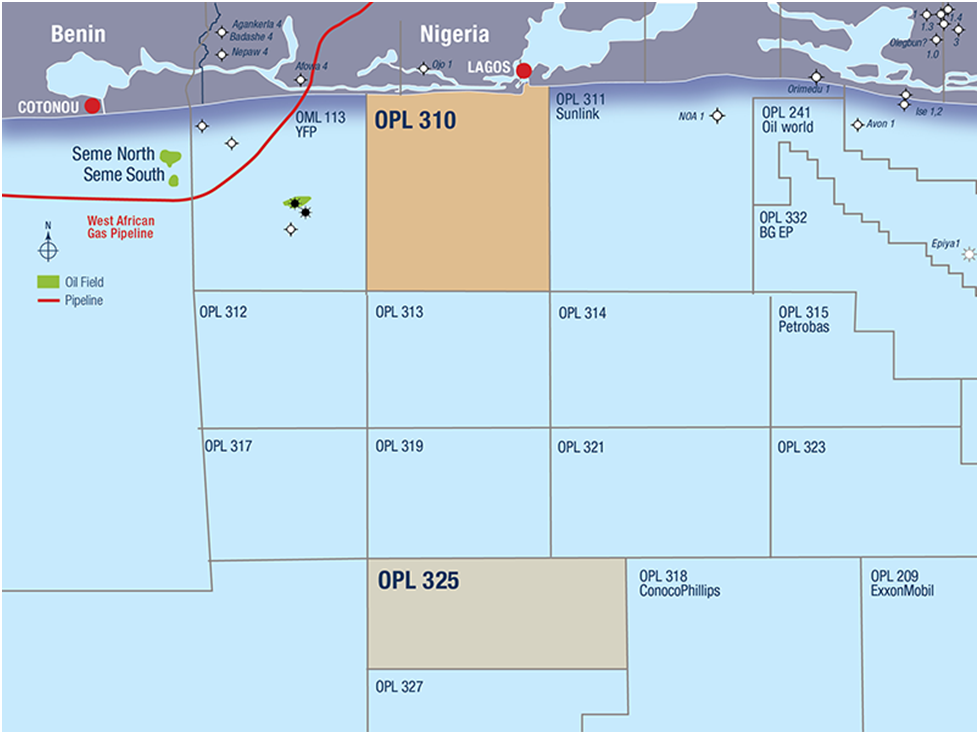

LEKOIL, the oil and gas exploration and production company with a focus on Nigeria and West Africa, has announced that Mayfair Assets and Trusts Limited, in which the Company has a 90 per cent economic interest, has received a letter from Optimum Petroleum Development Company, the Operator of the OPL 310 Licence, proposing to terminate the Cost and Revenue Sharing Agreement executed for OPL 310.

As announced on 11 December 2020, Optimum conveyed its enforcement of the default clause within the CRSA. Pursuant to the CRSA, the default clause stipulates that, following a cure period, if a default has occurred, Optimum and Mayfair shall jointly seek and agree on a buyer to whom Mayfair’s 17.14% Participating Interest as well as the financial obligation within OPL 310 will be transferred. Mayfair will also be entitled to a full reimbursement of all amounts due to it, as a result of past costs spent on the asset, from future production proceeds from OPL 310.

The Company believes that this further letter proposing to terminate the CRSA is not valid as the relevant provisions of the CRSA have not been adhered to by Optimum. The Company will engage with Optimum to ensure that the appropriate steps outlined in the Agreement are followed, and is also seeking legal advice on the matter. Further updates to shareholders will be provided in due course.