Reliance Industries Limited a Fortune 500 company and the largest private sector corporation in India, a global energy giant and owned by Asia’s richest man has toppled ExxonMobil Corp to become the world’s largest energy company after Saudi Aramco. Investors have now piled into the conglomerate lured by the Indian firm’s digital and retail forays.

Reliance, which manages the biggest refinery complex, gained 4.3% in Mumbai on Friday adding $8 billion to take its market value to $189 billion, while Exxon Mobil erased about $1 billion. Reliance’s shares have jumped 43% this year compared with a 39% drop in Exxon’s shares as refiners across the globe struggled with a plunge in fuel demand. Aramco with a market capitalization of $1.76 trillion is the world’s biggest energy company.

In 2002, Reliance struck gas in the D1-D3 field of KG D6 block. These fields were put on production in 2009.

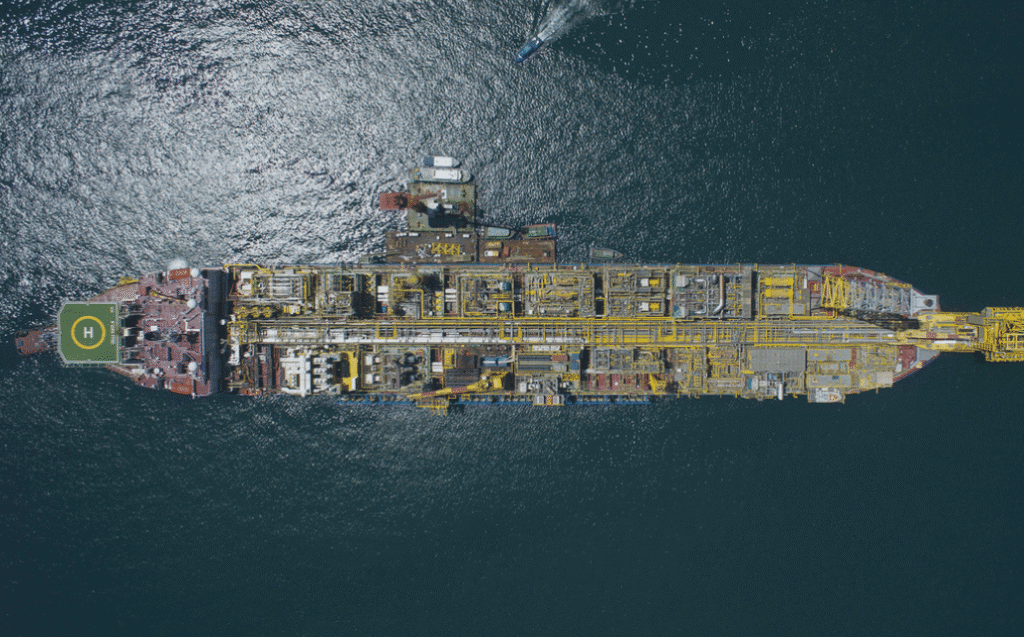

The KG D6 fields rank amongst one of the largest green-field deepwater oil and gas production facilities in the world. These fields were the first deepwater producing fields in India and remains among the most complex reservoirs in the world. Reliance, along with its partners, has committed ~$6 Billion for second wave of projects in KG D6 over the next few years. To supplement the existing asset base, we continue to look at new opportunities that are a strategic fit with capabilities and integrated petroleum value chain

While the energy business accounted for about 80% of Reliance’s revenue in the year ended March 31, Chairman Mukesh Ambani’s plan to expand the company’s digital and retail arms has helped him attract $20 billion into the Jio Platforms Ltd unit. That in turn helped add $22.3 billion to Ambani’s wealth this year, propelling him to the fifth spot in the Bloomberg Billionaires Index.

Ambani’s deal making has lured investments from Google to Facebook Inc into his digital platform in recent months. The 63-year-old tycoon has identified technology and retail as future growth areas in a pivot away from the energy businesses he inherited from his father who died in 2002.

Other energy global investment of Reliance is its upstream joint ventures in US Shale gas which includes a 45% working interest (WI) partnership with Ensign Natural Resources in the Eagle Ford shale play and a 40% WI partnership with Chevron.