San Leon has announced that it has entered an agreement with its partner Decklar Petroleum Limited as further discussion to its previous announcement of 1 September 2020 regarding its proposed investment of the Oza Field in Nigeria. The parties have agreed to a further three week extension to 21 November 2020 in order to finalise certain conditions precedent in the Subscription Agreement, which have taken longer to conclude due to travel restrictions in place as a response to Covid-19. All other terms of the transaction remain unchanged.

San Leon Energy the independent oil and gas production, development and exploration company focused on Nigeria, has conditionally agreed to invest US$7.5 million by way of a loan to Decklar Petroleum, the local subsidiary of Asian Mineral Resources, listed on the Canadian TSX Venture Exchange. Decklar is the holder of a Risk Service Agreement with Millenium Oil and Gas Company on the Oza field in Nigeria. Until the loan and its interest are repaid, 100% of the Available Funds that can be distributed from Decklar’s RSA proceeds will be paid to San Leon in satisfaction of those payments. San Leon will also subscribe for a 15% equity interest in Decklar.

The Oza Oil Field

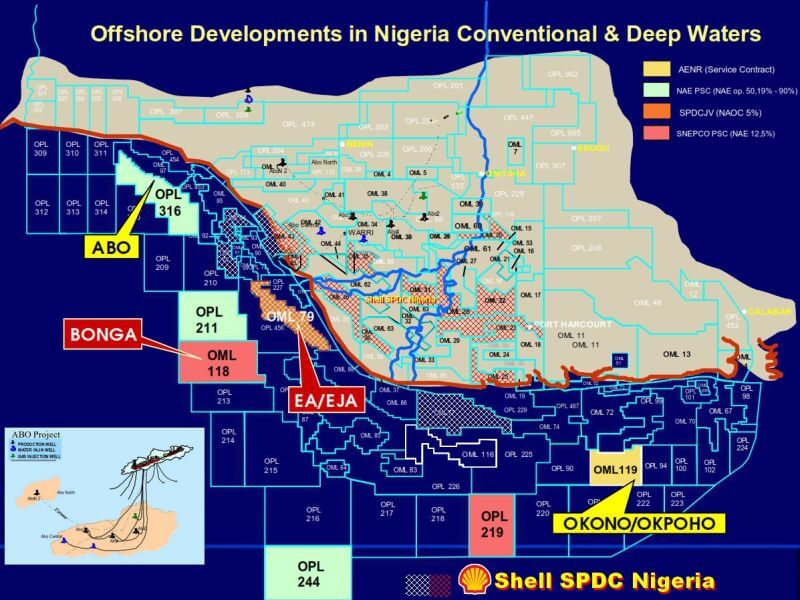

The Oza Oil Field was formerly operated by Shell Petroleum Development Company of Nigeria Ltd. The field has three wells and one side track drilled by Shell between 1959 and 1974. During the period when Shell was the operator, there were two periods of extended production testing from the Oza-1, -2 and -4 wells. The field was never tied into an export facility, nor was it fully developed by Shell and put into commercial production. In 2003, the Oza Oil Field was awarded to Millenium, having won the bid during the Marginal Fields Licensing Round. Since Millenium’s acquisition of the Oza Oil Field in 2003, approximately US$50 million has been spent on infrastructure in support of a restart of production including an export pipeline that connects the Oza Oil Field production into the Trans Niger Pipeline (TNP) which goes to the Bonny Export Terminal, a lease automatic custody transfer (LACT) unit fiscal metering system, infield flow-lines, manifolds and a rental 6,000 barrel per day early production facility.

In September 2016, San Leon Energy secured a 10.584%* initial indirect economic interest in Oil Mining Lease 18 (“OML 18”), onshore Nigeria. The Lease contains nine discovered fields, Alakiri, Asaritoru, Awoba, Bille, Buguma Creek, Cawthorne Channel, Krakama and Orubiri ) as well as a significant number of satellite exploration and appraisal prospects. The only field not entirely on block is Awoba which straddles OML 18 and OML 24 and is governed by a unitisation agreement dividing production equally between the OML owners. Cumulatively, OML 18 has produced over 1 billion bbls of oil (including Alakari condensate) and 1.8 TCF of gas.