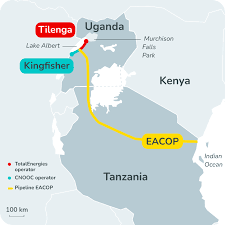

According to TotalEnergies information base, the projects for the development of the oil and gas resources of the Lake Albert region and the cross-border pipeline are situated in a sensitive social and environmental context that requires special measures for the environment and the rights of the local communities. So completion of the Tilenga and EACOP projects will require the implementation of a land acquisition program covering some 6,400 hectares.

For Tilenga and EACOP, this program means relocating 775 primary residences, and will affect a total of 18,800 stakeholders, landowners and land users. Carried out in compliance with IFC performance standards, this program will begin with a complete survey of the land and crops and monetary compensation and/or compensation in kind. Each family whose primary residence is being relocated may choose between a new home and monetary compensation. An accessible, transparent and fair complaints-handling system will be running throughout the process.

In the course of achieving an egalitarian, all encompassing and equitable resolutions Patrick Pouyanné, Chairman and CEO of TotalEnergies, has entrusted Lionel Zinsou, a recognized expert in African economic development, with a mission to assess the land acquisition program carried out in Uganda and Tanzania as part of the Tilenga and EACOP (East African Crude Oil Pipeline) projects, and the socio-economic development initiatives accompanying this program.

As the land acquisition process draws to a close, this mission will evaluate the land acquisition procedures implemented, the conditions for consultation, compensation and relocation of the populations concerned, and the grievance handling mechanism. It will also assess the actions taken by TotalEnergies EP Uganda and EACOP to contribute to the improvement of the living conditions for the people affected by these land acquisitions and suggest additional measures to be implemented if needed.

The mission will submit its report by April 2024, and its conclusions will be shared with the Tilenga and EACOP project partners.

The Tilenga and EACOP projects include a land acquisition program covering some 6,400 hectares, carried out on behalf of the Ugandan and Tanzanian governments. This program concerns 19,140 households and communities owning or using plots of land and includes the relocation of 775 primary residences. To date, 98% of the households concerned have signed compensation agreements, 97% have received their compensation, and 98% of households to be relocated have taken possession of their new homes.

The Tilenga upstream development project in Uganda is carried out by TotalEnergies (56.67%, operator), CNOOC (28.33%) and UNOC (15%). Production from the oil fields in Uganda will be transported to the port of Tanga in Tanzania through the cross-border pipeline developed by the EACOP Company, whose shareholders are TotalEnergies (62%), UNOC (15%), TPDC (15%) and CNOOC (8%).

AFRICA OILFIELD DIVESTMENT IN 2023

In addition to Eni’s Neptune acquisition with Vår Energi, Africa’s energy sector saw multiple transactions valued at more USD500 million, our report notes.

- Africa Finance Corporation (AFC) Equity Investment, headquartered in Nigeria, announced plans to acquire E&P company Aker Energy in Ghana. Following the completion of the USD605 million transaction, AFC will have a 50% stake in the deepwater Tano Cape Three Points block offshore Ghana, which includes the Pecan oil field. The Pecan Field project is expected to produce 80,000 barrels per day (bpd) of oil beginning in 2025-2026.

- In August, Paris-based oil and gas exploration company Maurel & Prom announced the acquisition of Gabon-focused oil and gas company Assala Energy (United Kingdom) from global investment firm The Carlyle Group, based in Washington, DC. The USD730 million transaction includes all of Assala Energy’s Gabon-focused assets and subsidiaries.

- Portuguese oil company Galp Energia (Galp) sold its upstream assets in Angola’s Block 14 to local independent Somoil. Galp has announced plans to focus on its upstream operations in Brazil and work on renewable operations in South America. Somoil is already active in the block and paid USD655 million for the mature upstream asset.

Additional acquisitions by independents included UK energy company Afentra signing a sale and purchase agreement with independent equity producer Azule Energy in July to acquire a 12% interest in Block 3/05 and a 16% interest in Block 3/05A, both in Angola, for approximately USD48 million.

Angola also approved Afentra’s acquisition of two oil blocks from state-owned Sonangol. That deal, scheduled to be finalized by the end of 2023, includes a 14% non-operating interest in Block 3/05 and a 40% non-operating interest in Block 23.

And in Egypt, US-based independent Apex Energy acquired six concessions from International Egyptian Oil Company, an Eni subsidiary, in January. The deal includes all of the company’s interests in the Ras Qattara, West El Razzak, East Kanayis, and West Abu Gharadig concessions, along with a 25% interest in the East Obaiyed and South West Meleiha concessions.