Petrobras a Brazilian national oil company has disclosed the recent board approval on the acquisition of investment interest in three oil exploration blocks operated by Shell in Sao Tome and Principe which were formerly owned by Kosmo Energy. The renewed investment interest in the oil-rich nation offshore West African coast is seen as part of the company’s global investment decision in exploring further frontiers in course business expansion purposes.

The acquisition interest in STP is further part of the scope of the Memorandum of Understanding signed in March 2023 by the CEOs of Petrobras and Shell, Jean-Paul Prates and Wael Sawan, whose objective includes, among others, the identification of business opportunities between the companies in the upstream segment – such as the acquisition in partnership of the 29 exploratory blocks in the Pelotas basin in the 4th Permanent Concession Offer Cycle that took place on 12/13/2023.

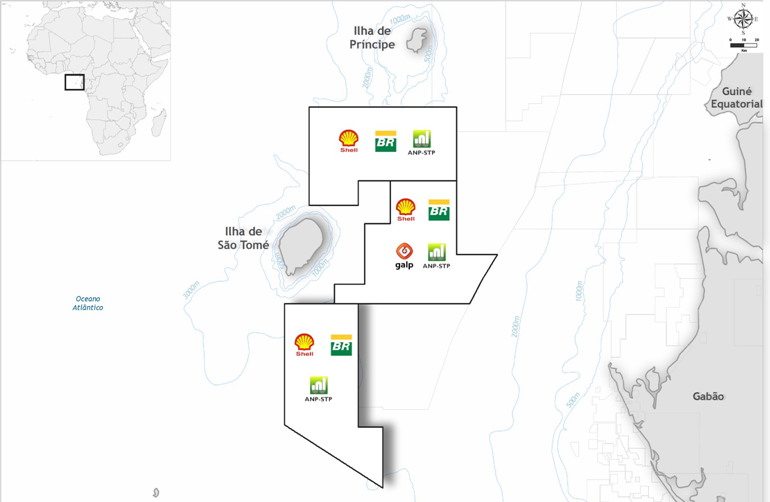

Petrobras thus acquired a 45% stake in blocks 10 and 13 and a 25% stake in block 11, with the consortia now composed as follows:

Block 10: Shell, operator (40%), Petrobras (45%) and ANP-STP (15%)

Block 11: Shell, operator (40%), Petrobras (25%), Galp (20%) and ANP-STP (15%)

Block 13: Shell, operator (40%), Petrobras (45%) and ANP-STP (15%)

The operation will mark the resumption of exploratory operations on the African continent with the aim of diversifying the portfolio and is in line with the company’s long-term strategy, aimed at rebuilding oil and gas reserves by exploring new frontiers and working in partnership.

In Sep. 9, 2020 Kosmo Energy entered into an agreement with Shell a wholly-owned subsidiary of Royal Dutch Shell PLC to farm down interests in a portfolio of frontier exploration assets for approximately $100 million, plus future contingent payments of up to $100 million. Under the terms of the agreement, Shell will acquire Kosmos’ participating interest in blocks offshore São Tomé & Príncipe, Suriname, Namibia, and South Africa.

The consideration consists of an upfront cash payment of approximately $100 million, plus contingent payments of $50 million payable upon each commercial discovery from the first four exploration wells drilled across the Assets, capped at $100 million in aggregate. Three of the four wells are currently planned for 2021.