San Leon, the independent oil and gas production, development and exploration company focused on Nigeria, has announced its audited final results for the year ended 31 December 2020.

Corporate

·Completed the return of approximately US$33.8 million to shareholders during the first half of 2020 delivering on the Company’s commitment to shareholder returns.

·The Company entered into an agreement dated 6 April 2020 amending the existing Loan Notes Instrument between San Leon and Midwestern Leon Petroleum Limited (“MLPL”). Under the terms of the Amendment, US$40.0 million was received immediately by San Leon.

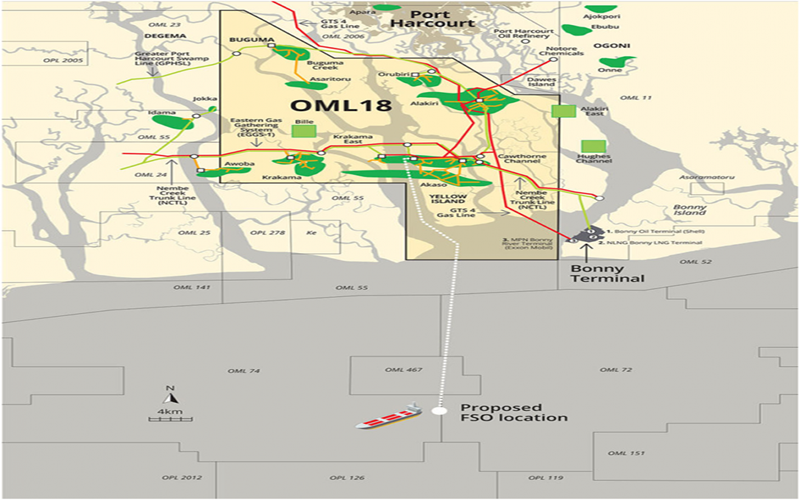

·On 3 August 2020 the Company provided a US$10.0 million loan plus an additional US$5.0 million loan on 6 October 2020 and acquired a direct 10% interest in Energy Link Infrastructure (Malta) Ltd (ELI). ELI’s sole asset is the proposed new Alternative Crude Oil Evacuation System (ACOES) constructed to provide a dedicated oil export route (comprising a new pipeline together with a Floating Storage and Offloading (FSO vessel) from OML 18. Once commissioned, the system is expected, by Eroton, to reduce the downtime and allocated pipeline losses to below 10%.

·On 1 September 2020, the Company announced that it had conditionally agreed to invest US$7.5 million by way of a loan to Decklar Petroleum Limited (“Decklar”), which is the holder of a Risk Service Agreement (“RSA”) with Millenium Oil and Gas Company Limited (“Millenium”) on the Oza marginal field, carved out of OML 11, onshore Nigeria. Under the agreements, once completed, the Company will also receive a 15% interest in Decklar for a nominal amount paid. This transaction is still awaiting final conditions precedents to complete.

·Board appointment process previously announced completed with appointment of John Brown as Independent Non-Executive Director and Chair of the Audit and Risk Committee and Adekolapo Ademola as Non-Independent Non-Executive Director on behalf of Midwestern Oil & Gas Company Ltd. Non-Executive Directors, Mark Phillips, Bill Higgs and Linda Beal, left the Board during 2020 and Alan Campbell has since stepped off the Board in 2021 as part of a board restructure.

Financial

·Cash and cash equivalents as at 31 December 2020 of US$18.5 million (includes US$6.8 million restricted and held in escrow for the Oza transaction) (31 December 2019: US$36.7 million).

·Cash and cash equivalents as at 18 June 2021 were US$14.8 million (includes Oza escrow of US$6.8 million).

·In the past 18 months US$47.3 million, of which US$46.5 million relates to 2020 (31 December 2019: US$43.2 million) in principal and interest payments has been received under the MLPL Loan Notes.

·US$5.8 million has so far been paid of the US$10.0 million due under the MLPL Loan Notes in September 2020, leaving US$4.2 million still outstanding.

·A share repurchase programme of US$2.0 million of Company’s shares was completed between October 2019 and January 2020.

·A special dividend of US$33.3 million was declared in May 2020, giving a dividend yield of approximately 30% as at the date of dividend announcement.

Operational

An update on OML 18 activity during 2020.

·Oil delivered to the Bonny terminal for sales was approximately 21,100 barrels of oil per day (“bopd”) in 2020 (32,000 bopd in 2019) and continues to be affected by combined losses and downtime of approximately 35%. The 2020 figure has also been affected by OPEC oil production quota restrictions, and some Covid-related delays. Together, the losses, downtime, OPEC restrictions and Covid-related delays have caused the majority of the difference between gross production when there is minimal disruption to production, and oil is received at Bonny terminal for sales.

·Gas sales averaged 32.7 million standard cubic feet per day (“mmscf/d”) in 2020 after downtime (36.0 mmscf/d in 2019).

·Production downtime of 9% in 2020 was caused by third party terminal and gathering system issues. This relates to days when oil production was entirely shut down at OML 18. OPEC quota restrictions on production also had an adverse effect on production rates, however downtime and Covid-related delays have meant these quotas at times have not been met. Such issues in the third-party export system are expected to be substantially resolved by the implementation of the new ACOES for the purpose of transporting, storing and evacuating crude oil from OML 18 export Pipeline. The pipeline will run from within the OML 18 acreage to a dedicated FSO vessel in the open sea, approximately 50 kilometres offshore. Expected timing for the commencement of operations is H2 of 2021. See ELI update below.

·Pipeline losses by the Bonny Terminal operator have increased over the past year (31 December 2020: 28%; 31 December 2019: 22%), largely due to lower pipeline throughput as a result of OPEC quota restrictions. In the longer term, the ACOES is expected to reduce losses significantly.

·Eroton completed its three well drilling programme in early 2020, with the final completion and flow of these wells impacted by Covid-19. Lower oil prices for much of 2020 have led Eroton to improve capital discipline and the prudent deferral of the next drilling campaign, now expected to commence during 2022.

·Eroton has taken all appropriate precautions for its operations and people, with regards to Covid-19 and we understand has had no Covid-19 cases on OML 18.

Energy Link Infrastructure

·ELI has received approval from the President of Nigeria (acting in his capacity as Minister for Petroleum Resources) for the FSO, ELI Akaso, to be set up as an oil terminal.

·ELI is in advanced negotiations with other third party injectors for use of its pipeline and terminalling facilities.

·Construction of the pipeline continues to progress and hook up with ELI Akaso is expected to take place in H2 2021.

Outlook 2021

·The commissioning of the ELI pipeline.

·Expected close out of the Oza transaction.

·Continuing to position the Company for further transactions.

“The period under review has been one of considerable uncertainty globally. Despite this, San Leon has continued to deliver its strategy. 2020 saw operational progress at OML 18 in preparation for its next stage of development, tempered by the macroeconomic environment. On a corporate level, we are very pleased to have been able to return just over $33 million to shareholders while also building and diversifying our portfolio with the Oza and ELI transactions, respectively. Our underlying strategy remains unchanged to deliver sustainable value to our shareholder,.” Oisin Fanning, CEO of San Leon, Commented

Please wait....

Thank you for subscribing...