Panoro Energy ASA has announced it has completed the sale of its fully owned subsidiaries Pan-Petroleum Services Holdings BV and Pan-Petroleum Nigeria Holding BV (together referred to as “Divested Subsidiaries”) to PetroNor E&P ASA for an upfront consideration of USD 10 million plus a contingent consideration of up to USD 16.67 million based on future gas production volumes (“the Transaction”).

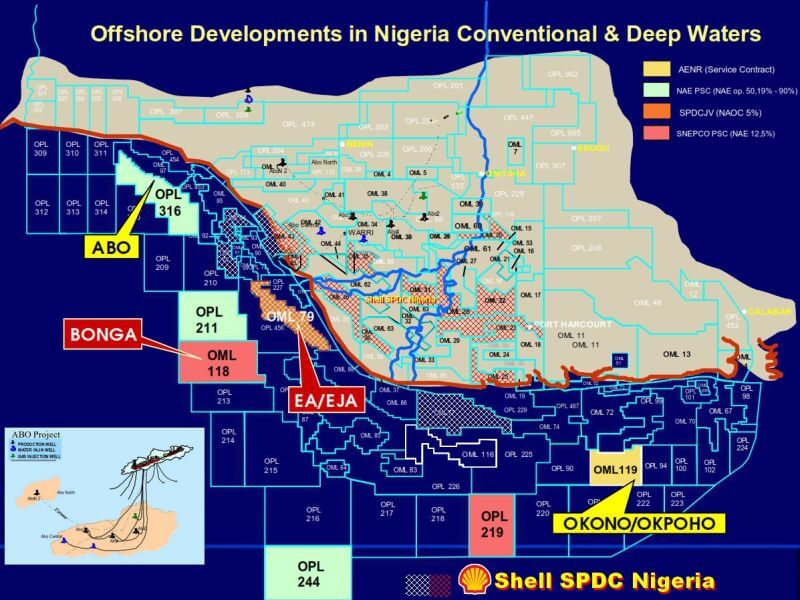

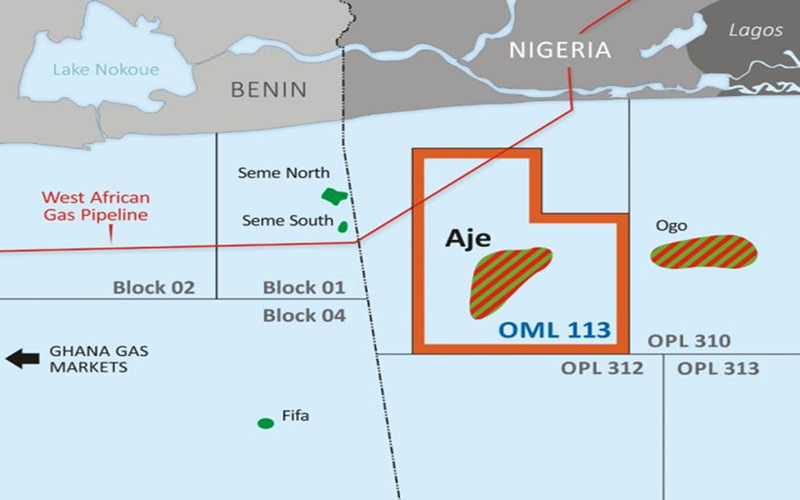

The Divested Subsidiaries hold 100% of the shares in Pan-Petroleum Aje Limited, which participates in the exploration for and production of hydrocarbons in Nigeria and holds a 6.502% participating interest, with a 16.255% cost bearing interest, representing an economic interest of 12.1913% in Offshore Mining Lease no. 113 (“OML 113”). Following completion of the Transaction Panoro has no operational presence remaining in Nigeria.

The upfront consideration of USD 10 million is expected to the paid within fifteen business days via the allotment and issue of 96,577,537 new PetroNor shares (the “Consideration Shares”). The volume of PetroNor shares issued to Panoro has been determined with reference to the contractually determined 30-day volume weighted average price (“VWAP”) of PetroNor’s shares which are listed on the Oslo Børs with the Ticker “PNOR”.

Once the Consideration Shares are issued and received, Panoro will implement steps to distribute these new PetroNor shares to Panoro shareholders as a dividend in specie. Panoro will communicate separately in due course the timetable for this process and key dates.

Following receipt of the Consideration Shares, Panoro will temporarily hold a 6.78% shareholding with voting rights in PetroNor, until such Consideration Shares are distributed in specie to Panoro shareholders.

“We are pleased to have finally concluded the sale of Panoro’s interest in OML 113 to PetroNor and unlock value for our shareholders who can continue to benefit from future gas successes at OML 113 through the upcoming distribution of the shares in PetroNor received as payment for the upfront consideration. This also represents a key milestone for Panoro’s strategy with the first dividend payment to its shareholders. Meanwhile the Board and management of the Company remain fully committed to initiating sustainable cash dividends at the earliest opportunity and to unlock further value for its shareholders,” John Hamilton, CEO of Panoro, said. This announcement is subject to disclosure pursuant to section 5-12 of the Norwegian Securities Trading Act.