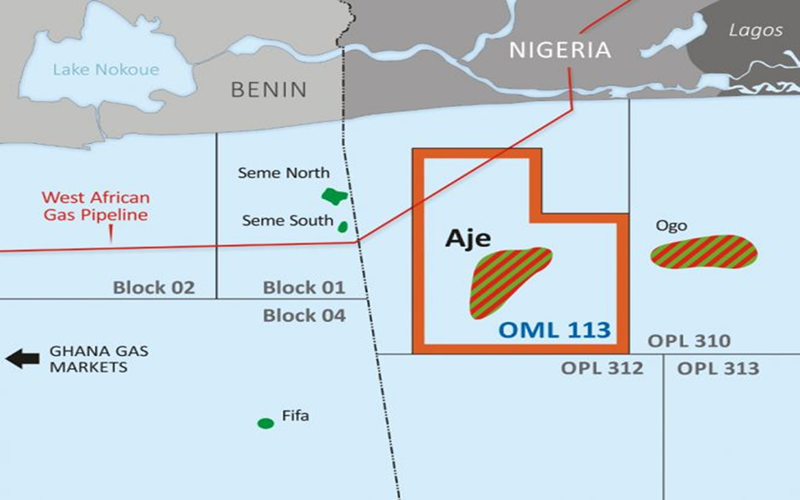

Panoro Energy ASAis pleased to announce that all government approvals have now been received for the sale of the shares of its fully-owned subsidiaries that hold 100% of the shares in Pan Petroleum Aje Limited to PetroNor E&P Limited. Pan Aje participates in the exploration for and production of hydrocarbons in Nigeria and holds a 6.502% participating interest, with 16.255% cost bearing interest, representing an economic interest of 12.1913% in Oil Mining Lease 113 (“OML 113”), which includes the Aje field.

Receipt of government approvals satisfies the last key condition precedent for the completion of the Transaction. Panoro and PetroNor will now proceed with the final steps to achieve completion of the Transaction, including the issuance of new PetroNor shares for distribution to Panoro shareholders. It is expected that the transaction will close within the next 90 days, and further information will become available in the coming weeks.

“The receipt of government approvals in Nigeria is a major achievement and enables us to now proceed swiftly to completion of the sale of Panoro’s interest in OML 113 to PetroNor and unlock value for our shareholders. The divestment is consistent with Panoro’s strategy to rationalise and high grade its upstream portfolio, placing emphasis on the allocation of capital to short-cycle oil production projects and focused exploration close to infrastructure hubs. The transfer of ownership of OML 113 to PetroNor will allow Panoro to reduce and optimise its capital expenditures while preserving the ability for our shareholders to benefit from future gas successes through the distribution of shares in PetroNor to its shareholders. Panoro is confident that PetroNor is strategically well positioned to unlock the gas potential at Aje for the benefit of all stakeholders,” John Hamilton, CEO of Panoro, commented.

Panoro Energy ASA is an independent exploration and production company based in London and listed on the main board of the Oslo Stock Exchange with the ticker PEN. Panoro holds production, exploration and development assets in Africa, namely a producing interest in Block-G, offshore Equatorial Guinea, the Dussafu License offshore southern Gabon, OML 113 offshore western Nigeria (held-for-sale, subject to completion), the TPS operated assets, Sfax Offshore Exploration Permit and Ras El Besh Concession, offshore Tunisia and participation interest in an exploration Block 2B, offshore South Africa.