Over the past few weeks, Tullow has been reviewing its business plan and operating strategy with lending banks within its RBL and their financial advisers, as well as with the financial advisers of the 2021 convertible bond holders and the 2022 bond holders. This plan is expected to generate material cash flow, which will enable reduction of the Group’s current debt levels and creates the foundation to address near-term debt maturities.

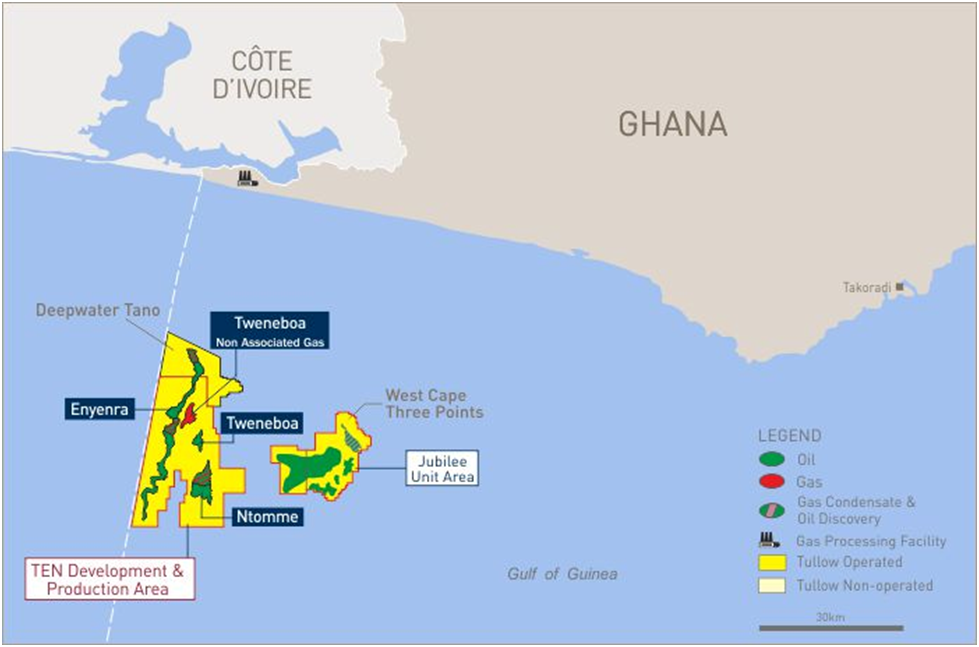

Completion of the Uganda transaction in 2020, the recent announcement of asset sales to Panoro Energy, exploration portfolio rationalisation and material cost savings, will enable the Group to deliver in excess of US$1 billion of self-help over two years. This, along with strong operational performance in Ghana and higher commodity prices, is providing positive impetus to constructive discussions with creditors with regards to Tullow’s debt refinancing options. The Group is confident that a mutually satisfactory agreement for all stakeholders can be reached in the first half of the year.

As part of this process, Tullow and its technical banks have agreed a new debt capacity amount under the RBL facility of c. US$1.7 billion; this remains subject to formal approval by a majority of lending banks and, once approved, will be effective from 26 February. The debt capacity reduction from c. US$1.8 billion based on the September 2020 redetermination reflects the effects of six months of production and the removal of the Equatorial Guinea and Dussafu assets as a result of their sale to Panoro Energy. Based on the new debt capacity amount, Tullow will have liquidity headroom of free cash and available debt facilities of c. US$0.9 billion. The next RBL redetermination is scheduled to take place in September 2021.

Tullow will provide a further update at its Full Year results on 10 March 2021