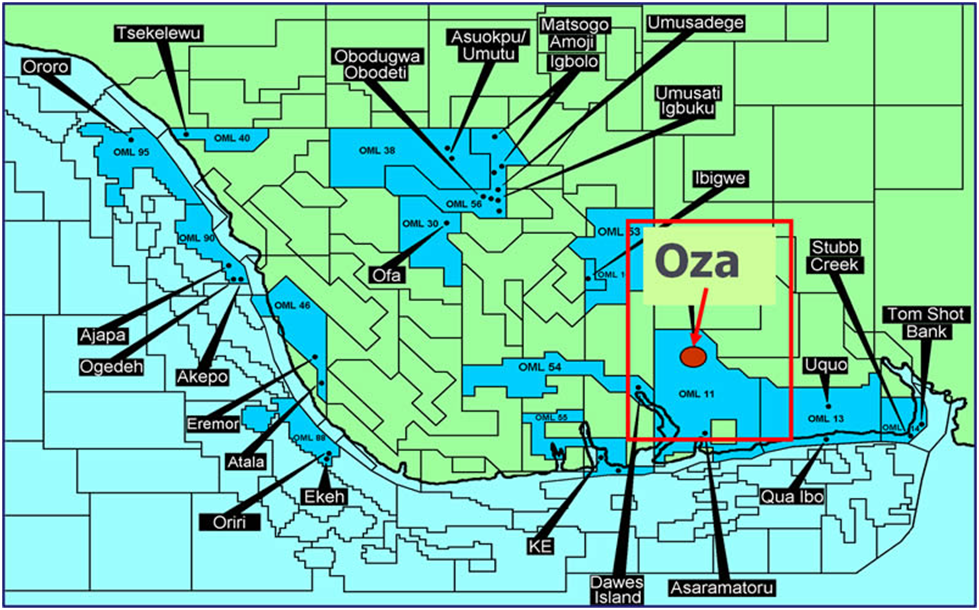

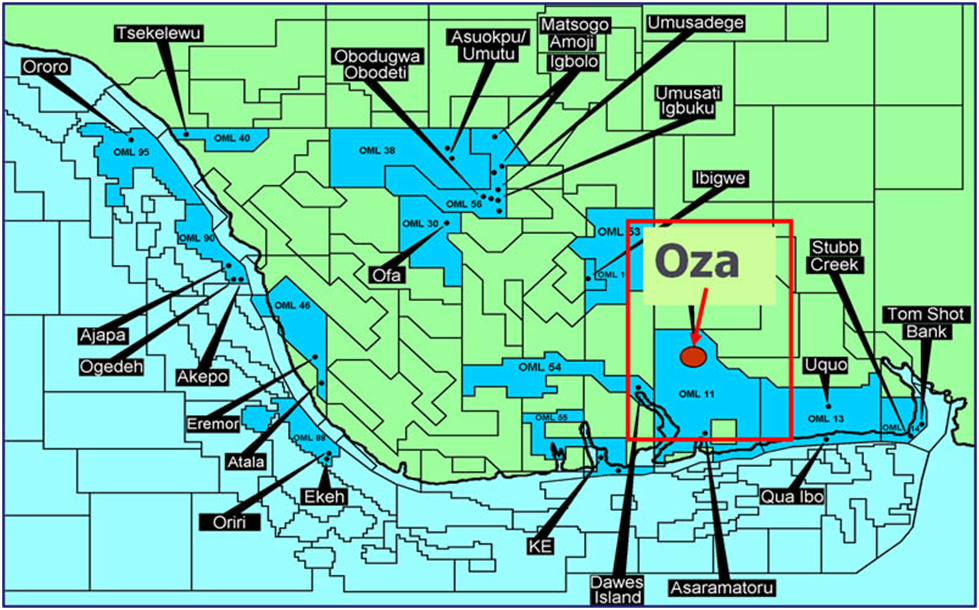

San Leon, the independent oil and gas production, development and Exploration Company focused on Nigeria, is pleased to provide an update on the funding arrangements by Decklar Petroleum Limited (“Decklar”) to develop the Oza Oil Field in Nigeria. When fully disbursed, the funding is expected to be sufficient to re-establish oil production and provide development funding for the Oza Oil Field.

Update Regarding Funding Arrangements

The due diligence required to finalise the term debt to Millenium Oil and Gas Company Limited, Decklar’s local partner, arranged with a Nigerian bank and the trading subsidiary of a large multinational oil company active in Nigeria has progressed and the final report by the independent technical consultant that they contracted, which is based on a review of reserve and production data and financial projections, has been issued. The definitive loan documents are now being finalised and are anticipated to be issued by the end of the first week of February 2021.

The details of the funding plans for the development of the Oza Oil

Field were included in the Company’s announcement of 1

September 2020. In particular, San Leon has entered into a subscription

agreement (the “Subscription Agreement”) with Decklar. The

Subscription Agreement entitles San Leon to purchase US$7,500,000 of 10%

unsecured subordinated loan notes of Decklar (the “Loan Notes”)

and 1,764,706 ordinary shares of Decklar (“Decklar Shares”)

(representing 15% of the enlarged share capital of Decklar) for a cash

consideration of US$7,500,000 and N1,764,706 (c.US$4,600)

respectively. Aside from an initial deposit of US$750,000, the balance of

San Leon’s proposed investment in Decklar is being held in escrow and will be

released upon satisfaction (or waiver) of the final conditions precedent

contained in the Subscription Agreement. A further announcement will be made in

due course in relation to the completion of the Subscription Agreement.

In addition, and as previously announced, Decklar and San

Leon have entered into an option agreement that, at San Leon’s sole discretion,

entitles San Leon to purchase an additional US$7,500,000 of Loan Notes and

2,521,008 Decklar Shares (representing an additional 15% of the enlarged share

capital of Decklar, together with a gross-up of the original 15% so as to

provide San Leon with a total of 30% of the enlarged share capital of Decklar)

for a cash consideration of US$7,500,000 and N2,521,008 (c. US$6,500),

respectively, at any time until the date that is forty-five (45) days after the

well test results of the first development well on the Oza Oil Field have been

delivered to San Leon.

Update Regarding Oza Field Preparation

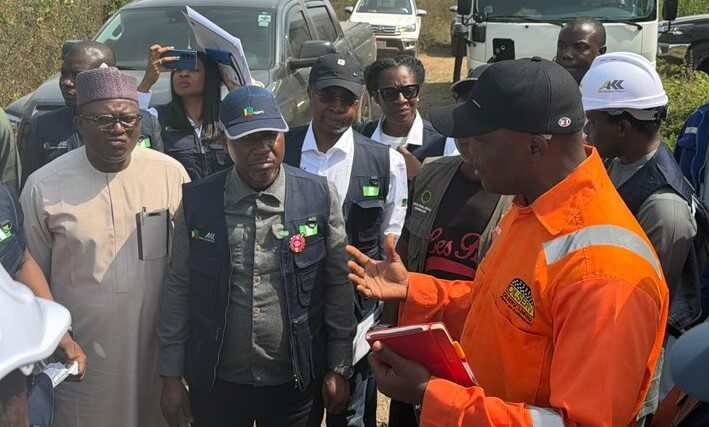

Well site and drilling location preparation for the Oza-1 well re-entry and first horizontal development well have progressed, and the Company is pleased to report that these steps have now been completed. The road to the well site location has been rebuilt and constructions of a concrete drilling pad, concrete mud pit, buildings and related infrastructure have also been completed. Long lead time items needed for the Oza-1 re-entry have been secured and a drilling rig currently located near the field has been identified and contracted.

As previously reported, an export pipeline that ties the Oza Oil Field production into the Trans Niger Pipeline and continues on to the Bonny Export Terminal, operated by Shell Production Development Company, is already in place. Infrastructure also in place at the Oza Oil Field includes a lease automatic custody transfer unit fiscal metering system, infield flow-lines, manifolds and a rental 6,000 barrel per day early production facility. These production and pipeline facilities should ensure that oil tested from the Oza-1 well re-entry and early production can be immediately delivered and sold on an expedited basis.

“As we have previously announced, the global restrictions imposed in response to the Covid-19 pandemic frustrated our attempts to complete our investment in the Oza Oil Field on our original timeframe. I am however pleased to report that, through the combined efforts of all of the partners, we are now close to concluding the funding arrangements. In the meantime, significant preparatory work has been completed on site and we now anticipate being able to start the project promptly.

“The Oza Oil Field is an existing field with historical production expected to deliver near-term cash flow. Furthermore, we have structured the transaction to minimise our own risk through a repayable loan at an attractive interest rate with an additional significant equity upside. The option to scale up our investment following receipt of the well test results provides us with valuable informed optionality.” Oisin Fanning, Chief Executive officer, said.