Scirocco Energy, the AIM investing company targeting attractive assets within the European sustainable energy and circular economy markets

Office Location

1 Park Row,

Leeds,

UK,

LS1 5AB

Ruvuma PSA (25%, non-operated WI)

Scirocco holds a 25% working interest in the Ruvuma Petroleum Sharing Agreement (“Ruvuma PSA”) in the south-east of Tanzania covering an area of 3,447 km2 of which approximately 90% lies onshore and the balance offshore.

The Ruvuma PSA is in a region of southern Tanzania where very substantial gas discoveries have been made offshore in recent years and where gas has also been discovered onshore and along the coastal islands at Ntorya, Mnazi Bay, Kiliwani North and Songo-Songo.

The Ruvuma PSA was granted in 2005. The original PSA comprised two licences, Lindi and Mtwara, and covered an area of over 6,079 square km, around 80% of which is onshore, in the Ruvuma Basin. Following several statutory relinquishments, the PSA is now composed of only the Mtwara Licence which contains the Ntorya Appraisal Area over the Ntorya gas condensate discovery.

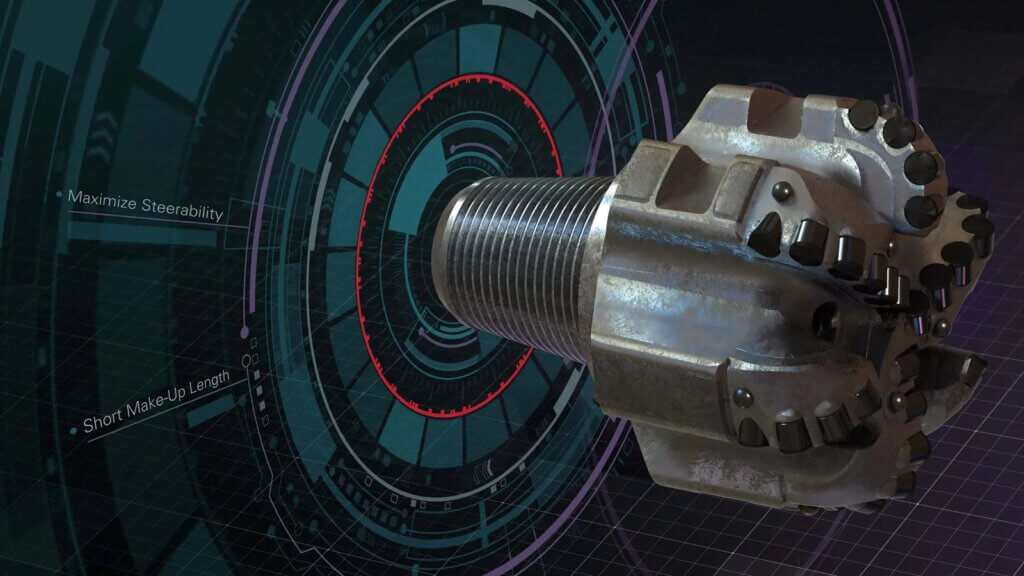

The Ntorya gas-condensate discovery, made in 2012 and operated by Aminex, represents the most immediate commercialisation opportunity in the Ruvuma PSA. The Ntorya-1 (“NT-1”) well was flowed over a 3.5-metre zone at the top of the gross 25-metre gas bearing interval at a maximum gross flow rate of 20.1 mmscfd and 139 bpd of 53 degree API condensate through a 1-inch choke. That well is suspended as a discovery for subsequent additional testing or production.

Following on from NT-1, it was decided to drill an up-dip well, Ntorya-2 (“NT-2”), at a location approximately 1.5 kilometres east of the discovery well. Drilled in early 2017, the well intersected a gross gas bearing sandstone reservoir interval of 51 metres thickness. A 34-metre interval of the gross reservoir was perforated and flowed dry gas at a stabilised rate of 17 mmscfd through a 40/64-inch choke.

Analysis of the well during testing and interpretation of electric logs strongly suggests that high mud weights, used to control gas influx during drilling, had caused a degree of formation damage around the well bore and these effects were reducing the test flows.

The joint venture has undertaken an independent resource study which estimates gross 2C contingent resources of 763 bcf, of which 191 bcf are net to Solo’s working interest, equivalent to approximately 31.8 mmbbls oil equivalent.

Resource Summary – Ntorya Field

| Gross Licene Basis – (bcf) | |||||

| Licence | Gas resource | 1C | 2C | 3C | Gross Mean unrisked GIIP |

| Mtwara | Development pending | 26 | 81 | 213 | |

| Mtwara | Development unclarified | 324 | 682 | 950 | 1,870 |

| 763 |

The project is ideally located with access to a major onshore gas pipeline which connects the Ruvuma PSA to Tanzania’s main economic centre, Dar es Salaam, allowing for the commercialisation of gas from Ntorya.

A work programme for Ruvuma is in place that will target a plateau rate of 140MMcf/d of gas from the Ntorya field.

The Joint Venture plans to drill the Chikumbi prospect targeting the Ntorya sand and a deeper Jurassic exploration target.

Kiliwani North Development Licence (8.39%, non-operated WI)

Kiliwani North Development Licence (KNDL) is located on Songo Songo Island in Tanzania and contains the Kiliwani North-1 (KN-1) well.

KN-1 reached 30MMcf/d during testing in July 2016.

The well has produced approximately 6.4 bcf of gas to date.

A competent person’s report (CPR) by RPS Energy estimates that KNDL’s remaining gross 2P gas reserves are 1.94bcf with a gross Pmean GIIP of 30.8bcf. A new prospect has been identified within the KNDL at Kiliwani South adding a further estimated gross 57bcf prospective Pmean GIIP.

The Joint Venture has been exploring various options to reinstate production from the well. The Operator has prepared, and is awaiting approval for, a remedial work programme intended to establish fluid levels in the well bore, measure reservoir pressure and to unload fluid using foam treatment technology.

If successful, this operation is expected to re-establish gas production from the well.

Scirocco holds an 8.39% stake in the Kiliwani North Development Licence, with Aminex the operator.

Helium One (1.59% interest)

Helium One Global Limited (HE1:AIM) is an AIM listed specialist explorer focussed on delineating and developing globally significant helium assets in Tanzania.

The company holds more than 4,500 square km of exclusive licences encompassing four project areas, the largest of which is Rukwa.

Netherland Sewell and Associates Incorporated (NSAI) estimates unrisked prospective recoverable (P50) helium resources of 98.9bcf at Rukwa.

The acquisition of a stake in Helium One provides Scirocco with early entry into the global helium market estimated to be worth over US$6bn annually.

Demand for helium has been growing at a rate of between 1.5 to 3 per cent per annum over the last decade and is a vital component of many modern technologies. As a result of its unique properties as a super fluid, it plays a vital role in devices which use super conducting magnets; as in MRI machines.

The Company completed an RTO to AIM in December 2020 securing access to funding for drilling.

Helium One is now focused on three key initiatives:

- Executing the seismic data acquisition on to its Rukwa Project;

- Fully financed for exploration drilling in H1 2020 to test selected target structures for the presents of Helium rich gas which can be recovered to surface; and

- Offtake programme. To engage with relevant counterparties in the speciality industrial gases sector regarding the offtake and sale of helium in a success case.

Scirocco holds a 1.59% stake in Helium One.