The company set out its plans in its annual filing with the US Securities and Exchange Commission (SEC).

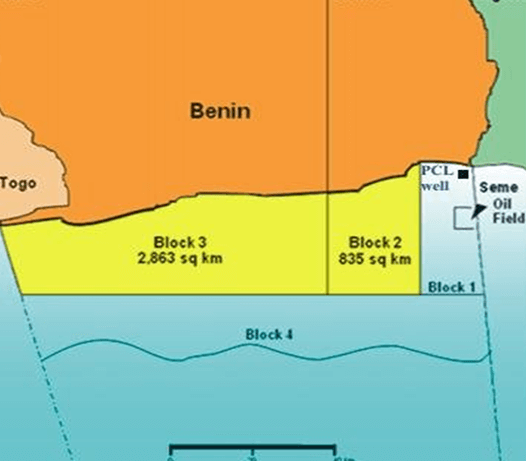

Total began drilling an appraisal well on Block 20/11 in January and another is planned for Block 48 this year. It bought the former block in June 2020, following the collapse of Cobalt International Energy, which had made a number of discoveries.

On Angola’s Block 17, Total and the local authorities reached a deal to extend the licence until 2045. Total agreed to drill two exploration wells on the block in 2022-23.

It is also working to maintain production from the block. Total will drill infill production wells this year, which will also begin producing this year. Further out, it is also working on three brownfield brownfield projects.

These are Zinia Phase 2, CLOV Phase 2 and Dalia Phase 3 – will begin producing in 2022, it said. It had previously expected to start in 2020/21

Total paid $2.96 billion in taxes in sub-Saharan Africa, of which $1.09bn was paid on Block 17 to the Angolan government.

The French company paused work on Block 0 in April 2020, because of the pandemic. It expects to resume this in 2021.

Meanwhile, in Namibia, Total is planning to drill the Venus well this year, on Block 2913B. The company did not commit to a particular time, but various sources have predicted the third quarter.

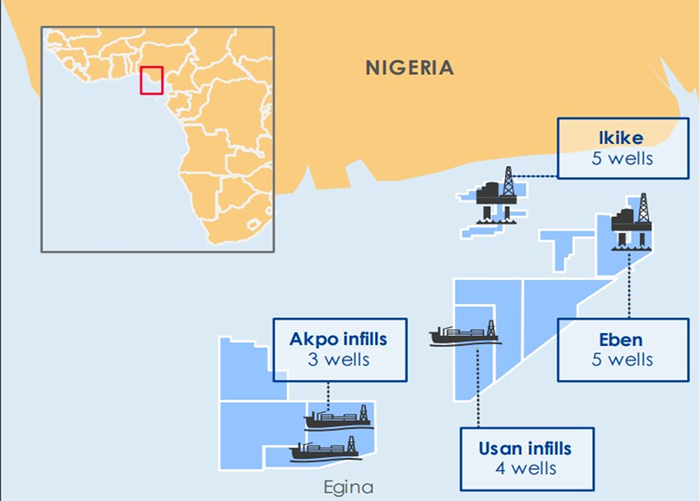

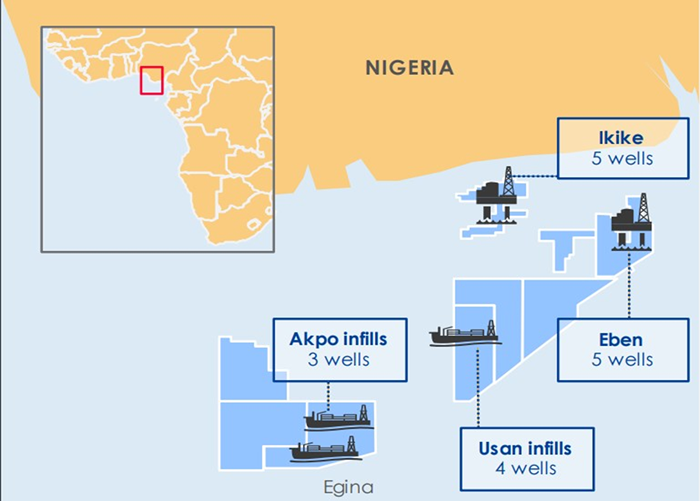

The French company took a final investment decision (FID) on Nigeria’s Ikike project in January 2019. It expects to reach first oil late this year.

The company had hoped to begin production at the project in 2020. The field will be tied back to the existing Amenam field.

Total singled out two potential projects in Nigeria. The authorities approved a field development plan for Preowei in 2019. The company is also considering work on the Owowo discovery, which it found in 2012.

The company also noted that its board had approved development plans in Uganda. These consist of the Tilenga development and the East African Crude Oil Pipeline (EACOP). CNOOC Ltd will work on the matching Kingfisher project.

Under the Ugandan development plans, the companies will drill around 430 onshore wells and build two crude processing facilities.

Tilenga will require 400 wells, half of which will be water injection, and is expected to produce 190,000 barrels per day. Kingfisher, which is 150 km to the south of Tilenga, will involve 31 wells and produce 40,000 bpd.

Uganda, Tanzania and Total planned to sign a deal on March 22. However and was later push into April.

The Uganda plan took top billing for the company, with Total saying it would “focus its investments primarily” on the EACOP and Tilenga projects. Other plans named by the company were all post-FID.

The Tilenga, Kingfisher and EACOP projects will produce oil with 13 kg of CO2 per barrel, ahead of the industry average of 20 kg. As such, Total defended its investment in the project, saying this was in line with its climate ambition plans set out in May 2020.

Angola is at the heart of Total’s production, with output of 184,000 bpd in 2020, down from 205,000 bpd in 2019. Africa’s liquids contribution to the company were all down last year.