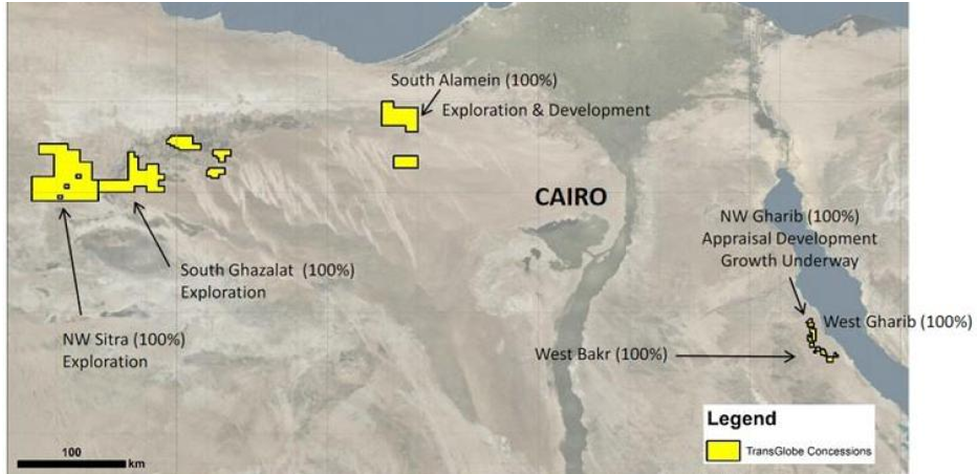

TransGlobe Energy Corporation cash flow-focused oil and gas exploration and development company whose current activities are concentrated in the Arab Republic of Egypt and Canada has announced an update on its operations in Egypt and Canada. All dollar values are expressed in US dollars unless otherwise stated.

UPDATES

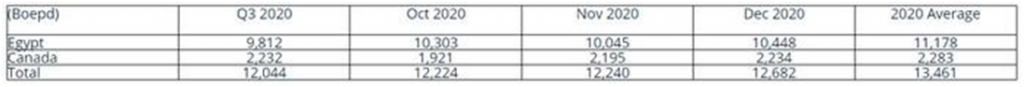

- Production averaged 12.4 MBoepd in Q4, 2020 and 13.5 MBoepd for the year ended 2020, meeting updated guidance of 13.3 to 13.8 MBoepd provided on August 11, 2020;

- Following the Egyptian General Petroleum Company’s approval of the amendment, extension and merger of the Company’s Eastern Desert concession agreements in December, 2020, the Company expects ratification by Egypt’s Parliament in Q2, 2021;

- A 2021 work program and budget is being prepared for implementation in parallel with the ratification process that accelerates exploitation of the Eastern Desert merged concession with the aim of increasing oil production;

- Work has begun to expand the early production facility at South Ghazalat in order to facilitate a planned Q2, 2021 recompletion of the SGZ-6X well to the deeper, more prospective lower Bahariya reservoir;

- Preparations are underway to stimulate and equip, in Q1, 2021, the 2-mile horizontal South Harmattan well drilled, but uncompleted, in Q1, 2020. Further development activity targeting the exciting South Harmattan oil resource is also anticipated in 2021;

- Collected ~$32.3 million in receivables in Q4, 2020.

PRODUCTION

Production Summary (WI before royalties and taxes):

Company production met the lower end of production guidance for 2020 of 13.3 to 13.8 MBoepd. This is principally due to delayed Egypt well maintenance, reflecting the weak economics of the fiscal terms of the pre-consolidation concession agreements, and was in line with the Company’s focus on maintaining the Company’s balance sheet strength in 2020. Canadian production met expectations.

OPERATIONS UPDATE

Arab Republic of Egypt

Eastern Desert (100% WI)

During the quarter oil prices remained weak, with well repair and maintenance activities focused only on those that generated positive cash flow while negotiations to amend, extend and consolidate the Company’s Eastern Desert concession agreements continued.

As previously disclosed, the Company announced a merged concession agreement with a 15-year primary term and improved Company economics in early December, 2020. Ratification of the concession is anticipated in Q2, 2021, and the February 1, 2020 effective date for the improved concession terms supports increased investment in parallel with ratification.

The Company is in the process of finalizing an enhanced 2021 work program and budget that reflects this breakthrough, accelerating production and cash flow in 2021 through an invigorated well maintenance program and development activities on the contingent resource projects previously disclosed. At this time, the joint venture operating organization in Egypt is sourcing a drilling rig and the necessary equipment in support of this program.

Western Desert – South Ghazalat (100% WI)

Work to expand the production handling capacity at South Ghazalat has begun, in advance of a planned Q2, 2021 SGZ-6X recompletion to the deeper, more prospective lower Bahariya reservoir. The Company announced on November 19, 2018 that a 42 foot perforated interval in the Lower Bahariya had flowed 2,437 Bopd of light oil, 21 Bpd of water and 1.4 MMCFD of natural gas on a 40/64″ choke. Reservoir and surface facility management practices are expected to constrain production from this interval following the expected recompletion.

Canada

Preparations have commenced to stimulate and equip, during Q1, 2021, the 2-mile horizontal well drilled but not completed, as part of the Company’s 2020 Cardium drilling program in South Harmattan. This well offsets the successful 2-mile horizontal oil well 2-20, previously disclosed by the Company on January 30, 2020. The 2-20 well has been producing continuously since original tie-in in late November of 2019, other than for maintenance conducted on third-party facilities. This long-term production performance has further strengthened our confidence in the potential of South Harmattan.

Further development activity is anticipated in South Harmattan in 2021. The Company holds 22.5 sections of land in the South Harmattan area.

CORPORATE

The Company repaid $5 million on the $75 million Mercuria prepayment facility agreement in Q4, 2020, leaving $15 million drawn and outstanding on the facility. TransGlobe is actively engaged with Mercuria on an amendment and extension to the facility currently maturing in September, 2021.

TransGlobe collected $32.3 million of receivables in Q4, 2020 and ended the year with over $30 million of cash and no net debt.

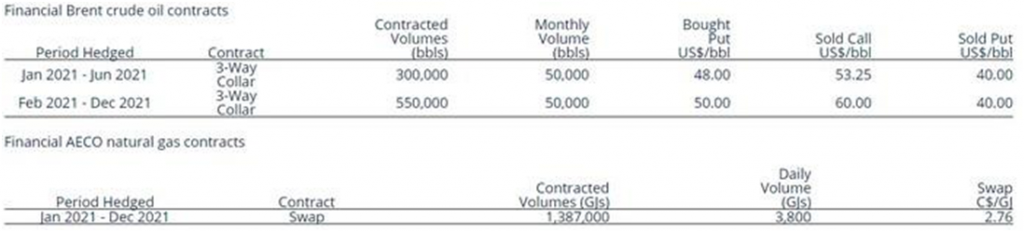

The material increase in recent oil prices and subsequent positive impact to the forward strip have positively impacted TransGlobe’s 2021 budget planning and the Company has entered into the following hedges to support a material 2021 capital program:

Business continuity plans remain effective across our locations in response to COVID-19 with no health or safety impacts, or production disruption due to illness.

CEO’s Statement

‘With the announcement of the consolidation, amendment and

extension of our Eastern Desert PSCs now behind us and with oil prices firming

up in the $50-$55 / Bbl range, we are working diligently on high grading

opportunities as we finalize a work program that reflects both the significant

resource potential and the greatly improved cash flow generating capacity of

our assets. We are excited about the investment alternatives now

available to the Company in 2021 to grow production, cash flow, and reserves in

both Egypt and Canada.’