Tullow Oil plc (Tullow) is pleased to announce that it has signed two separate sale and purchase agreements with Panoro Energy ASA (Panoro) for all of Tullow’s assets in Equatorial Guinea (the EG Transaction) and the Dussafu asset in Gabon (the Dussafu Transaction).

Rahul Dhir, Chief Executive Officer of Tullow, and Les Wood, Chief Financial Officer, will host a call for investors at 9am UK time on 10 February 2021. The dial-in details for this call can be found at the end of this press release.

Transaction Highlights

- US$180 million asset sales consisting of up to US$105 million for the EG Transaction, up to US$70 million for the Dussafu Transaction and a further US$5 million consideration to be paid after both transactions have completed.

- EG Transaction: US$89 million upfront cash consideration subject to customary completion adjustments; contingent cash payments of up to US$16 million linked to asset performance and oil price.

- Dussafu Transaction: US$46 million upfront cash consideration subject to customary completion adjustments; contingent cash payments of up to US$24 million linked to asset performance and oil price.

- Sale of c. 6,000 bopd of 2021 production and c. 20 million barrels of 2P reserves, with an effective date of 1 July 2020.

- Government of Equatorial Guinea has approved the EG Transaction and confirmed that no tax arises on the disposal.

- Completion of both transactions and receipt of funds is expected in the first half of 2021.

Strategic and Financial Impact

- These are value accretive transactions which further strengthen the balance sheet and are in line with Tullow’s strategy of focusing on high-margin, self-funded production with strong cash flows.

- These transactions will have a neutral impact on Group’s 2021 operating cashflow at US$50 / barrel and increase Tullow’s 2021 pre-financing free cash flow by c. $0.1 billion; US$129 million of longer-term decommissioning liabilities assumed by the purchaser.

- Important steps in reducing net debt and enabling the Group to deliver US$1 billion of self-help in two years through asset sales, exploration portfolio rationalisation and material cost savings.

- Limited impact of disposals on the debt capacity of Tullow’s Reserve-Based Lending facility; these transactions are also expected to provide positive impetus to Tullow’s ongoing constructive discussions with its creditors.

Rahul Dhir, Chief Executive Officer, Tullow Oil plc, commented today:

“These are important, value accretive deals for Tullow that will have a positive effect on our financial position as we look to further reduce our net debt and continue constructive discussions with our creditors. These transactions are also in line with our strategy of investing our capital on cash-generative, high return investment opportunities in our core portfolio.

“Our Equatorial Guinea assets have formed an important and stable part of our non-operated West Africa producing portfolio since 2004. We will be exiting Equatorial Guinea after many years of successful investment and co-operation and we thank the Government of Equatorial Guinea for their continued support. Gabon remains a core country of operations for Tullow and we will continue to invest in our assets and seek new opportunities.”

Transaction Structure

Tullow has signed two separate sale and purchase agreements with Panoro, pursuant to which Tullow has agreed to the sale to Panoro of its entire interest in Equatorial Guinea through the sale of Tullow Equatorial Guinea Limited and its entire interest in the Dussafu Marin Permit Exploration and Production Sharing contract in Gabon, in each case with an effective date of 1 July 2020.

The EG Transaction constitutes a Class 1 transaction under the UK Listing Rules and is subject to the approval of Tullow’s shareholders. The Dussafu Transaction constitutes a Class 2 transaction and therefore does not require shareholder approval. Completion of the EG Transaction and the Dussafu Transaction are not inter-conditional. However, both transactions are subject to the approval by Panoro’s shareholders of a proposed equity fundraising, to part finance the transactions by Panoro, and also customary government and other approvals.

Panoro’s two largest shareholders, Sundt AS and Kistefos AS, have committed to subscribe for new ordinary shares in Panoro, representing an amount of NOK 100 million (approximately US$11.6 million) and NOK 86 million (approximately US$10 million) respectively, in Panoro’s equity fundraising. In addition, members of Panoro’s board and executive management team, including its Chairman, Julien Balkany and its CEO, John Hamilton, are participating in the placing.

Completion of both transactions and receipt of funds is expected in the first half of 2021.

EG Transaction highlights

Tullow, Panoro and their respective subsidiaries, Tullow Overseas Holdings B.V. and Panoro Energy Holding B.V. have signed a sale and purchase agreement (EG SPA), with the consideration payable thereunder calculated with effect from 1 July 2020, pursuant to which Tullow Overseas Holdings B.V. has agreed to transfer its entire shareholding in Tullow Equatorial Guinea Limited (TEGL) to Panoro Energy Holding B.V. for cash consideration of US$89 million payable at completion of the EG Transaction (based on a locked box mechanism as at 1 July 2020 and subject to a customary locked box indemnity for a period of 6 months after completion). Deferred consideration of US$5 million is payable on the later of (i) completion of the EG Transaction, or (ii) within two business days of completion of the Dussafu Transaction and additional contingent consideration payments of up to a maximum of US$16 million in aggregate will be payable over a 5 year period, triggered by meeting a production threshold and payable in years where that threshold is met and average oil prices are greater than US$60/bbl.

Confirmation has been received from the Ministry of Finance, Economy and Planning that the disposal of TEGL will not trigger any Equatorial Guinean tax. Equatorial Guinea’s national oil company (GEPetrol) has waived its preferential right to acquire Tullow’s interests in Equatorial Guinea. The EG Transaction is not subject to any further rights of pre-emption.

Subject to completion, the EG Transaction will remove all future capital expenditure associated with TEGL, forecast to be around US$12 million in 2021 and Tullow will no longer hold any assets in Equatorial Guinea beyond retaining exposure to the Equatorial Guinea operations via the potential contingent payments described above. Upon completion of this transaction, Tullow and its consolidated subsidiaries and subsidiary undertakings’ (the Group) production forecast for 2021 will reduce by c. 4,500 bopd. Group 2P reserves will reduce by approximately 14 million barrels, 3P reserves will reduce by approximately 22 million barrels and 2C resources will reduce by approximately 26 million barrels.

Under the UK Listing Rules, the EG Transaction constitutes a Class 1 transaction and is therefore conditional on the approval of Tullow’s shareholders by a simple majority.

Subject to the satisfaction of the conditions to completion of the EG Transaction, including Tullow and Panoro shareholder approvals and customary government and other approvals, the EG Transaction is expected to complete in the first half of 2021.

Dussafu Transaction highlights

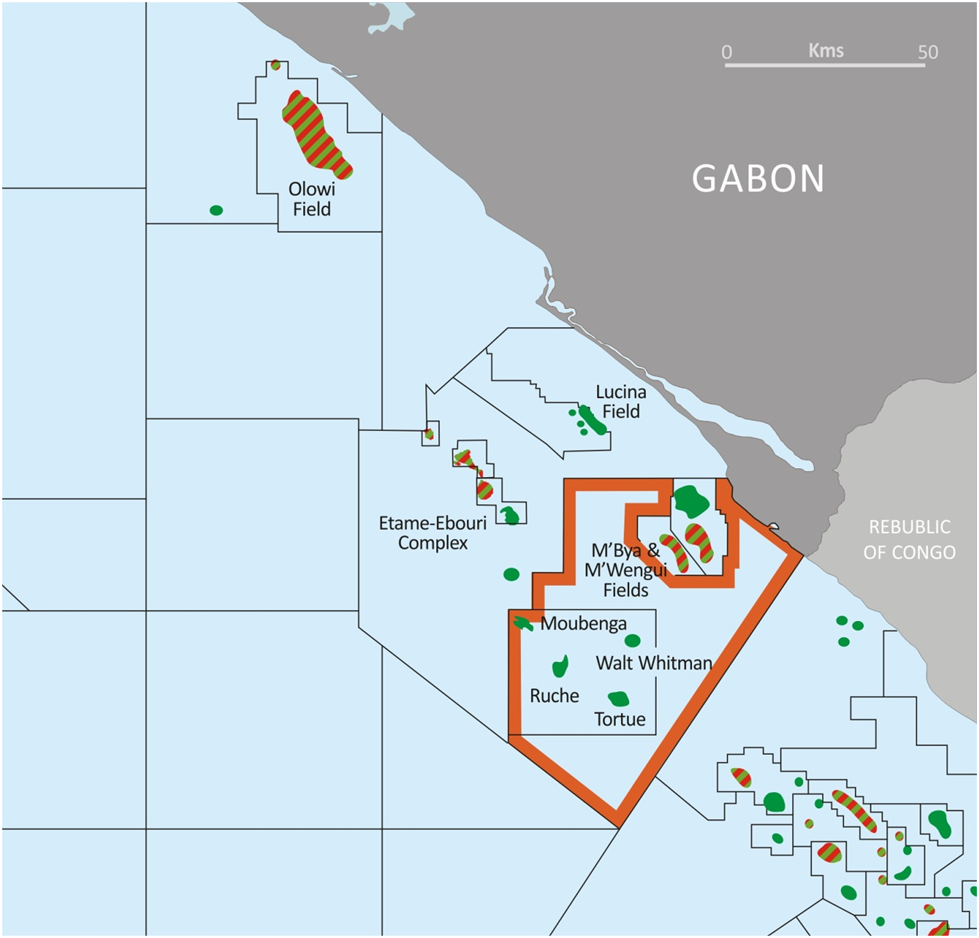

Tullow, Panoro and their respective subsidiaries, Tullow Oil Gabon SA and Pan Petroleum Gabon B.V., have also signed a sale and purchase agreement (Dussafu SPA), with an effective date of 1 July 2020. Under the Dussafu SPA, Tullow Oil Gabon SA has agreed to transfer its (i) entire 10% undivided legal and beneficial interest in the Dussafu Marin Permit Exploration and Production Sharing contract (Dussafu PSC) in Gabon and (ii) its interest in and under certain other documents related to the Dussafu PSC (the Dussafu Assets) to Pan Petroleum Gabon B.V. for cash consideration of US$46 million payable at completion of the Dussafu Transaction, which is subject to customary working capital and other adjustments at completion. Additional contingent payments of up to US$24 million in aggregate will be payable over a 5 year period once production from the Hibiscus and Ruche discoveries meets an agreed daily average and where oil prices for the relevant year are greater than US$55/bbl.

Subject to completion, the Dussafu Transaction will remove all future capital expenditure associated with the Dussafu PSC, estimated to be around US$14 million in 2021 while Tullow will retain a number of other assets in Gabon it will have no exposure to the Dussafu PSC beyond the additional contingent payments related to the production from the Hibiscus and Ruche discoveries described above. Upon completion of the Dussafu Transaction, Group production forecast for 2021 will reduce by approximately 1,500 bopd, Group 2P reserves will reduce by approximately 5 million barrels, 3P reserves will reduce by approximately 10 million barrels and 2C resources will reduce by approximately 5 million barrels.

Under the UK Listing Rules, the Dussafu Transaction is classified as a Class 2 transaction and is therefore not conditional on the approval of Tullow’s shareholders.

Subject to the satisfaction of the conditions, including Panoro shareholder approval and customary governmental and third-party approvals, the Dussafu Transaction is expected to complete in the first half of 2021.

THE EG TRANSACTION

Background to and reasons for the EG Transaction

Tullow initiated a business review in 2019, involving a thorough reassessment of the Group’s organisation structure, cost base, future investment and asset portfolio plans. This resulted in the sale of assets in Uganda to Total E&P Uganda B.V. for US$575 million in 2020 and completion of an organisational restructuring which is expected to deliver sustainable annual cash savings of over US$125 million.

The Tullow Board also undertook a review of Tullow’s portfolio and corporate strategy which led Tullow to exit a number of licences and countries. Tullow’s new business plan and operating strategy (the New Business Plan and Operating Strategy) was presented to investors and the wider market at a Capital Markets Day on 25 November 2020. The New Business Plan and Operating Strategy is focused on short-cycle, high-return opportunities and the substantial potential associated with Tullow’s producing assets within its large resource base. The New Business Plan and Operating Strategy, alongside a rigorous focus on costs, is expected to generate material cash flow over the next decade, which the Group anticipates will enable reduction of its current debt levels and deliver significant value for its host nations and investors. The New Business Plan and Operating Strategy will deliver production growth in the medium term and the ability to sustain production over the longer term.

At the Capital Markets Day, Tullow also stated that it would continue to consider additional asset sales, provided that they are value accretive and strengthen the balance sheet. The EG Transaction is in line with this strategy, reducing Tullow’s capital commitments and operating expenditure per barrel and allowing the Group to focus its investment on the highest value and highest return opportunities within its portfolio.

Summary of the terms of the EG Transaction

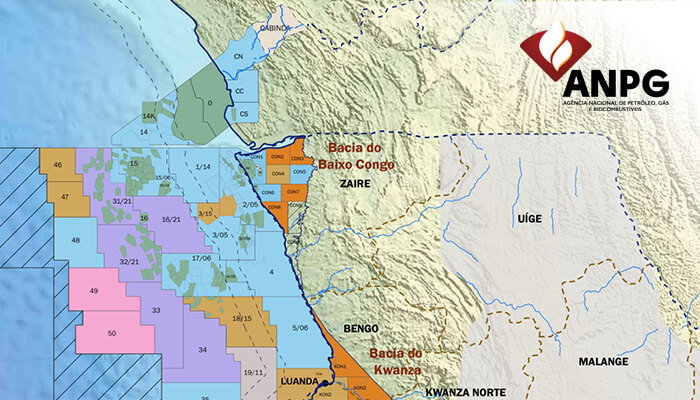

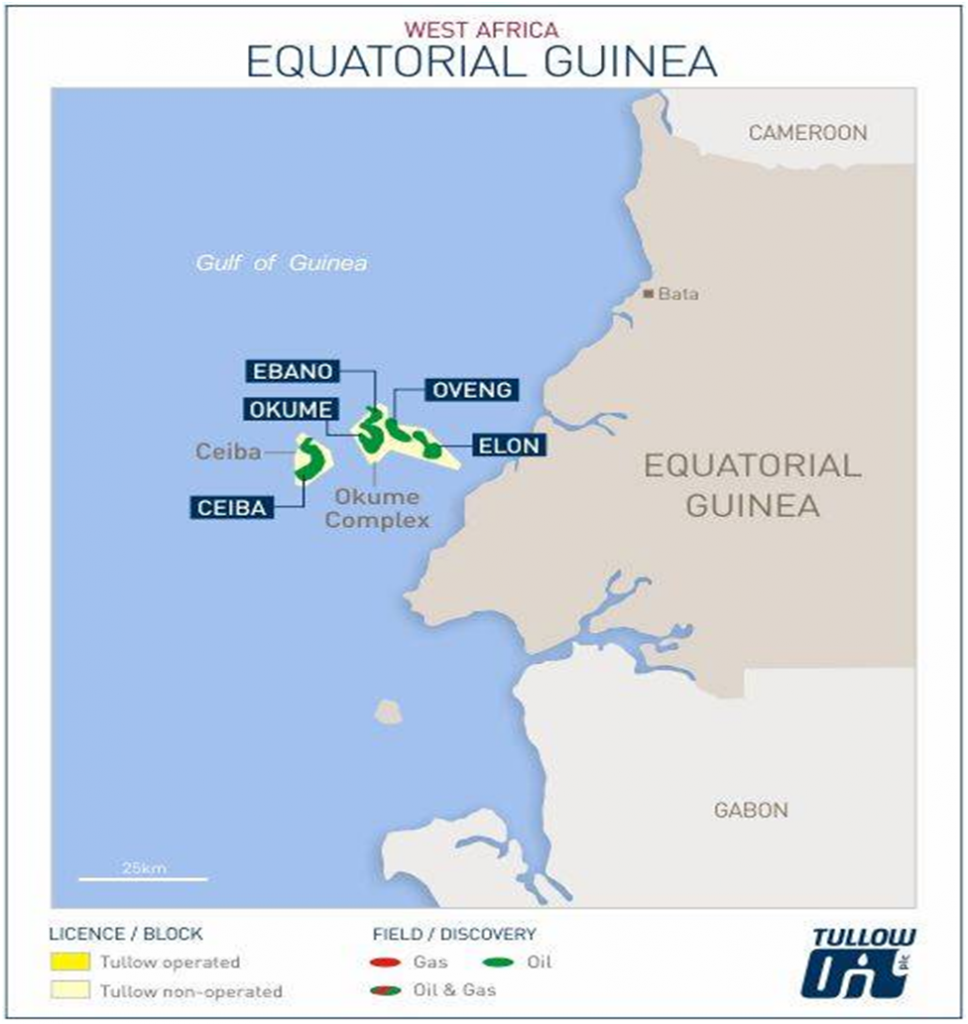

Pursuant to the EG SPA, which was signed today and has an effective date of 1 July 2020, Tullow Overseas Holdings B.V. (TOHBV) has agreed to transfer to Panoro Energy Holding B.V. (Panoro Netherlands) for cash consideration TOHBV’s entire shareholding in Tullow Equatorial Guinea Limited (TEGL). TEGL holds an undivided 14.25 per cent. participating interest in and under (i) the Production Sharing Contract dated 26 March 1997 between Triton Equatorial Guinea Inc and the Republic of Equatorial Guinea (the PSC) and (ii) the joint operating agreement dated 1 June 1999 between Triton Equatorial Guinea Inc, Kosmos Equatorial Guinea Inc and TEGL, both of which relate to two offshore licenses in Equatorial Guinea, encompassing the Ceiba field and Okume Complex (being, together with the share capital of TEGL, the EG Interests).

The EG SPA concerns the transfer of the entire issued share capital of TEGL from TOHBV to Panoro Netherlands in exchange for cash consideration at completion, deferred consideration and contingent consideration determined by oil production and price parameters. The total consideration payable by Panoro Netherlands in relation to the EG Transaction is structured as follows:US$89 million on completion (based on a locked box mechanism as at 1 July 2020 and subject a customary locked box indemnity for a period of 6 months after completion);

- US$89 million on completion (based on a locked box mechanism as at 1 July 2020 and subject a customary locked box indemnity for a period of 6 months after completion);

- Deferred consideration of US$5 million payable on the later of (a) completion of the EG Transaction, or (b) within two business days of completion of the Dussafu Transaction; and

- Potential additional contingent consideration, of up to US$16 million in aggregate, payable only in years where the average net production of the EG Interests is in excess of 5,500 bopd and the average daily Brent oil prices in respect of the relevant year exceed US$60/bbl. Once the foregoing conditions have been reached in each annual period, annual contingent consideration of US$5.5 million will apply to that year and to each of the four subsequent years where that production threshold and oil price is met, subject to the aforementioned cap of US$16 million.

Signing of the EG SPA was conditional on receipt by Tullow from Panoro of a signed commitment letter between an entity within the Trafigura group of companies in respect of fully underwritten debt facilities of up to US$90 million for the financing of the EG Transaction and the Dussafu Transaction. The commitment letter was received on 9 February 2021.

In addition, Panoro is launching an equity fundraising in connection with the financing of the EG Transaction and the Dussafu Transaction through the issue of new ordinary shares to certain existing and new investors, with such issuance being conditional on Panoro shareholder approval at an extraordinary general meeting to be held on or around 3 March 2021. Panoro will procure subscribers for the new ordinary shares for an aggregate amount of US$70 million.

Panoro’s two largest shareholders, Sundt AS and Kistefos AS, have committed to subscribe for new ordinary shares in Panoro, representing an amount of NOK 100 million (approximately US$11.6 million) and NOK 86 million (approximately US$ 10 million) respectively, in Panoro’s equity fundraising. In addition, members of Panoro’s board and executive management team, including its Chairman Julien Balkany and its CEO John Hamilton, are participating in the placing.

Use of proceeds of the EG Transaction

Net proceeds from the EG Transaction will be used to strengthen Tullow’s balance sheet as part of its strategy to reduce its net debt and focus its capital on high-return investment opportunities within its current portfolio.

If completion of the EG Transaction occurs, capital expenditure of the Group will reduce by US$12 million approximately for 2021. Had completion occurred on 30 June 2020, the Group’s total assets would have, before receipt of cash proceeds, reduced by US$101.2 million, being the total amount of the EG Interests as at 30 June 2020. The loss in respect of the EG Interests for the six-month period ended 30 June 2020 was US$ 88.5 million.

Tullow announced its full year results for the year ended 31 December 2019 on 12 March 2020. In these results, the Directors assessed that the Group was a going concern for 12 months from the date of approval of Tullow’s annual report and accounts for the financial year ended 31 December 2019.

At the time of issuing Tullow’s annual report and accounts for the financial year ended 31 December 2019, there were unprecedented market conditions relating to COVID-19 and Brent oil prices. These conditions increased the risk that the Group may not be able to sufficiently progress planned portfolio management activities, as a result of which its lenders may not approve the bi-annual liquidity assessments or covenant amendments under a secured revolving credit facility (RBL Facility) if subsequently required. Therefore, the Directors concluded that there was a material uncertainty that may cast significant doubt that the Group will be able to operate as a going concern.

This assessment of going concern by the Directors was repeated in Tullow’s half year results for the six months ended 30 June 2020 which were announced on 9 September 2020. At that time the Directors once again concluded that there was a material uncertainty that may cast significant doubt that the Group will be able to continue as a going concern due to the Company forecasting a breach of the gearing covenant under the RBL Facility in both December 2020 and June 2021 and a potential liquidity shortfall under the periodic liquidity assessment contained in the RBL Facility at the redetermination dates in January 2021 and March 2021.

Since publication of Tullow’s half year results for the six months ended 30 June 2020, the Company has agreed an amendment with the lenders under the RBL Facility in respect the gearing covenant as at 31 December 2020. As a result, there was no breach of the covenants under the RBL Facility in December 2020. Furthermore, Tullow announced in its Trading Statement and Operational Update issued on 27 January 2021 (the “Trading Statement”) that it has agreed with the lenders under the RBL Facility to an extension of the January 2021 redetermination date by up to one month, with the result that the redetermination is expected to complete by the end of February 2021.

Tullow will provide a further update on its financial position when it issues its audited 2020 Full Year results on 10 March 2021.

Current trading and prospects

In its Trading Statement, Tullow announced that:

- Group working interest oil production in 2020 averaged 74,900 bopd in line with expectations.

- 2020 full year revenue is expected to be c.US$1.4 billion; gross profit is expected to be c.US$0.4 billion.

- Capital and decommissioning expenditure for 2020 were c.US$290 million and c.US$50 million respectively.

- Year-end net debt reduced to c.US$2.4 billion (2019: US$2.8 billion), as a result of US$430 million free cashflow including Uganda proceeds of US$500 million.

- Pre-tax impairments and exploration write-offs expected to be broadly in line with the Group’s 2020 half-year results of US$1.4 billion.

Looking ahead to 2021, Tullow announced in the same statement that:

- Group working interest oil production is forecast to average 60-66,000 bopd in 2021 following the COVID-driven drilling hiatus in 2020

- Capital expenditure is forecast to be c.US$265 million, with an additional c.US$100 million to be spent on decommissioning

- Organisational restructuring completed which is expected to deliver sustainable annual cash savings of over US$125 million.

- In Ghana, production from Jubilee and TEN for the year to date is in line with expectations. This is supported by gas export in excess of 120 mmscfd. A new oil offloading system is due to be commissioned on Jubilee in the first quarter of 2021

- On Jubilee, a drilling rig is being mobilised to commence drilling in the second quarter of the year and the first new production well is forecast to be onstream in the third quarter

Tullow also announced in its Trading Statement that the Group has started discussions with its creditors with regards to its debt refinancing options and these discussions are progressing constructively and are expected to conclude in the second quarter of 2021.

As part of these discussions, Tullow and its lenders agreed to extend the redetermination of the Group’s RBL Facility, which was due to complete in January 2021, by up to one month. This is to allow additional time for the lending banks to review the New Business Plan and Operating Strategy. Following its September 2020 RBL Facility redetermination, Tullow had US$1.8 billion of debt capacity approved by the lending syndicate.

As demonstrated at the Group’s Capital Markets Day, Tullow’s portfolio has substantial potential and a large resource base associated with its producing assets in West Africa where there is extensive infrastructure in place. Tullow believes that these assets, managed with a rigorous focus on costs, will generate material cash flow over the next decade, which the Group anticipates will enable reduction of its current debt levels and deliver significant value for its host nations and investors. Tullow intends to deliver production growth in the medium term and the ability to sustain production over the longer term.

Separately, Tullow retains a 50% stake in an onshore development project in Kenya for which the Kenyan government has agreed an extension of the Second Additional Exploration Period for the 10BB and 13T licence blocks until 31 December 2021. This extension will provide time for Tullow and its partners to conduct a comprehensive review of the development concept to ensure it continues to be robust even at low oil prices and to consider the strategic alternatives for the asset.

Finally, Tullow has a focused but extensive exploration portfolio in Africa and South America. Drilling of the Goliathberg-Voltzberg North (GVN-1) exploration well in Block 47 in Suriname, started in late January 2021 and work continues on developing the prospect inventory on the Orinduik and Kanuku licences offshore Guyana.

As of December 31, 2020, Tullow is also benefitting from a hedging programme which has 60 per cent of 2021 sales revenue hedged. 2021 is hedged with a floor of approximately US$48/bbl, whilst retaining good access to upside in oil prices with caps averaging approximately US$67/bbl. 2022 sales revenue is currently hedged 3% with a floor of approximately US$51/bbl. Tullow’s realised oil price for 2020 was approximately US$51/bbl (versus an average of US$54.1/bbl Brent oil price for the year) including the benefit of approximately US$219 million of net hedge receipts during the period.

Closing of the Ugandan transaction with Total E&P Uganda B.V. took place on 10 November 2020, with US$500 million received from Total as part consideration for the Ugandan Interests. Once a final investment decision is taken (which is expected in 2021), Tullow will receive an additional US$75 million payment by way of deferred consideration with further contingent payments linked to Brent oil price payable after production from the assets in Uganda commences.

As announced on 21 April 2020, Rahul Dhir was appointed as Chief Executive Officer and as Executive Director of the Group with effect from 1 July 2020 and as announced on 9 September 2020, Mitchell Ingram was appointed as an independent Non-Executive Director of the Company with immediate effect.

Approvals, consents and termination rights for EG Transaction

The EG Transaction is classified as a Class 1 transaction as defined by Chapter 10 of the Listing Rules. As such, it is conditional on the approval of Tullow’s shareholders, by a simple majority of votes cast at a general meeting.

Completion of the EG SPA is also subject to a number of other conditions, including:

- Approval by Panoro shareholders of the proposed issuance by Panoro of new ordinary shares in connection with the financing of the EG Transaction and the Dussafu Transaction at an extraordinary general meeting of Panoro shareholders;

- The consent or deemed consent of the Minister of Mines and Hydrocarbons responsible for petroleum operations in Equatorial Guinea having been received in respect of the EG Transaction.

- Release from certain existing security held by BNP Paribas as security trustee under the RBL Facility in respect of the shares and certain assets of TEGL.

- Confirmation that no fact, event or circumstance has occurred or been notified to Tullow that would or may cause Tullow to incur a liability as guarantor under certain intra-company loan notes.

Completion of the EG Transaction is not conditional on completion of the Dussafu Transaction.

The consent of the Minister of Mines and Hydrocarbons was received on 3 February 2021. Under Article 102 of Law No. 8/2006, dated November 3 of Hydrocarbons of the Republic of Equatorial Guinea. It was agreed between TOHBV, Panoro Netherlands and the Government of Equatorial Guinea that a transaction fee of US$9 million would be payable and that this fee would be borne equally by Tullow and Panoro.

Confirmation has been received from the Ministry of Finance, Economy and Planning that no Equatorial Guinean tax arises on the disposal of TEGL.

If the EG SPA is terminated as a result of (i) TOHBV or Tullow’s failure to obtain the approval of its shareholders as required under the Listing Rules, (ii) a breach by TOHBV of its undertaking to use its reasonable endeavours to procure fulfilment of the conditions to completion (with the exception of the condition relating to Panoro shareholder approval) or (iii) where Panoro Netherlands terminates the EG SPA due to failure by TOHBV or Tullow to comply with their completion obligations (in circumstances where Tullow is at fault), then TOHBV shall pay to Panoro Netherlands by way of compensation a break fee equal to US$2 million. If the EG SPA is terminated as a result of (i) Panoro’s failure to either launch or complete its private equity placement through an accelerate book build, (ii) Panoro’s failure to obtain the approval of its shareholders of the equity financing as required under section 10-1 et. Seq. of the Norwegian Public Limited Liability Companies Act 1997, as amended, (iii) a breach by Panoro Netherlands of its undertaking to use its reasonable endeavours to procure the fulfilment of the conditions to completion (with the exception of the condition relating to Tullow shareholder approval) or (iv) where TOHBV terminates the EG SPA due to failure by Panoro Netherlands or Panoro to comply with their completion obligations (in circumstances where Panoro is at fault), then Panoro Netherlands shall pay to TOHBV by way of compensation a break fee equal to US$2 million.

TOHBV and Panoro Netherlands also each have a right to terminate the EG SPA between signing and completion if: (i) the other party fails to comply with their completion obligations at the date of completion of the EG Transaction, or (ii) the other party breaches or becomes subject to any applicable international sanctions.

A circular setting out further details of the EG Transaction and seeking the approval of Tullow’s shareholders for the EG Transaction will be issued in due course.

Subject to the satisfaction of the conditions to the EG Transaction, the EG Transaction is expected to complete in the first half of 2021.

Information on the EG Interests

TOHBV has agreed to transfer the entire issued share capital of TEGL to Panoro Netherlands. TEGL is the licence-holder in respect of the EG Interests, which include TEGL’s undivided participating interests relating to the development and production interests in two offshore licenses, encompassing the Ceiba field and Okume Complex. During 2020, TEGL’s working interest production in these fields was 4,800 bopd.

Tullow acquired TEGL in 2004 through the acquisition of the Energy Africa Group. At that time, TEGL (named Energy Africa Equatorial Guinea Limited) held an interest in the Block G PSC in 2004, including the Ceiba field which was on production and the Okume Complex fields, and had been a partner in the block from the first discovery. In late November 2017, Kosmos Energy Ltd and Trident Energy Management Limited completed the acquisition of the shares in the Hess Corp. licensee entity for US$650 million through a jointly held entity, Kosmos Trident Equatorial Guinea Inc., and this entity took over as operator of the Ceiba field and Okume Complex fields. In February 2019 the equity jointly held by Kosmos-Trident Equatorial Guinea Inc. was split equally between Kosmos Energy Equatorial Guinea and Trident Equatorial Guinea Inc., with Trident Equatorial Guinea Inc. becoming the operator.

DUSSAFU TRANSACTION

Tullow, Panoro and their respective subsidiaries, Tullow Oil Gabon SA and Pan Petroleum Gabon B.V., have also signed a sale and purchase agreement (Dussafu SPA), with an effective date of 1 July 2020. Under the Dussafu SPA, Tullow Oil Gabon SA has agreed to transfer its entire 10% (i) entire 10% undivided legal and beneficial interest in the Dussafu Marin Permit Exploration and Production Sharing contract (Dussafu PSC) in Gabon and (ii) its interest in and under certain other documents related to the Dussafu PSC (the Dussafu Assets) to Pan Petroleum Gabon B.V. for cash consideration of US$46 million payable at completion of the Dussafu Transaction, which is subject to customary working capital and other adjustments at completion. Additional contingent payments of up to US$24 million in aggregate will be payable over a 5 year period once production from the Hibiscus and Ruche discoveries meets an agreed daily average and where oil prices for the relevant year are greater than US$55/bbl.

Subject to completion, the Dussafu Transaction will remove all future capital expenditure associated with the Dussafu PSC, estimated to be around US$14 million in 2021 while Tullow will retain a number of other assets in Gabon it will have no exposure to the Dussafu PSC beyond the additional contingent payments related to the production from the Hibiscus and Ruche discoveries described above. Upon completion of the Dussafu Transaction, Group production forecast for 2021 will reduce by approximately 1,500 bopd, Group 2P reserves will reduce by approximately 5 million barrels, 3P reserves will reduce by approximately 10 million barrels and 2C resources will reduce by approximately 5 million barrels.

Under the UK Listing Rules, the Dussafu Transaction is classified as a Class 2 transaction and is therefore not conditional on the approval of Tullow’s shareholders.

Subject to the satisfaction of the conditions, including Panoro shareholder approval and customary governmental and third-party approvals, the Dussafu Transaction is expected to complete in the first half of 2021. The Dussafu Transaction is not subject to any pre-emption rights.

Summary of the terms of the Dussafu Transaction

Pursuant to the Dussafu SPA, which was signed today and has an effective date of 1 July 2020, Tullow Oil Gabon SA (TOGSA) has agreed to transfer to Pan Petroleum Gabon B.V. (PPGBV) for cash consideration the entirety of TOGSA’s 10% interest in the undivided legal and beneficial interest in the Dussafu Marin Permit Exploration and Production Sharing contract (Dussafu PSC) in Gabon and its interest in and under certain other documents related to the Dussafu PSC (the Dussafu Assets).

The Dussafu SPA concerns the transfer of the Dussafu Assets from TOGSA to PPGBV in exchange for cash consideration at completion of the Dussafu Transaction and contingent annual consideration, subject to future operational performance and oil prices. The total consideration for the Dussafu Transaction is structured as follows:

- US$46 million in cash at completion of the Dussafu Transaction (based on an effective date of 1 July 2020 and subject to customary working capital and other adjustments to be made at completion); and

- Potential additional contingent consideration of up to US$24 million in aggregate may be payable once production commences from the Hibiscus and Ruche discoveries (which is expected in 2023) and the average daily production associated with the developments related to the Hibiscus and Ruche discoveries is equal to or greater than 33,000 bopd over any 60 day continuous period. Once this milestone has been reached, the contingent consideration will apply to that year and to each of the four subsequent consecutive years where the average daily Brent oil price in respect of the relevant year is in excess of US$55/bbl, subject to the aforementioned aggregate cap of US$24 million and an annual cap of US$5 million. No payment will be due in respect of the contingent consideration if the average daily Brent oil price in respect of the relevant year is less than or equal to US$55/bbl. Where the oil price exceeds this threshold, Tullow shall be entitled to 15 per cent. of the net cash flow attributable to the Dussafu Assets, in respect of the relevant year after taking into account operating costs, capital and abandonment costs, insurance costs and a contribution of US$500,000 per annum towards the general and administrative expenses, subject to the annual and aggregate caps noted above.

Signing of the Dussafu SPA was conditional on receipt by Tullow from Panoro of a signed commitment letter from an entity within the Trafigura group of companies, in respect of fully underwritten debt facilities of up to US$90 million for the financing of the Dussafu Transaction and the EG Transaction. As indicated above, the commitment letter was received on 9 February 2021.

In addition, Panoro is launching an equity fundraising in connection with the financing of the Dussafu Transaction and EG Transaction through the issue of new ordinary shares to certain existing and new investors, with such issuance being conditional on Panoro shareholder approval at an extraordinary general meeting to be held on or around 3 March 2021. Panoro will seek subscribers for the new ordinary shares for an aggregate amount of US$70 million. As detailed below, completion of the Dussafu SPA is conditional on, amongst other things, Panoro shareholder approval for the equity fundraising.

Panoro’s two largest shareholders, Sundt AS and Kistefos AS, have committed to subscribe for new ordinary shares in Panoro, representing an amount of NOK 100 million (approximately US$11.6 million) and NOK 86 million (approximately US$ 10 million) respectively, in Panoro’s equity fundraising. In addition, members of Panoro’s board and executive management team, including its Chairman Julien Balkany and its CEO John Hamilton, are participating in the placing.

The Dussafu Transaction is classified as a Class 2 transaction as defined by Chapter 10 of the Listing Rules and therefore is not conditional on the approval of Tullow’s shareholders. However, completion of the Dussafu SPA is subject to a number of conditions, including:Approval by Panoro shareholders of the proposed issuance by Panoro of new ordinary shares in the capital of Panoro in connection with the financing of the Dussafu Transaction and the EG Transaction at an extraordinary general meeting of Panoro shareholders;

- Approval by Panoro shareholders of the proposed issuance by Panoro of new ordinary shares in the capital of Panoro in connection with the financing of the Dussafu Transaction and the EG Transaction at an extraordinary general meeting of Panoro shareholders;

- TOGSA having notified the relevant Gabon governmental authority of the Dussafu Transaction and either (i) having obtained a copy of the letter by which the relevant Gabon governmental authority confirms its approval of the Dussafu Transaction on behalf of Gabon, or (ii) the 30 day period referred to under the Exploration and Production Sharing Contract in respect of the Dussafu Marine Permit having expired without having expressed its opposition to the Dussafu Transaction within this period;

- TOGSA having received written consent of each party to the Joint Operating Agreement in respect of the Dussafu Block, offshore Gabon, to the Dussafu Transaction; and

- If applicable, release from and termination of the pledge provided by TOGSA to BW Energy Gabon SA in respect of a settlement agreement relating to the Dussafu Assets.

Subject to the satisfaction of all of the conditions to the Dussafu Transaction, the Dussafu Transaction is expected to complete in the first half of 2021.

Use of proceeds and financial effects of the Dussafu Transaction

The Dussafu Transaction represents a further step in Tullow’s portfolio management programme and is value accretive to Tullow. Net proceeds from the Dussafu Transaction will be used to strengthen Tullow’s balance sheet as part of its strategy to reduce its net debt and focus its capital on high-return investment opportunities within its current portfolio.

If completion of the Dussafu Transaction occurs, capital expenditure of the Group will reduce by approximately US$14 million for 2021. Had completion occurred on 30 June 2020, the Group’s total assets would have, before receipt of cash proceeds, reduced by US$46.3 million, being the total asset amount of the Dussafu Assets as at 30 June 2020. The losses in respect of the Dussafu Assets for the six-month period ended 30 June 2020 were US$27.4 million.