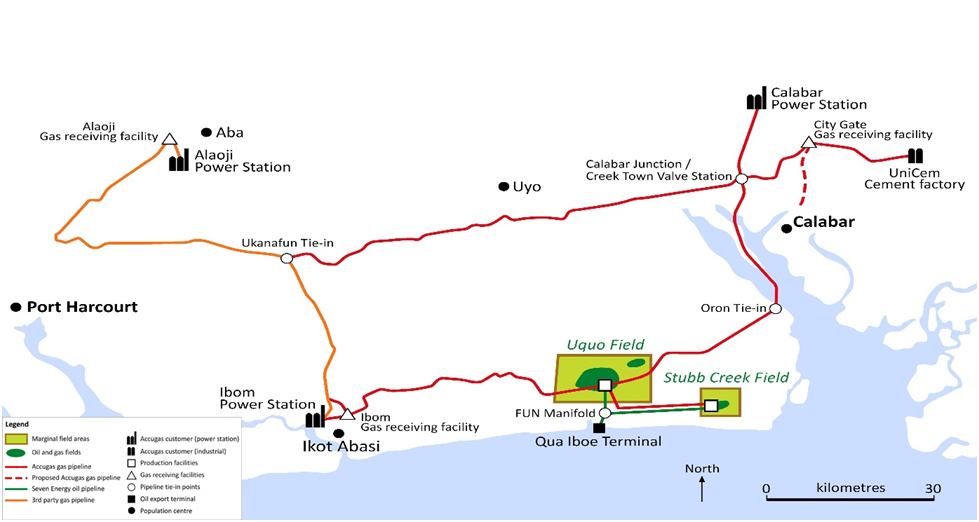

Savannah Energy PLC the African-focused British independent energy company sustainably developing high quality, high potential energy projects in Nigeria and Niger, has announced a trading update for the full year 2020 and guidance for the full year 2021.

Financial Year 2020 Nigeria Operational Highlights

According to the press release, the total cash collections from the Company’s Nigerian assets rose 11% year-on-year to US$187.4m. Financial Year 2020 average gross daily production was 19.5 Kboepd, a 13.5% increase from the average gross daily production of 17.2 Kboepd in Financial Year 2019, and at the mid-point of the Gross Production guidance range for Financial Year 2020 of 19.0 – 20.0 Kboepd.

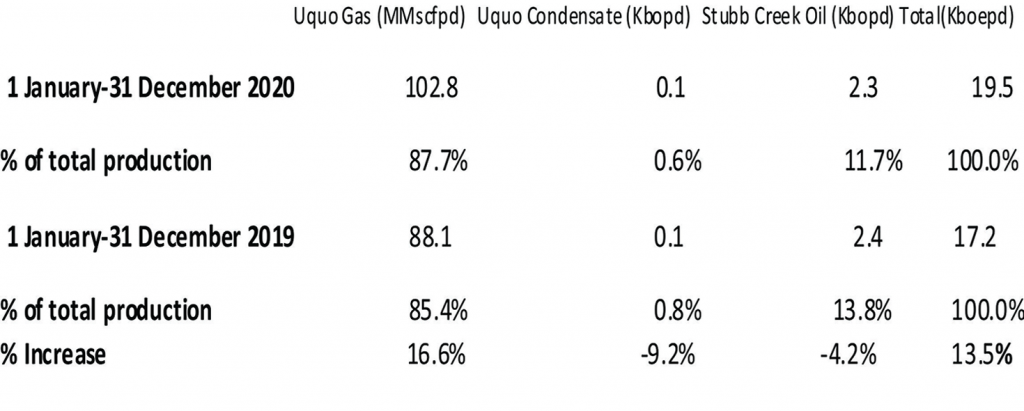

Of the FY 2020 total average gross daily production of 19.5 Kboepd, 88% was gas, including a 16.6% increase in production from the Uquo gas field compared to last year, from 88.1 MMscfpd (14.7 Kboepd) to 102.8 MMscfpd (17.1 Kboepd).

Nigeria Average Gross Daily Production

Note that Nigeria production levels are largely driven by customer nomination levels, while cash collections are largely driven by contractual maintenance adjusted take-or-pay provisions.

Guidance Issued for Financial Year 2021

Savannah is issuing guidance for the full year 2021 as follows:

-Total Revenues1 of greater than US$205.0m from upstream and midstream activities associated with the Company’s three active Nigerian gas sales agreements and liquids sales from the Company’s Stubb Creek and Uquo fields. Any revenues received from new additional gas sales agreements would, therefore, be incremental to this;

– Group Administrative and Operating Costs4 of US$55.0m – US$65.0m;

– Group Depreciation, Depletion and Amortisation of US$19m fixed for infrastructure assets plus US$2.6/boe; and

– Group capital expenditure of up to US$65.0m.

Modifications to 2020 – 23 Capital Expenditure Profile

Following the completion of the relevant technical and commercial studies, Savannah has amended its planned fouryear capital expenditure programme in Nigeria, as originally set out in the Nigeria Competent Person’s Report (the “Nigeria CPR”) published December 20196 . The Company now expects to reduce its Nigerian capital expenditures by 15% over the 2020-23 period from approximately US$118m to US$100m. This has resulted in a reduction in the overall indicative Group capital expenditure plans of around 13% from US$137m to US$119m over the same period.

The principal work programme changes will see only one gas well drilled in the 2020–23 period (as opposed to four assumed previously) on the Uquo field and the acceleration of the Uquo field compression project previously assumed to commence in 2026/27 to 2021/22.

It should be noted that the Uquo reservoir continues to perform in line with expectations and that the proposed change in the capital expenditure profile is not expected to impact Uquo field production or expected ultimate reserve recovery. The amendments, therefore, enhance the project economics of the ongoing Uquo field development

“As this FY 2020 trading update demonstrates, despite the challenging headwinds, 2020 was a milestone year for Savannah Energy. It was our first full year of operating the high margin assets we acquired in Nigeria and I am delighted to report that we have significantly exceeded all of the original financial guidance we presented to the market this year, as laid out in our corporate Key Performance Indicator statement published within our FY 2019 Annual Report. In 2020 we grew revenues, reduced our underlying cost base and continued to provide gas contributing to over 10% of Nigeria’s daily national average power generation, highlighting the resilience of the business.

Looking forward to 2021, we are providing guidance for the year for continued strong revenue generation, investments in key drilling and compression projects and an increased level of maintenance project activity versus 2020. Overall we have reduced our cost estimate for our indicative 2020–23 capital expenditure programme by around 13%, versus our previous indications and are guiding that we expect our underlying operating costs (which include maintenance expenditures) to track levels consistent with 2020 (in real terms) over the medium term. It should also be noted that our 2021 guidance excludes contributions from any new gas sales agreements or any contribution from the R3 East development project in Niger, which would be incremental to this.

I am excited around the potential for our business to grow further over the coming years, especially given the opportunity-rich West African environment in which we operate, and look forward to keeping our stakeholders up to date on the progress we make,” Andrew Knott, CEO of Savannah Energy, said.