Tower Resources the AIM-listed oil and gas company focused on Africa, is pleased to provide an update on the farm-out process in respect of its Thali production-sharing contract in Cameroon (the “PSC”).

The Company is also announcing a placing of 4,401,851,851 ordinary shares of 0.001p each (the “Subscription Shares”) at a price of 0.027p per Placing Share (the “Placing”), representing a discount of approximately 22.9% to the closing bid price of the Company’s shares on 15 October 2024.

The Placing has been arranged by the Company’s joint broker, Axis Capital Markets Limited.

Cameroon Farm-out Update

The Company has received an updated proposal from the party whose financing proposal was first announced together with the Company’s Interim Results on 30 September 2024, and is also still in discussions with other parties and expecting another proposal in due course.

The updated proposal the Company has received is more detailed and would now provide in excess of US$15 million of funding for the Thali PSC work programme, including drilling the NJOM-3 well (which is already partly funded), in return for a minority interest in the PSC, and with Tower remaining as the Operator. It also provides for future production-based payments to the Company, a portion of which are committed to Pegasus Petroleum Limited (“Pegasus”, wholly owned by a trust of which the Company’s CEO and Chairman is a lifetime beneficiary) pursuant to agreements made in 2019 arising from the working capital facility that Pegasus had provided to the Company at that time and as announced on 4 March 2021 (the “Production Payment Agreements”).

The proposal has normal conditions precedent, including the Cameroon Government’s approval for the farm-out and drilling schedule, and the proposal would also require amending the Production Payment Agreements, which the Company believes can be agreed. Importantly, the proposal does not contain any financing contingency as the counterparty has available funds, and a portion of the funding would be secured by a bank guarantee.

The Company is presently reviewing the current proposal and clarifying its terms where appropriate, and expects to work on detailed contracts with this partner, or one of the other parties, over the coming weeks. The Company does not intend to comment further on these negotiations until a final agreement is reached.

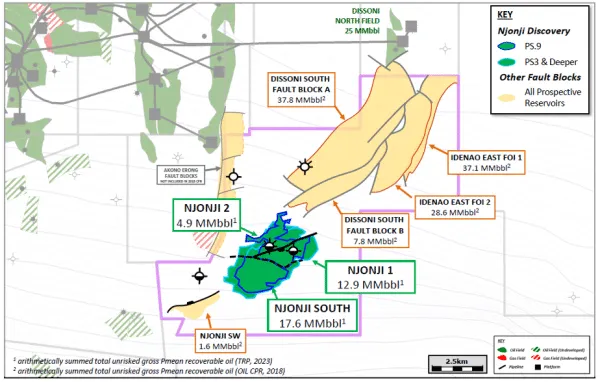

The Company is also continuing its discussions with African banks about either or both of a short-term facility to enable earlier production from the NJOM-3 well, and also a longer-term facility to finance production from the subsequent wells the Company intends to drill on the Njonji structure. The Company has now signed a mandate to BDEAC, the Development Bank of the Central African States, for it to provide a guarantee in respect of such a facility, following a lengthy process of due diligence, and that proposal is now being reviewed at the highest levels of the bank.

While we remain confident of achieving a positive funding result, there can be no certainty in respect of the final outcome of discussions or the timing thereof until we have signed definitive agreements.

Tower Resources Chairman & CEO, Jeremy Asher, commented:

“We are very pleased with the progress of the farm-out process and look forward to finalising an agreement in the near future. Although the Thali farm-out is a key priority for us, we also want to move forward with