San Leon, the independent oil and gas production, development and Exploration Company focused on Nigeria, notes the announcement on the funding arrangements made by Decklar Resources Limited (“Decklar Resources”) today. On 1 September 2020, San Leon announced that it had conditionally agreed to invest US$7.5 million by way of a loan to Decklar. Decklar is the holder of a Risk Service Agreement (“RSA”) with Millenium Oil and Gas Company Limited on the Oza Oil Field in Nigeria. San Leon also announced that it was subscribing for a 15% equity interest in Decklar.

Decklar Resources has today announced that a private placement financing for a total of just over CAD $4 million is in the final stages of completion, which will enable it to immediately advance operational activities to re-enter the Oza-1 well at the Oza Oil Field in Nigeria. Closing of this private placement is expected to provide sufficient funds to re-enter the Oza-1 well and to re-establish oil production at the Oza Oil Field through its wholly-owned Nigeria-based subsidiary, Decklar Petroleum Limited (“Decklar Petroleum”). The previously announced debt funding plans, including the arrangements of which San Leon is part, are in the final stages of being concluded which will provide additional development funding for further operations and development drilling for the full development of the Oza Oil Field. The current private placement, which will allow Decklar Petroleum to begin the Oza-1 well re-entry and production operations on an expedited basis, is expected to close by the end of February 2021.

This additional expected project funding of Oza (which is anticipated to constitute an intercompany loan at a coupon no higher than that earned by San Leon’s funding, and will not involve the issue or transfer of any equity of Decklar Petroleum) will preserve San Leon’s rights with respect to its proposed subscription agreement and the cash sweeps and debt seniority associated with it.

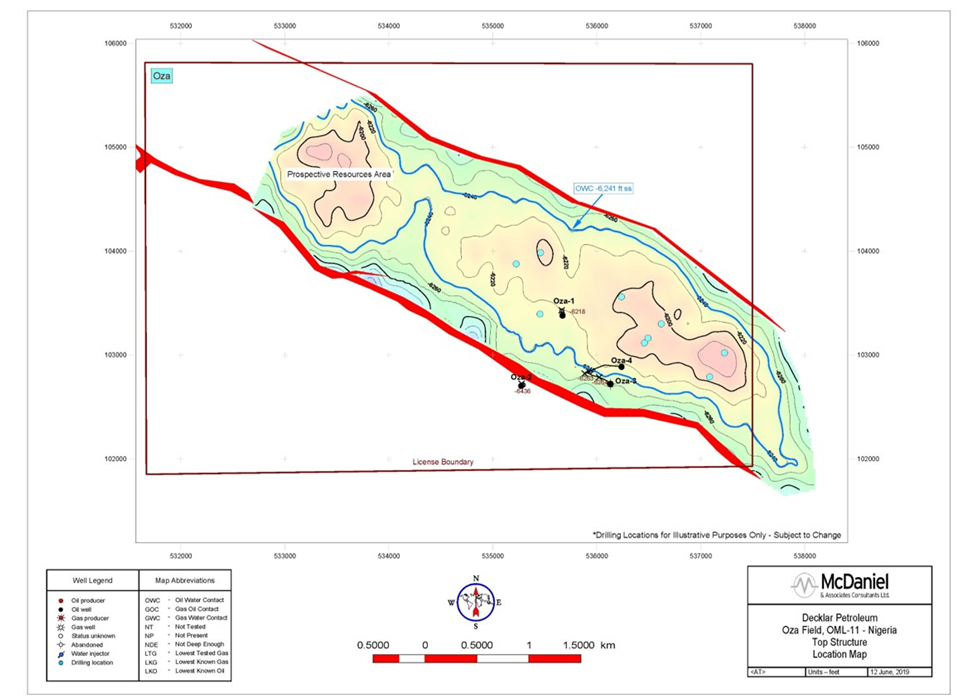

The funds proposed to be used from San Leon on Oza are now expected to be used on the drilling of the new well on the Oza structure. The additional investment outlined by Decklar Resources is not expected by San Leon to have a material effect on San Leon’s investment risk or returns.

Oza-1 Well re-entry plans and status

Decklar has also announced that the civil works required for the Oza-1 wellsite are complete, including rebuilding of the access road, construction of a concrete drilling pad, a concrete mud pit, buildings and other facilities required for well re-entry and drilling operations and management. A drilling rig located near the field has been contracted and will be moved to the Oza-1 wellsite in the near term, and operations to perform the planned re-entry of the Oza-1 well will begin shortly thereafter. The recently completed drilling pad will be used for both the Oza-1 well re-entry and the first horizontal development well on the Oza Oil Field.

As previously reported, Decklar Resources states that an export pipeline that ties the Oza Oil Field production into the Trans Niger Pipeline (TNP) and continues on to the Bonny Export Terminal, operated by Shell Production Development Company (SPDC) is already in place. Infrastructure also in place at the Oza Oil Field includes a lease automatic custody transfer (LACT) unit fiscal metering system, infield flow-lines, manifolds and a rental 6,000 barrel per day early production facility. These production and pipeline facilities should ensure that oil tested from the Oza-1 well re-entry and early production can be immediately delivered and sold on an expedited basis.

Update regarding debt funding arrangements

Decklar Resources reports that the due diligence required to finalise the term debt arranged with a Nigerian bank and the trading subsidiary of a large multinational oil company active in Nigeria has continued to progress, and the final report by the independent technical consultant contracted to review reserve and production data and financial projections was previously issued. The definitive loan documents and formal legal agreements are being finalised and are nearing conclusion with the Nigerian bank. As previously announced, the remainder of the US$7,500,000 for the subscription agreement with San Leon remains in escrow and will be released upon satisfaction (or waiver) of the final conditions precedent which is anticipated in the near future. A further announcement will be made in due course in relation to the completion of the subscription agreement.