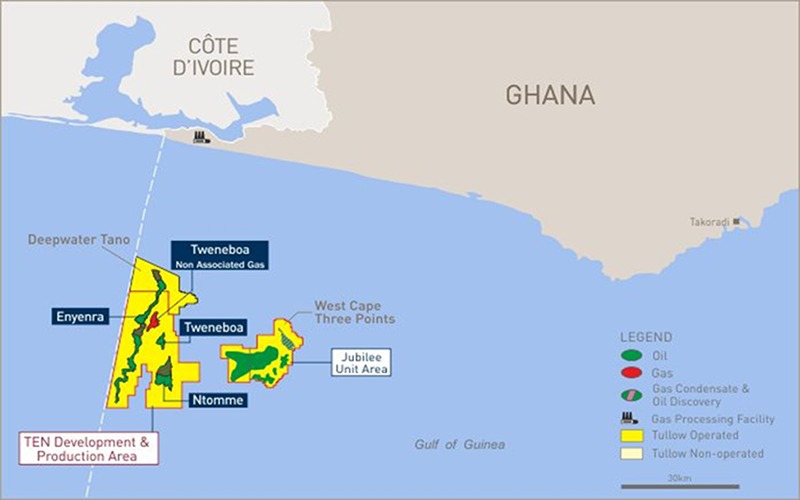

Tullow Oil plc an exploration and production (E&P) company with focused on Africa and operational interest in interests in two exploration – Jubilee and Ten – licences offshore Ghana has issued an update and guidance in advance of the Group’s 2022 Half Year Results scheduled for 14 September 2022.

Merger with Capricorn Energy

On 1 June 2022 Tullow announced that it had reached agreement with Capricorn Energy on the terms of an all-share merger to create a leading African energy company with a material and diversified asset base and a portfolio of investment opportunities delivering visible production growth. This proposed merger will realise meaningful cost synergies and deliver a combined group with robust cash generation and a resilient balance sheet. It will also have a sustainable capital returns programme and a deep commitment to environmental stewardship, social investment, development of local content and its national workforces.

Strategic Update

Tullow has performed well in the first half of the year and has built on the progress that the Group made in 2021. Production in the first half of the year was in line with expectations and drilling performance across the portfolio was strong.

Tullow outlined a number of critical actions for 2022 in its recent Annual Report, and is pleased to report that it has made significant progress on these:

- The pre-emption of the sale by Occidental Petroleum to Kosmos Energy of its interests in the Jubilee and TEN fields in Ghana was completed successfully in March, adding c.4 kbopd of unhedged production.

- On 1 July 2022 Tullow took over the Operation & Maintenance (O&M) of the Jubilee FPSO from MODEC. This is part of a major transformation plan to make the assets in Ghana more efficient and cost-effective, notably sustaining strong FPSO uptimes and targeting further operating cost reductions.

- Tullow and its Partners are in discussions with the Government of Ghana regarding the development of the material resources of c.2 TCF of associated and non-associated gas located in Jubilee and TEN. This will be an important contributor to the long-term energy security of the country.

A confidential process to secure a strategic partner for the material development project in Kenya continues and Tullow is confident that it will make substantial progress in the second half of the year.

Operational Update

Full year Group production guidance has been maintained at 59-65 kboepd, inclusive of incremental production from the successful pre-emption in Ghana.

In Ghana, the ongoing drilling programme, that started in April 2021 has delivered seven new wells, six at Jubilee and one at TEN, at an average cost of less than $50 million per well, more than 10% below the average expected cost for these wells. In addition, two existing wells have been completed, one at Jubilee (J12-WI) and one at TEN (En16-WI).

The Jubilee field has performed well with production of c.82.4 kbopd gross (c.30.8 kbopd net) in the first half of the year, in line with expectations. This year two new water injection wells and one new producer well have been drilled and brought onstream in the Jubilee field, helping to offset natural decline. The current pace of drilling in Ghana is expected to result in an acceleration of the next phase of drilling at Jubilee into the fourth quarter of 2022. These wells will be tied into the Jubilee South East infrastructure in 2023.

The TEN fields produced c.24.3 kbopd (c.12.5 kbopd net) in the first half of the year. No new wells were drilled in TEN in the first half of 2022, however active reservoir management has helped slow the natural decline. A previously drilled water injection well at Enyenra (En16-WI) has been completed and will come onstream later this year to provide pressure support for existing producers. A further Enyenra producer is planned to be drilled and completed later this year. The rig is currently drilling the first of the two strategic Ntomme Riser Base producer wells, which are due to be tied in and brought onstream in the second half of 2023, following installation of a Riser Base manifold.

Production performance has also been supported by strong FPSO uptime of c.99% at TEN and c.95% at Jubilee, including a planned maintenance shutdown of the Jubilee FPSO, which was successfully completed in May. On 1 July 2022, Tullow took over Operations and Maintenance (O&M) of the Jubilee FPSO from MODEC.

In Gabon the Simba expansion project has resulted in increased production from the Simba field of c.6.0 kbopd net to Tullow in the first half of the year. A long-term appraisal well test at the Tchatamba field is on track to start in August, and infill drilling campaigns at the Ezanga and Oba fields are progressing to plan.

In Côte d’Ivoire, production from the Espoir field averaged c.2.1 kboepd in the first half of the year. A two-month shutdown which had been planned for March has been postponed to August. Required cargo tank maintenance work is progressing well and Tullow continues to engage with the operator, CNR International, on identifying development drilling opportunities.

Total net production from the non-operated portfolio in Gabon and Côte d’Ivoire averaged c.17.6 kboepd in the first half of the year, in line with expectations.

In Kenya, as reported above, the Joint Venture Partners continue to make good progress with the farm-down to a strategic partner and the approval of the Field Development Plan (FDP) for Project Oil Kenya. The project is expected to be a key driver of growth, value and diversification for Tullow.

In Guyana, our partner Repsol is currently drilling the c.200mmbbls Beebei-Potaro prospect on the Kanuku Block, in which Tullow has a 37.5% equity, with results expected in the third quarter of 2022.

Financial update

In February, Tullow received $75 million in contingent consideration in relation to Tullow’s sale of its assets in Uganda to TotalEnergies, which completed in November 2020. Tullow will continue to have exposure to the Tilenga Project through additional cash consideration which may be received in the form of contingent payments if the average annual Brent price exceeds $62/bbl once production commences.

Also in February, a panel of arbitrators delivered an award in favour of HiTec Vision (HiTec), judging that discoveries made in the PL-537 Licence (Offshore Norway) between 2013 and 2016 had triggered a further payment under the SPA between Tullow and HiTec regarding the purchase of Spring Energy in 2013. As a result, Tullow made a payment of c.$76 million to HiTec.

In March, Tullow completed the pre-emption related to the sale of Occidental Petroleum’s interests in the Jubilee and TEN fields in Ghana to Kosmos Energy for a total consideration of $126 million, consisting of $118 million upfront and a subsequent post-completion adjustment payment of $8 million. The transaction took Tullow’s equity interests to 39.0% in the Jubilee field and to 54.8% in the TEN fields and added c.4 kbopd of annualised unhedged production to Tullow’s portfolio for 2022. At current oil prices it is expected that this acquisition of additional equity in the Jubilee and TEN fields will have paid for itself by the end of the year.

The Group generated revenue, including the cost of hedging, of c.$0.8 billion in the first half of the year, with a realised oil price of c.$106/bbl before hedging and c.$87/bbl after hedging. Capital expenditure in the first half of the year was c.$155 million.

Taking into account the contingent consideration ($75 million inflow), the arbitration payment ($76 million outflow) and the pre-emption payment ($126 million outflow), and after adjusting for revenues of over $200 million relating to two Ghana liftings which took place in early June but for which cash was received shortly after 30 June 2022, on 1 and 5 July respectively, free cash flow1 in the first half of the year was neutral.

Full year capital expenditure is expected to be c.$380 million, including c.$30 million related to the additional equity interests in Ghana. Full year free cash flow1 guidance remains c.$200 million assuming an average oil price of $95/bbl.

The mandatory prepayment of $100 million of Senior Secured Notes due 2026 in May reduced total debt to $2.5 billion.

“It is two years since I joined Tullow and today, we are in a very different place. A relentless focus on costs, capital discipline and operating performance is ensuring delivery of our business plan. We have also added unhedged production through the pre-emption in Ghana.

Our current business plan is underpinned by assets that yield a deep portfolio of compelling investment opportunities. A continuing and comprehensive review of our resource base has identified additional opportunities to unlock material value, these include:

- Work on the TEN Enhancement Plan, which has identified significant upside to the current 2025 production target of c.50 kbopd (gross). A development concept is currently being finalised for the project, with detailed engineering expected to start later this year.

- Ghana’s gas demand is expected to continue growing strongly, supporting economic development and growth of industry. We have identified approximately 2 TCF of gas resources in Jubilee and TEN. This indigenous resource has the potential to provide energy security for Ghana, while reducing dependence on the highly competitive global LNG market. We are preparing an integrated plan for the rapid development of this material resource.

We also continue to make progress on securing a strategic partner for Project Oil Kenya, which has the potential to be a key driver of growth, value and diversification for Tullow,” Rahul Dhir, Chief Executive Officer, Tullow Oil plc, commented today. Each of these projects has the potential to deliver material returns on capital and further enhance our production and cashflow generation. The proposed merger with Capricorn is an important enabler for a new business plan of the combined group, leveraging the combined resources of both companies and underpinned in part by the accelerated implementation of these projects. With a new business plan, pre-tax cost synergies of $50 million per year, the opportunity to drive down cost of capital and further optimise capital allocation, the combined group will be well positioned to play a leading role in the African energy sector, delivering material value for all shareholders and our host nations. We are preparing a circular and prospectus for shareholders in connection with the proposed merger with Capricorn which we expect will be available in the fourth quarter ahead of a shareholder vote on this proposed merger expected towards the end of the year.”