TransGlobe Energy Corporation has programmed the sum of $57.7MM for its 2022 capital program (before capitalized G&A) this includes $33.1MM for Egypt and $24.6MM for Canada. The 2022 Plan was prepared to focus on value accretive projects within the Company’s portfolio, maximize free cash flow to direct at future value growth opportunities, to increase the Company’s production base and to allow the Company to revisit its dividend policy.

Egypt

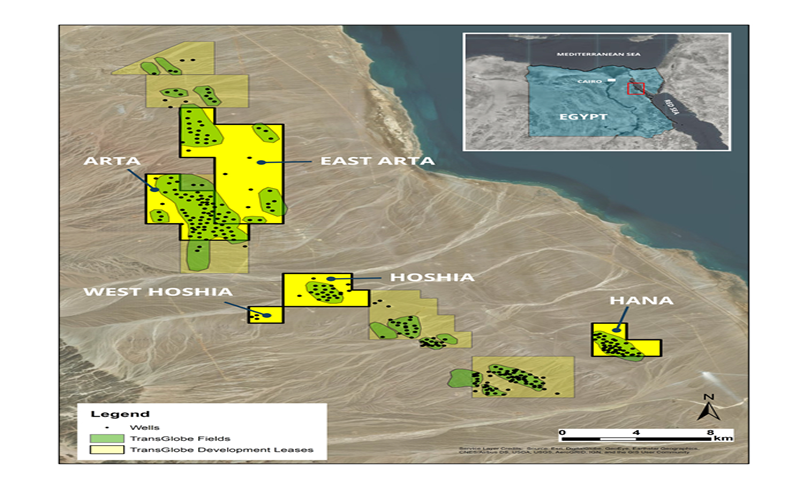

As announced on January 20, 2022, the Company has executed its agreement with the Egyptian General Petroleum Corporation (EGPC) to merge its three existing Eastern Desert concessions with a 15-year primary term and improved Company economics. An official signing ceremony with the Minister of Petroleum and Mineral Resources was held on January 19, 2022. The Agreement consolidates the three existing producing concessions in the Eastern Desert which, in December 2021, had a combined average production of 9,394 Bopd (8,590 Bopd Heavy Crude; 803 Bopd Light and Medium Crude).

The Agreement is effective as of February 1, 2020, and, as such, there will be an effective date adjustment owed to the Company for the difference in the historic commercial terms and the revised commercial terms applied against the production since the effective date. The quantum of the effective date adjustment is expected to be finalized with EGPC in the coming months. The Agreement has a 40% cost recovery limit and a variable profit share. Detailed commercial terms of the Agreement are presented at the end of this release.

The 2022 $33.1MM Egypt capital program is predominantly weighted towards 13 development wells within the Eastern Desert, including two ArtaNukhul horizontal multi-stage completion wells. Additionally, two exploration wells are planned for the second half of the year along with a further two water injection wells, bringing the total planned number of wells in Egypt to 17. The Egypt capital program includes $12.6MM of other spending, of which half relates to materials, including long-lead capital items which are expected to provide continuity into 2023. With the finalization of the concession agreement, the primary focus of the 2022 Egypt plan is to accelerate the exploitation of the Company’s Eastern Desert acreage while optimising the potential of modern, horizontal multi-stage completion wells in accessing the Company’s contingent resource base.

The 13 well development program, already underway, consists of nine vertical development wells in K-field, the two previously mentioned horizontal wells in Arta field, and two further vertical wells in Arta field.

Egypt production is expected to average between 10.0 and 10.8 MBopd for the year.

Canada

The $24.6MM Canada program consists of drilling seven (seven net) horizontal wells all targeting the Cardium light oil resource at South Harmattan along with additional maintenance/development capital. The Cardium drilling program in 2022 consists of six 1-mile and one 2-mile wells. Two of these wells are expected to be drilled in Q1 2022. The remaining five wells are expected to be drilled in late June through August, and all wells are expected to be completed and brought onstream in late summer to early fall 2022.

Canada production is expected to average between 2.4 and 2.6 MBoepd for the year.

“With the agreement to merge our Eastern Desert concessions executed, and recent commodity price improvements, the Company is rapidly moving forward to increase investment in Egypt and Canada to support our growth plans in both countries. In Egypt, the focus will be chiefly on maintaining / growing production in the Eastern Desert while we work to further mature our contingent resource portfolio through the drilling of our first horizontal multi-stage completion wells. In Canada, the focus will be on developing our South Harmattan acreage, following on from our very successful 2021 drilling program, and continuing to expand the discovered resource base. Our 2022 budget underlines the confidence we have in the potential of the TransGlobe portfolio. With the much improved terms in the Eastern Desert, expectation of continued strong oil prices, and the realization of the amounts owing from the effective date adjustment on the consolidation of the Eastern Desert concessions, the Company expects to revisit its dividend policy in the near term,”RANDY NEELY, PRESIDENT & CEO’S STATEMENT