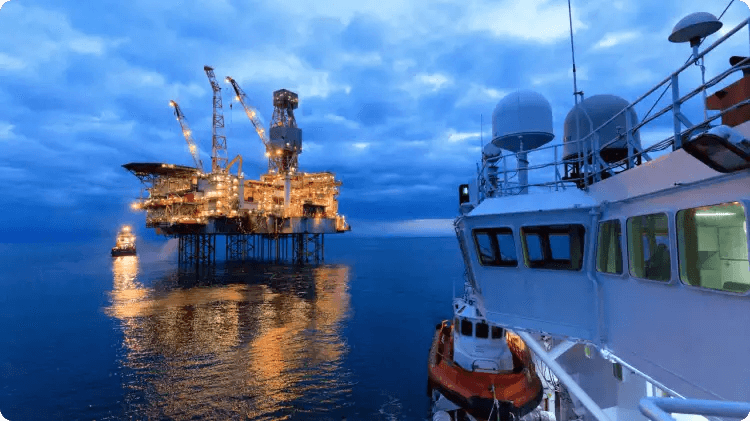

drilling rig outside of Artesia, in eastern New Mexico, which is part of the Permian Basin

that extends into the state to the west of Texas. Robert Nickelsberg | Getty Images News | Getty Images

Oil markets are expected to face excess supplies in 2020 due to a production boost amid weak demand growth, the director for energy

markets and security at the International Energy Agency said

“Overall, we will continue to see a well supplied market in 2020,” said

Keisuke Sadamori at the Singapore International Energy Week.

“Unless other things change, we will see a surplus probably, unless there is very strong demand growth recovery,” Sadamori told CNBC. In its latest monthly report, the Parisbased agency cut its oil demand growth figure by 100,000 barrels a day for 2019 and 2020. Oil demand is

expected grow at a “still solid” 1.2 million barrels a day in 2020, IEA said

in the report. Global macroeconomic concerns such as the U.S.- China

trade dispute and the developments surrounding Brexit — the UK’s exit

from the European Union trade bloc — are issues clouding the oil market outlook, said Sadamori. The Organization of the Petroleum

Exporting Countries, and other producers including Russia, have

implemented an output cut by 1.2 million barrels per day since January

in a bid to support the market.However, oil supplies this year have

been boosted by non-OPEC members such as the U.S. in shale oil

production. Brazil and Norway will also produce more oil next year, said Sadamori. Meanwhile, demand in 2019 has been weak, amid weak growth in the first half and India demand growth slower than expected, he said. Growth in the second half of 2019 is being supported by a low base over the same period in 2018.In September, Saudi Arabia was

forced to cut its oil production by half following a series of drone

“Unless other things change,we will see a surplus probably,

unless there is very strong demand growth recovery,, strikes on its oil processing facility.The closure affected nearly 5.7 million barrels of crude production a day —or about 5% of the world’s daily oil production. While there were concerns about the supply security after the attack, claimed by Yemen’s Houthi rebels, the recovery in supplies has been “quite impressive,” said Sadamori, giving comfort to the Kingdom’s customers around the world and assurance of the stability of world oil markets.