Shell and Nigeria go back a long way – but net zero plans are leading to a clean break from Niger Delta assets

Shell has been active in Nigeria since the 1930s. It’s no exaggeration to say that Nigeria helped transform the company into the supermajor IOC we know today.

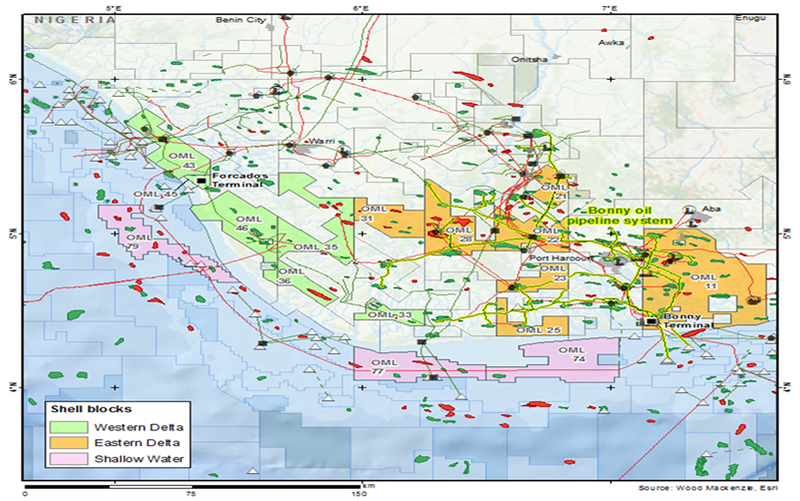

Now, 63 years after producing its first barrel in Nigeria, Shell plans to divest all of its operated joint venture (JV) licences held by the Shell Petroleum Development Company (SPDC). This includes a 30% interest in 19 oil mining leases (OMLs), according to Wood Mackenzie opinion report.

This is a radical step which would have seemed unlikely only 12 months ago, but is highly symbolic of what the energy transition means for IOCs in Africa.ExxonMobil could also divest its 40% stake in its JV with NNPC. Although the company has not set a net-zero target, its shallow water assets are high-cost, high-emission assets which are in steady decline.

Transition Energy and re-Investment outlook

Emissions from Shell’s assets in the onshore and shallow water Niger Delta are among the highest in its global portfolio. This is because of ageing infrastructure, under-investment, vandalism, continued flaring and the harsh operating conditions.

Until now, Shell has sold oil blocks but kept gas blocks supplying NLNG. This has changed, perhaps surprisingly, given that Shell seeks 55% gas in its global portfolio by 2030. Shell’s gas assets have the lowest emissions intensity within the JV, although still comparatively high compared with its global average.

The integration of these assets with oil infrastructure coupled with the ever-present security risks may have further persuaded Shell that a clean break from the onshore delta is, on balance, preferable.

Rather than sell single OMLs, Shell is seeking buyers for asset packages in the eastern, western and shallow water delta.

Shell’s JV assets in Nigeria

NNPC’s pre-emptive right paramount

Before all that though, Shell must negotiate with NNPC (holder of 55% in the JV assets), on the terms of a sale. This could cover NNPC’s pre-emption rights, treatment of outstanding JV liabilities including decommissioning, the fate of the JV’s terminals, transfer of staff and host community approval.

Shell’s priority is identifying credible buyers and ensuring deal completion. It wants to limit negotiations to hand-picked bidders, thus avoiding a long drawn-out process. But it needs NNPC’s buy in.

Indigenous EP Companies acquisition portfolios

Who wants high-cost, emissions-intensive assets in the Niger Delta? Not many. Yet Nigerian independents and new entrants are eager to acquire under-invested assets with plenty of volume upside. Playing at home, their acceptance of risk differs markedly from international E&Ps, so there will be few in the latter category. But in the energy transition era, can bidders raise enough finance to a) acquire, and b) invest in, a challenging portfolio of swampy assets?

Deal financing will be necessarily complex to mitigate risks. The recent OML 17 transaction highlighted that with a consortium of buyers backed by local and international lenders with multiple layers of debt.

Shell itself may provide finance to help smooth deals. It may even maintain an indirect interest in the OMLs, coupled with a clear exit strategy. This would get assets off the balance sheet, and provide more comfort to lenders. Innovative solutions will be needed.

A complete sell-off would be historic. However, all 19 OMLs will be extremely hard to shift in the current environment. Expressions of interest are due by 10 September.

Acquisition enablers

There could be as much as 4 billion boe (30% net) across the JV portfolio. However, we consider only 20% to be commercial due to a lack of investment, crude theft, insecurity and gas market constraints. Five of the OMLs are undeveloped.

A competent buyer/operator, giving priority to the assets, could commercialise much more than 20% of the resource base. The availability of funding for the JV partners will, as ever, dictate how much.

The recently passed Petroleum Industry Bill (PIB) overhauls the fiscal regime in Nigeria offering materially lower oil royalties and taxes. Hence, there is much more upside than downside which bidders will need to carefully quantify.

After decades of dominance in Nigeria, Shell is preparing for a new era with a much smaller, advantaged portfolio.