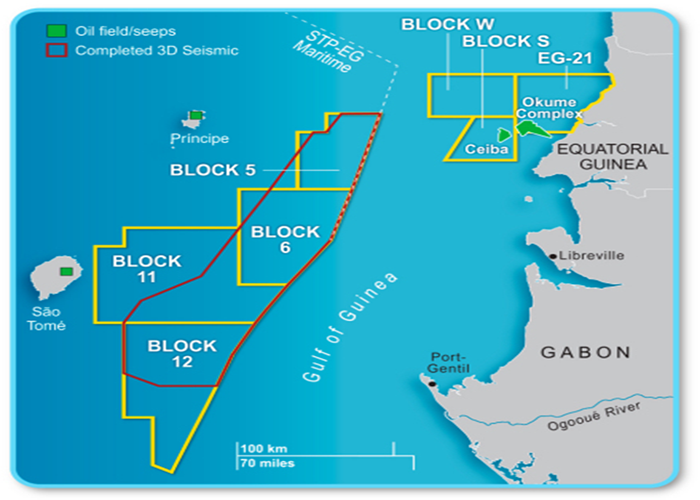

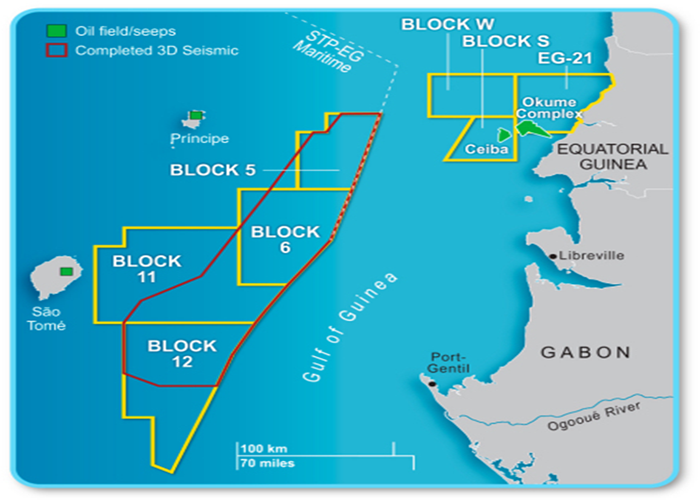

Tullow Oil plc (Tullow) has announced that the sale of its assets in Equatorial Guinea to Panoro Energy ASA (Panoro) has now completed. Tullow received a payment of $88.8 million from Panoro.

As previously disclosed, this transaction also includes contingent cash payments of up to $16 million which are linked to asset performance and oil price. The closing of this transaction follows the satisfaction of all completion conditions, including the approval from the Government of Equatorial Guinea and Tullow and Panoro shareholders and other customary third-party approvals.

Although Tullow will continue to have a financial link to the assets in Ceiba and Okume fields, the closing of this transaction marks Tullow’s exit from its licences in Equatorial Guinea after 18 years. On receipt of funds, Tullow has net debt of c. $2.3 billion and liquidity headroom of c. $1 billion.

The sale of the Dussafu Asset in Gabon to Panoro is expected to complete in the second quarter of 2021. A further $5 million consideration is due be paid to Tullow after both transactions with Panoro have completed.

Tullow is an independent oil & gas, exploration and production group which is quoted on the London, Irish and Ghanaian stock exchanges (symbol: TLW) and is a constituent of the FTSE250 index. The Group has interests in over 50 exploration and production licences across 10 countries including Ghana where it operates the Jubilee and TEN fields. In March 2021, Tullow committed to becoming Net Zero on its Scope 1 and 2 emissions by 2030.