Reconnaissance Energy Africa Ltd. and Renaissance Oil Corp. has announced that they have entered into a letter of intent (the “LOI”) setting forth the material terms and conditions upon which ReconAfrica will acquire all of the issued and outstanding common shares (the “Renaissance Shares”) and convertible securities of Renaissance (the “Transaction”). The Transaction is expected to be implemented by way of a statutory plan of arrangement under the Business Corporations Act (British Columbia).

Pursuant to the LOI, ReconAfrica will issue to each holder of a Renaissance Share 0.046 of a common share of ReconAfrica (each whole common share, a “ReconAfrica Share”) (the “Consideration”). The value of the Consideration represents a 1.45% premium over the closing price of the Renaissance Shares on the TSX Venture Exchange (the “TSXV”) on April 16, 2021, the last day of trading prior to the announcement of the Transaction, and based on the closing price of the ReconAfrica Shares on the TSX.V of $7.62 on April 16, 2021. The terms of the Transaction value Renaissance at $.35 per share or approximately $155 million. Following the completion of the Transaction, current shareholders of Renaissance will hold approximately 20,340,792 shares or 11.36% of the fully-diluted issued and outstanding shares of ReconAfrica.

The boards of directors of each of ReconAfrica and Renaissance, respectively, have unanimously approved the entering into of the LOI. The companies have agreed to a 30 -day exclusivity period to, among other things, negotiate and settle a definitive agreement.

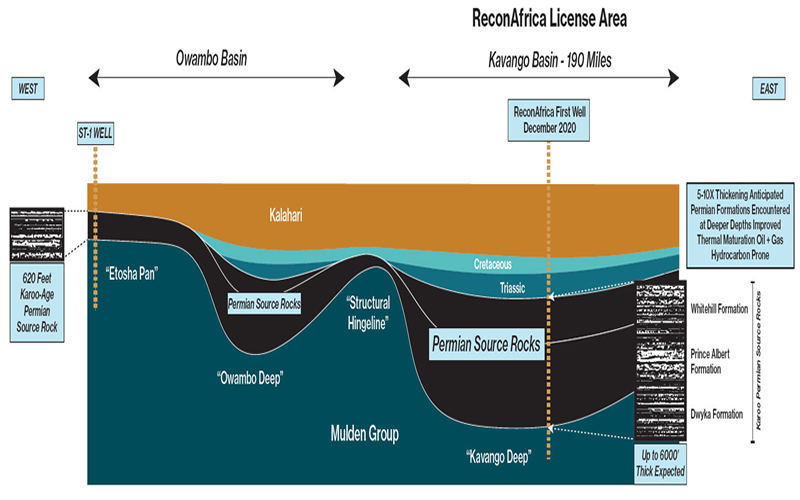

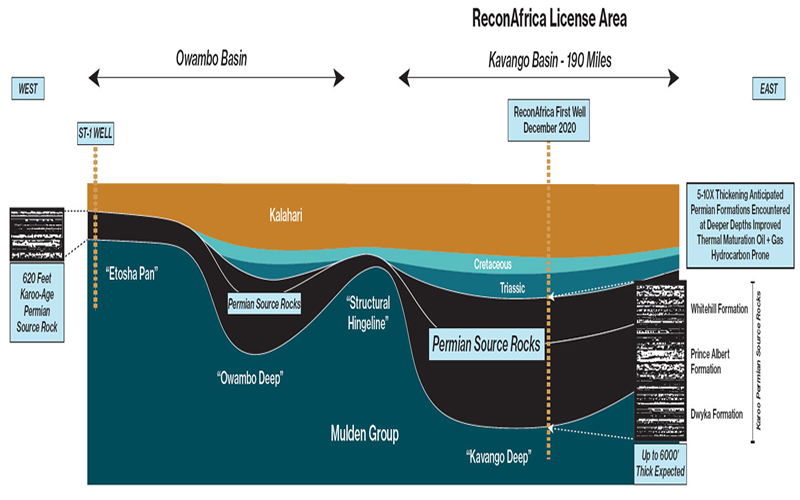

“With ReconAfrica’s recent drilling success in the Kavango Basin, the Company has determined it is in the best interest of ReconAfrica shareholders to consolidate all interests,” stated Scot Evans, CEO of ReconAfrica. “Renaissance Oil’s right to acquire 50% working interest in 2.2 million acres in the eastern part of the Kavango basin (Botswana) is potentially very valuable to ReconAfrica as it pursues the development of conventional resources in the basin.”

“Consolidating all interests in the Kavango Basin to 8,500,000 acres, which covers the entire sedimentary basin, is in an accretive transaction for both ReconAfrica and Renaissance,” stated Craig Steinke, CEO of Renaissance. “The combined company will solely focus on the development of the deep Kavango basin while exploring strategic alternatives for the Mexican assets.”