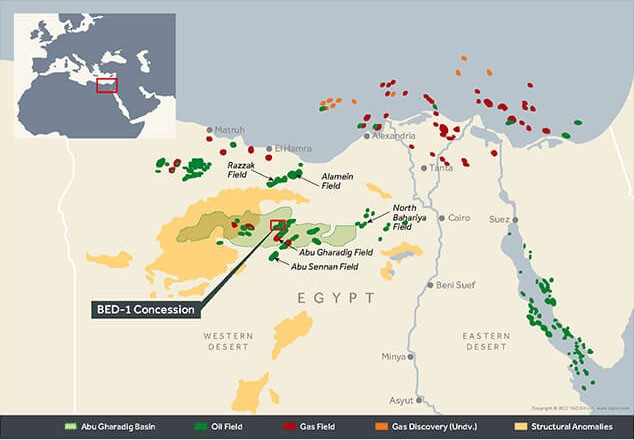

TAG Oil announces the following operations update and upcoming development of the Abu Roash F (ARF) unconventional carbonate reservoir at the Badr Oil Field (BED-1) concession in the Western Desert of Egypt and various corporate initiatives.

The BED4-T100 (T100) horizontal well continues to produce at an average rate of 100 barrels of oil per day (BOPD). The well has been steady, producing for close to 90 days under a rod pumping system. Cumulative gross production to date is in excess of 20,000 bbls of oil from the well.

TAG Oil resumed production from the BED 1-7 vertical well in December at approximately 40 BOPD on natural flow. Currently, a rod pump and associated surface facilities are being installed to optimize the oil rate and it is projected the well will be back on production later this month. Cumulative gross production from the well to date is approximately 10,000 bbls of oil.

Improved field treating of the medium grade crude oil and regular deliveries have commenced as sales and transportation logistics continue to be optimized. Other operating costs are being reviewed and reduced to improve per barrel netback margins on both the T100 and BED 1-7 oil production.

For the 2025 development plans at the BED-1 concession, the Company intends to drill a vertical well in Q2-2025 to further develop the ARF formation in a high intensity natural fractured area that can potentially produce at good initial oil volumes. Planning of a second horizontal well is tentatively scheduled for drilling in Q4-2025.

TAG Oil has signed an Engagement Agreement with PillarFour Capital of London to sell the New Zealand royalty interests. Proceeds from the sale will be used to strengthen the Company’s balance sheet.

The Company also signed an Engagement Agreement with LAB Energy Advisors of London to offer participation in the BED-1 concession by strategic international industry partners to accelerate the development of the ARF formation. Acquisition approval of the large 2,000 km2 concession in the Western Desert is progressing and the Company will provide any updates as they arise.

“Closing of the $6.8 million equity financing, cost reductions, production revenue improvements from existing wells, and the potential sale of the New Zealand Royalty will supplement our cash balances and funding of the 2025 capital program. The appointment of LAB Energy Advisors and securing a partner at the BED-1 concession will have a significant impact on the scale of activities and accelerating the development of our assets in Egypt,” Abby Badwi, TAG’s Executive Chairman and CEO, commented.