Papua New Guinea Prime Minister James Marape has told Santos Ltd the country wants an extra stake in the $19 billion dollar PNG LNG project if Santos’ proposed takeover of Oil Search goes ahead, the Australian newspaper reported on Friday.

Marape met with Santos CEO Kevin Gallagher and Oil Search CEO Peter Fredericson in Port Moresby on Wednesday to discuss the deal, which the government has said must meet the national interest.

The newspaper, citing unnamed sources, said the cash-strapped Papua New Guinea government, which needs to give permission for the takeover to proceed, would expect to acquire a stake for a low price or potentially via a loan.

“All things considered, the state would like to pick a portion of whatever Santos will make available in their rebalancing,” PNG Petroleum Minister KerengaKua told the Australian.

“The Prime Minister is asking that the joint venture project partners should all agree for the state to be given the first right of refusal to acquire some portion of that equity,” he said.

A Santos spokesperson confirmed Gallagher met with Marape but declined to comment on what he said were confidential talks.

Credit Suisse analyst Saul Kavonic said it was likely that negotiations were just beginning.

“Our view is the government will extract something here, but ultimately it will be modest and shouldn’t prevent the deal from proceeding,” Kavonic said.

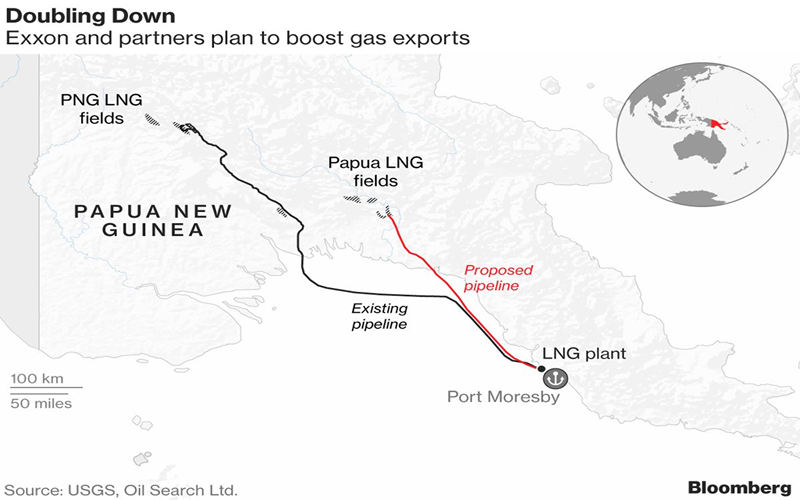

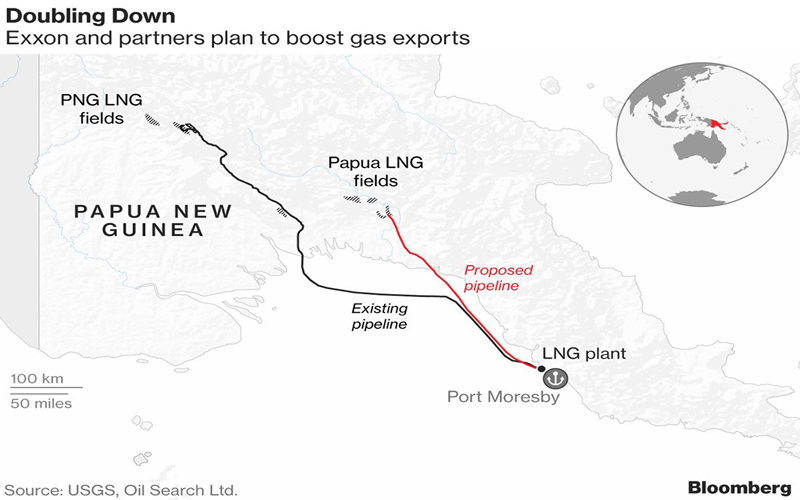

Under the proposed deal, Santos will acquire Oil Search’s holding in the prized PNG LNG project, making it the biggest single shareholder in the gas project operated by Exxon Mobil Corp , with a 42.5% stake.

Gallagher has said Santos would look to sell down part of its stake in PNG LNG to help align partner holdings in PNG LNG and another project set to be developed, TotalEnergie SE’s Papua LNG project.

Kavonic said a bigger risk from PNG’s request was that prolonged negotiations with the government could delay preliminary design work on the Papua LNG project ahead of a final investment decision due in 2023.

Shareholders in Oil Search are due to vote on the deal on Nov. 29, which will require support from 75% of the votes cast. The deal is slated to be completed in December.

In November 2019, talks tied to a $13 billion expansion of the country’s liquefied natural gas (LNG) exports fell apart with the government saying Exxon was unwilling to negotiate on the country’s terms.

Papua New Guinea has been pressing for better returns for the impoverished country than it obtained in the original PNG LNG agreement in 2008.

“We look forward to further discussions with the government to align on a gas agreement that ensures fair benefits for project stakeholders and the people of PNG,” Exxon said in an emailed comment, declining to elaborate on details of the discussions.

“We look forward to further progress in these negotiations and will support (Exxon) through our 38.51% interest in the joint venture,” said Diego Fettweis, Oil Search’s executive vice president for commercial.

P’nyang gas field, licensed under PRL 3, is located in the Western Province of Papua New Guinea. The gas field was first discovered in the 1990s by then operator Chevron Niugini Ltd. The structure trends approximately 20km NW-SE and extends 10km NE-SW. Net reservoir thickness ranges from 182-202 meters with an estimated 2C recoverable hydrocarbon resource of 4.3 tcf.

Currently operated by ExxonMobil Limited, the joint venture partners are Ampolex (PNG) Pty Ltd, Oil Search (PNG) Ltd, Merlin Petroleum Company and Oil Search Ltd.