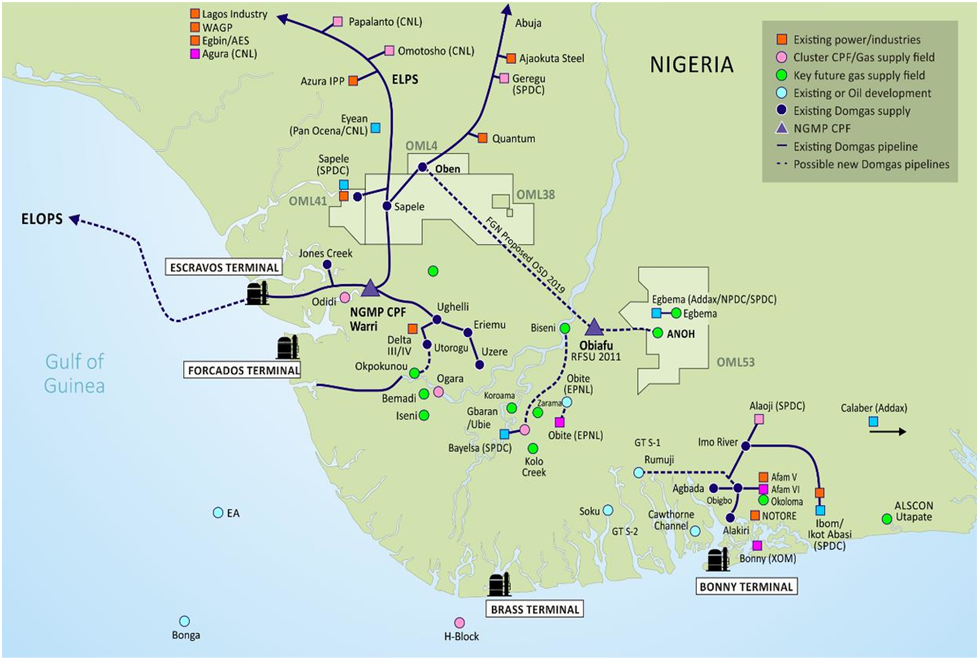

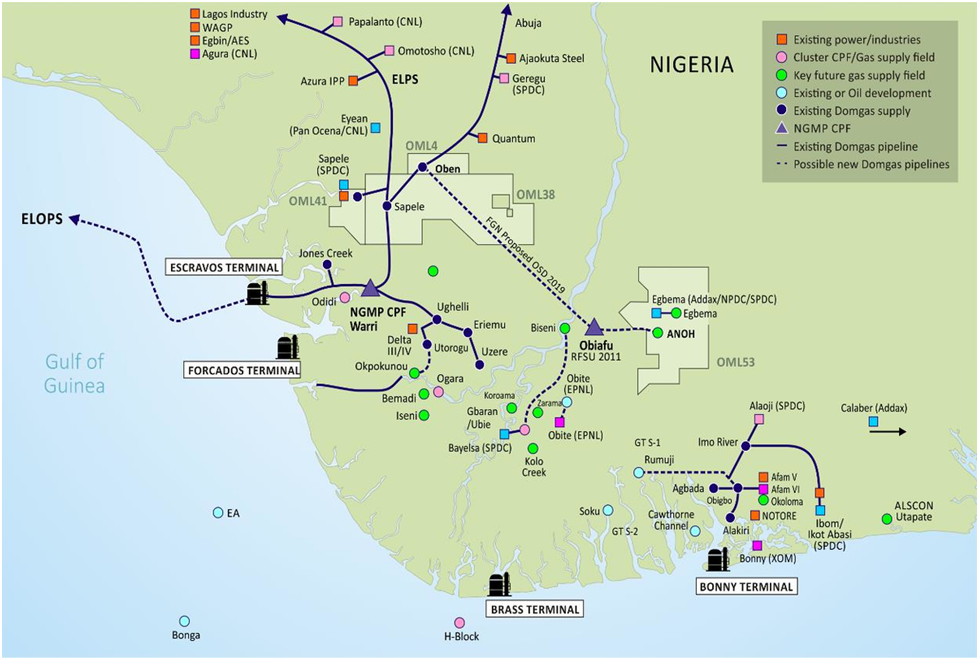

The ANOH Gas Processing Plant development at OML 53 (and adjacent OML 21 with which the upstream project is unitised) will drive the next phase of growth for Seplat’s expanding gas business. The project will comprise a Phase One 300 MMscfd midstream gas processing plant.

The ANOH plant is being built by AGPC, which is an IJV, owned equally between Seplat and the Nigerian Gas Company (“NGC”), a wholly owned subsidiary of Nigerian National Petroleum Corporation (“NNPC”). In February 2021, The IJV, AGPC, successfully raised $260 million in debt to fund completion of the ANOH project. The project is now fully funded following completion of equity investments of $210 million by each partner ($420 million combined).

ANOH is one of Nigeria’s most strategic gas projects. It will help Nigeria to accelerate its transition away from small-scale diesel generators to cleaner, less expensive fuels such as natural gas for power generation.

The upstream development, including the drilling of six production wells, will be delivered by the upstream unit operator SPDC, with four wells expected to be completed in 2021. We have made excellent progress on the project despite the COVID-19 challenges and we expect the major gas processing units to arrive in Nigeria in Q3 2021, to commence installation before the end of the year, with mechanical completion and pre-commissioning in Q1 2022 and first gas flowing to customers by the end of H1 2022.

The initial total project cost was budgeted at $700 million. Following a cost optimisation programme, the AGPC construction cost is now expected to be no more than $650 million, inclusive of financing costs and taxes, significantly lower than the original projected cost at FID.

“Our flagship ANOH project, with the Nigerian Gas Company, is now fully funded and we have made excellent progress in difficult times, with major gas processing units expected to arrive in Nigeria in Q3 2021, installation to commence before the end of the year, mechanical completion and pre-commissioning in Q1 2022 and first gas flowing to customers before the end of H1 2022, at a lower expected cost of up to $650 million,” Roger Brown, Chief Executive Officer, said.