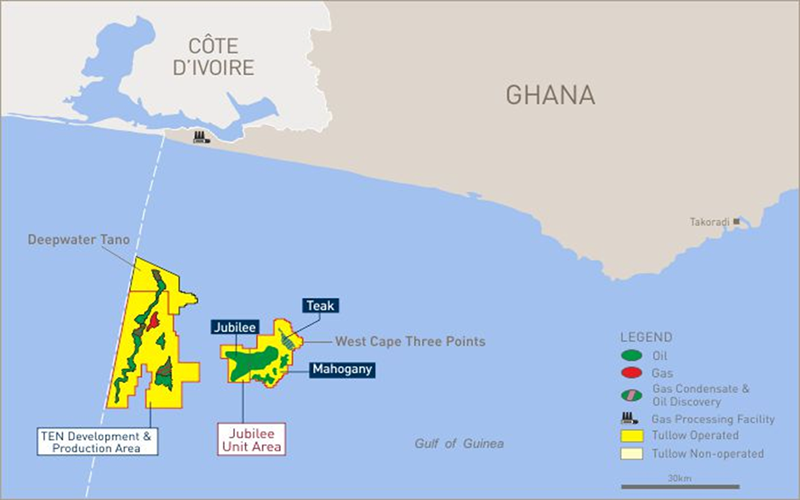

JUBILEE OILFIELD

Tullow has disclosed that its Oil production from Jubilee is averaged 74.9 kbopd (net 26.6 kbopd), ahead of guidance set at the start of the year2021.Jubilee oilfield average daily production has grown from c.70 kbopd at the beginning of 2021 to exceed 90 kbopd by the end of the year, achieved through a combination of new wells brought on stream and improved operational performance.

The drilling programme delivered two producers (J56-P online in July, J57-P online in December), one water injector (J55-WI online in September) and a work over (J12-WI online early in January 2022).Strong drilling performance over the period achieved both cost and efficiency improvements compared to previous drilling campaigns.

Also the FPSO uptime has averaged c.98%; while the gas offtake rates averaged >100 mmscfpd; and water injection rates averaged >200 kbwpd.

According to Tullow, Jubilee production in the year2021 was expected to average between 80 to 84 kbopd (net: 28 to 30 kbopd). This included the impact of a planned maintenance shutdown of approximately two weeks, scheduled to take place in the second quarter.

In 2022, three new wells are planned to be drilled at Jubilee. A water injector is due onstream in the first quarter, which will provide pressure support to existing producers. This will be followed by a producer and a second water injector.

The work programme is focused on delivering reliable in-year production through continued infill drilling as well as investment in projects that will access undeveloped resources and lead to meaningful production growth in subsequent years.

This investment will focus on new infrastructure to support the development of over 170 mmbbls gross estimated ultimate recovery (EUR) in previously undeveloped areas in the eastern parts of the field.

As part of a longer-term operational transformation plan, Tullow, supported by its Joint Venture (JV) Partners, has taken the decision to self-operate the Jubilee FPSO and will take over all operations and maintenance (O&M) from MODEC when the current O&M contract comes to a scheduled end in 2022. This presents an opportunity to realise further efficiency improvements whilst sustaining top quartile production operating performance in terms of safety, emissions, reliability, costs and local content.

Tullow’s commitment in becoming a Net Zero Company by 2030 on its Scope 1 and 2 emissions targets is equally reiterated in the scheduled shutdown of the Jubilee FPSO and this will help facilitates increased gas handling capacity. Planned facility modifications will support increased gas export capability and help towards the target of eliminating routine flaring in Ghana by 2025. Other activities planned during the shutdown will focus on maintenance, integrity and reliability of the FPSO for the long-term.

TEN OILFIELD

Ten oilfield productions in 2021 averaged 32.8 kbopd (net 15.5 kbopd). This was primarily due to higher production decline rates than expected at some wells.

A gas injector at the Ntomme field, (Nt06-GI), was brought on stream in the fourth quarter to provide pressure support to existing production wells. Nt06-GI also encountered oil at the base of the well, de-risking the development potential of areas further to the north of Ntomme.

In 2021, uptime on the TEN FPSO was c.97%, water injection was c.90 kbwpd and gas injection was c.100 mmscfpd.

In2022,TEN oil production is expected to average between 22 to 26 kbopd (net 11 to 12 kbopd), driven by natural decline in the existing wells.

The JV Partners have identified material potential across TEN and a coordinated effort to improve field performance is under way with plans to accelerate production from undeveloped resources in the Greater Ntomme and Tweneboa (GNT) areas.

Drilling in 2022 will focus on further defining future development plans to maximise production and the fields’ value potential. Two strategic development wells are to be drilled in the Ntomme riser base area and an additional well is planned in the Enyenra area in the second half of the year. The JV is also investing in the infrastructure required to allow these wells to be brought on stream from 2023.

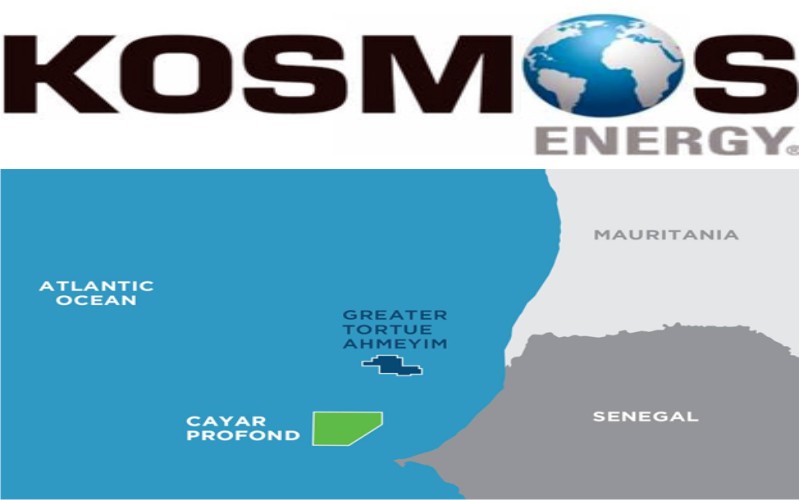

As previously announced, in November 2021, Tullow exercised its right of pre-emption related to the sale of Occidental Petroleum’s interests in the Jubilee and TEN fields to Kosmos Energy for an expected consideration of c.$150 million. Consequently, Tullow’s equity interests are expected to increase to 38.9% in the Jubilee field and 54.8% in the TEN fields upon completion of the transaction. Completion of the transaction remains subject to finalising definitive agreements with Kosmos Energy/Anadarko WCTP Company, and securing approval from the Government of Ghana.