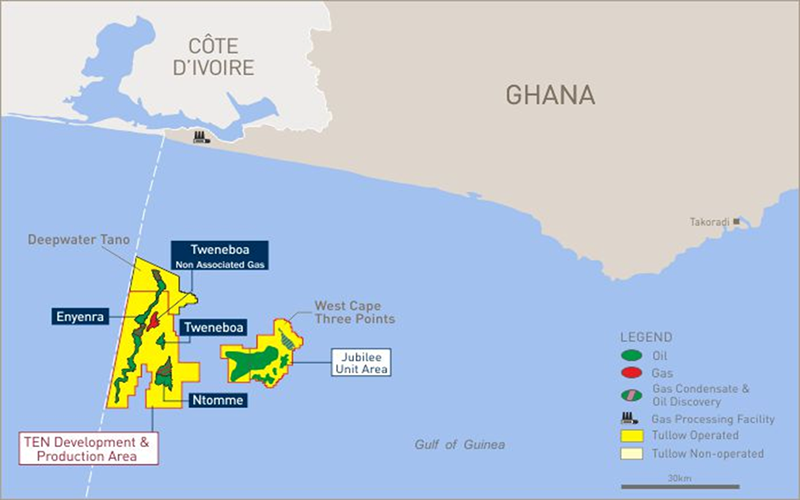

Tullow Oil plc (Tullow) has announced that it has exercised its right of pre-emption related to the sale of Occidental Petroleum’s interests in the Jubilee and TEN fields in Ghana to Kosmos Energy.

Rahul Dhir, CEO of Tullow Oil, commented:

“This is a value accretive, self-funded opportunity for the Group which will increase Tullow’s daily Group production by c.10% and generate additional cash flow to help accelerate debt reduction. Increasing our operated stakes in the Jubilee and TEN fields underscores our commitment to investing in and delivering our Ghana Value Maximisation Plan. This opportunity fits well with our strategy to focus on maximizing value from our producing assets. We look forward to constructive conversations with our JV Partners and the Government of Ghana as we finalise the transaction.”

As per the DWT Joint Operating Agreement (JOA), Tullow has pre-emption rights in respect of the 11.05% participating interest within the offshore DWT Block acquired by Kosmos Energy as a result of its acquisition of Anadarko WCTP Company announced on 13 October 2021. Tullow has exercised its right of pre-emption over this participating interest in DWT and assuming all JV Partners also fully exercise their pre-emption rights, this would increase Tullow’s share in the Block by 7.7% (to a total of 54.8%). This would in turn increase Tullow’s equity interests in the Jubilee and TEN fields to 38.9% and 54.8%, respectively.

The consideration for the 7.7% increase in equity would be c.$150 million with an economic effective date of 1 April 2021, subject to concluding definitive agreements and closing adjustments. The purchase of the participating interest in the DWT Block will be funded from Tullow’s existing resources.

Increasing exposure to these assets is aligned with Tullow’s strategy to focus on its producing assets. The additional equity is expected to increase Group daily production by c.10% and generate over $250 million incremental free cash flow at $65/bbl for Tullow between 2022 and 2026, which will help to accelerate debt reduction.

As of 30 June 2021, based on Tullow’s reported Half Year 2021 Reserves Report, the 7.7% additional equity would increase Tullow’s net 2P reserves by approximately 21 mmboe and has an estimated post-tax NPV 10 valuation of $347 million.

Completion of the transaction remains subject to finalising definitive agreements with Kosmos Energy/Anadarko WCTP Company and gaining approval from the Government of Ghana consistent with the agreed Kosmos/Occidental transaction. Tullow will update the market accordingly as these discussions progress.

In the event that both Kosmos Energy Ghana HC and Petro SA do not pre-empt, Tullow would pre-empt the entire participating interest which would increase Tullow’s equity in the DWT block by 11.05%. The consideration to be paid by Tullow in this event would be c.$206 million, subject to closing adjustments.

Based on Tullow’s Full Year 2020 financial accounts, the loss before tax attributable to the acquired assets would be $30 million and based on Tullow’s interim results as 30 June 2021 the gross asset value of the acquired interests would be $755 million. These figures have been extracted from the Tullow Oil plc consolidated financial statements and pro-rated for an additional equity interest of 11.05% in the DWT Block.