Shelf Drilling, Ltd. announced results for the fourth quarter and full year of 2024 ended December 31. The results highlights will be presented by audio conference call on March 3, 2025 at 6:00 pm Dubai time / 3:00 pm Oslo time.

Fourth Quarter Results

Adjusted revenues were $225.4 million in Q4 2024 compared to $264.7 million in Q3 2024. The $39.3 million (15%) sequential decrease in adjusted revenues was driven by the $45.2 million acceleration of mobilization revenue in Q3 2024 on two rigs for which operations were suspended in Saudi Arabia, partially offset by higher average earned dayrates and higher effective utilization in Q4 2024.

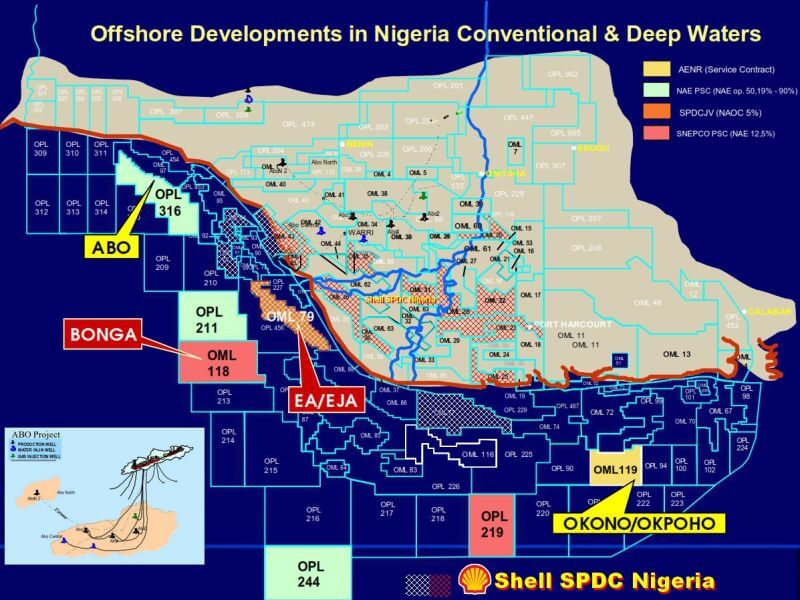

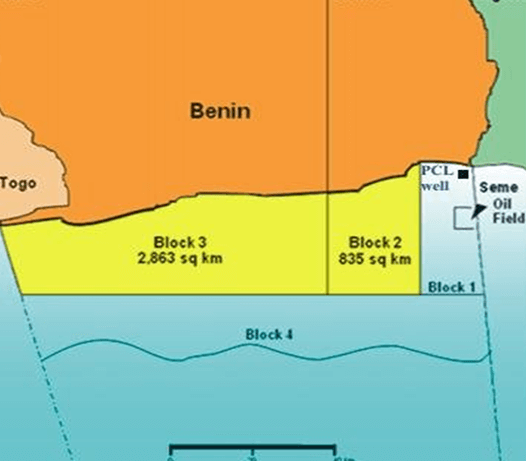

Effective utilization increased to 80% in Q4 2024 from 77% in Q3 2024, primarily due to the commencement of new contracts for three rigs in Vietnam, West Africa and Norway from mid-Q3 2024 to late Q4 2024. Average earned dayrate increased to $87.5 thousand in Q4 2024 from $81.8 thousand in Q3 2024 mainly due to one rig in Norway and two rigs in West Africa starting new contracts.

Total operating and maintenance expenses decreased by $3.1 million (2%) in Q4 2024 to $129.5 million compared to $132.6 million in Q3 2024. The sequential decrease was primarily due to lower mobilization costs for one rig in West Africa that commenced a new contract in Q4 2024 and lower operating costs for one rig in West Africa that was sold in Q3 2024. General and administrative expenses decreased by $0.8 million in Q4 2024 to $15.8 million as compared to $16.6 million in Q3 2024. The sequential decrease was primarily due to a decrease in compensation and benefit expenses partially offset by an increase in provision for credit losses

Adjusted EBITDA for Q4 2024 was $85.0 million compared to $114.2 million for Q3 2024. The adjusted EBITDA margin of 38% for Q4 2024 decreased as compared to 43% in Q3 2024. The significant decrease in adjusted EBITDA resulted primarily from the acceleration of mobilization revenues on two suspended rigs in Saudi Arabia in Q3 2024. The adjusted EBITDA for SDNS increased sequentially to $16.7 million from $(4.9) million primarily due to the commencement of new contracts in Vietnam and Norway in August and November 2024, respectively.

Capital expenditures and deferred costs of $31.0 million in Q4 2024 decreased by $3.9 million from $34.9 million in Q3 2024. This sequential decrease was primarily due to lower planned maintenance and shipyard costs for one rig in Saudi Arabia and lower contract preparation expenditures for two rigs that commenced new contracts in late Q3 and Q4 2024 in West Africa. This was partially offset by increased spending on fleet spares and for one rig in Norway that commenced a new contract in Q4 2024

Q4 2024 ending cash and cash equivalents balance was $152.3 million. The decrease of $67.8 million from $220.1 million at the end of Q3 2024 was primarily due to higher debt service payments ($37.5 million of principal payment and $69.0 million of interest payments) in Q4 2024 and a $30.1 million payment for the purchase of the remaining 40% shares from the former SDNS shareholders in Q4 2024. This was partially offset by cash insurance proceeds of $44.0 million for the Trident VIII that was declared a total constructive loss by the Company’s insurance underwriters in October 2024 following its structural damage in April 2024.

Greg O’Brien, Chief Executive Officer, commented: “Our Adjusted EBITDA for the fourth quarter of 2024 was $85 million, representing an increase of 23% over the previous quarter, after excluding the acceleration of mobilization revenue in Q3 for two suspended rigs in Saudi Arabia. The increase was mostly driven by higher revenue in Nigeria and Norway, following the commencement of new contracts in Q4.”

O’Brien added: “The fourth quarter of 2024 concluded a year marked by significant and unexpected challenges for Shelf Drilling, including rig suspensions in Saudi Arabia and a start-up delay in Norway. I am extremely proud of the responses from our entire team, redeploying assets and securing new backlog, identifying innovative ways to reduce costs and preserve cash, while continuing to deliver best-in-class services to our customers.

Two of the suspended rigs in Saudi Arabia were quickly redeployed to Nigeria and started new long-term contracts in the last quarter of 2024, while another two rigs are now being mobilized to West Africa for programs in the region. The recently announced alliance with Arabian Drilling will create additional opportunities in our core markets.

While we continue to see short-term pressure on dayrates following multiple rounds of rig suspensions in Saudi Arabia in 2024, we remain very confident in the long-term outlook for jack-up supply and demand. We firmly believe that the constructive backdrop for oil and gas, combined with our strong customer relations and unique operating platform, will enable us to drive long-term value for our stakeholders.”