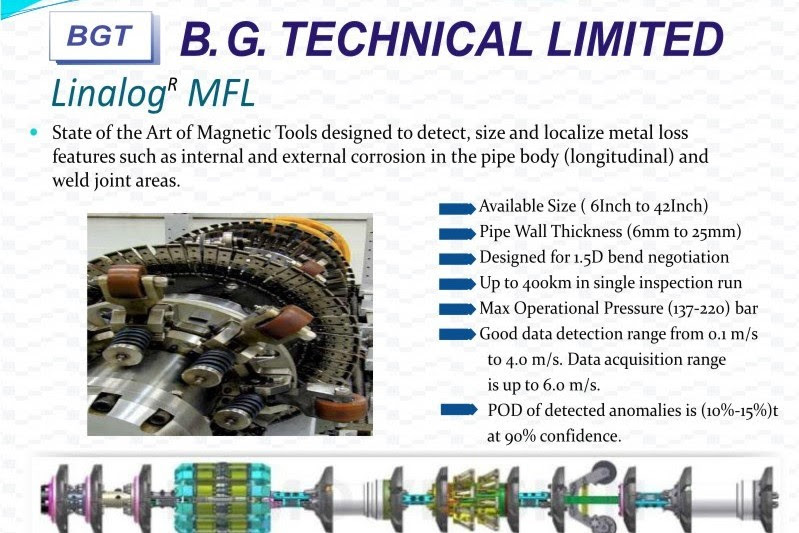

This positive development follows Oando’s landmark $783 million acquisition of the Nigerian Agip Oil Company (NAOC) from Italian energy giant, ENI, in August 2024. This transformative acquisition significantly expanded Oando’s operational landscape, incorporating twenty-four currently producing fields, approximately forty identified exploration prospects and leads, twelve key production stations, an extensive network of approximately 1,490 km of pipelines, three vital gas processing plants, the strategic Brass River Oil Terminal, the significant Kwale-Okpai phases 1 & 2 power plants boasting a total nameplate capacity of 960MW, and a comprehensive suite of associated infrastructure.

This successful refinancing underscores the confidence of leading financial institutions in Oando’s strategic direction and its ability to capitalize on its expanded asset base to drive growth and value creation in the Nigerian energy sector and beyond.