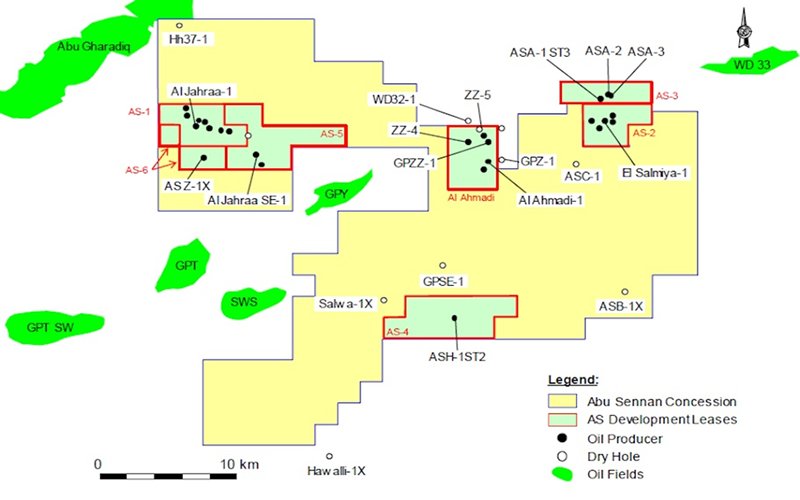

United Oil & Gas PLC, the growing oil and Gas Company with a portfolio of production, development, exploration and appraisal assets is pleased to provide the following reserves update on the Abu Sennan concession, onshore Egypt. United Oil & Gas holds a 22% working interest in the Licence, which is operated by Kuwait Energy Egypt.

Highlights:

Independent reserves and resources report, relevant to end 2020, by Gaffney Cline & Associates (“Independent Reserves Report”) indicates material increase in reserves at Abu Sennan:

24% increase in Abu Sennan Gross 2P Reserves to 16.8 MMboe (15% gas) from 13.5 MMboe at the beginning of 2020, representing a near 200% reserves replacement ratio, before the recent drilling success at the ASH-3 and ASD-1X wells

Gross 1P reserves up by 59% to 6.7 MMboe and gross 3P reserves up by 21% to 34.7 MMboe (from 4.2 MMboe and 28.6 MMboe respectively at the beginning of 2020)

Significant additional growth opportunities evaluated in the report, noting 21 exploration prospects, many with multiple reservoir targets

Reserves

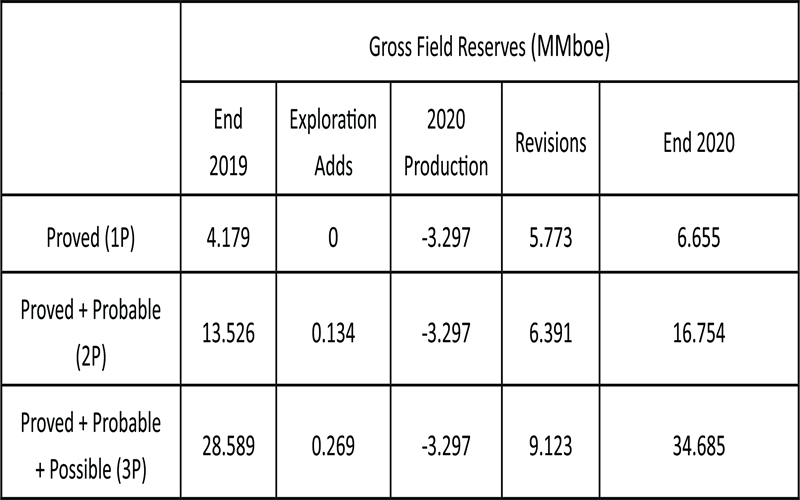

The results of an Independent Reserves Report that was completed on the Abu Sennan concession at the end of 2020 by Gaffney, Cline & Associates, using PRMS definitions for Reserves and Resources, has now become available to United. The comparison with the last reported Reserves as at 31 December 2019 on a Gross Field basis are summarised in Table 1, below.

The report indicates that gross 2P reserves have increased to 16.8 MMboe (15% gas) compared to 13.5 MMboe at the end of 2019. This is an annual increase of 24%, and given that c. 3.3 MMboe was produced from the Abu Sennan assets during 2020, indicates a reserves replacement ratio for 2020 of 198%. Gross 1P and 3P reserves have also increased, and are up by 59% to 6.7 MMboe and 21% to 34.7 MMboe respectively (from 4.2 MMboe and 28.6 MMboe at the beginning of 2020).

Applying United’s 22% working interest to the gross 2P reserves gives 3.7 MMboe, up from 2.97 MMboe at the end of 2019.

The Independent Reserves Report has an effective date of 31st December 2020, and has not incorporated the results of the successful ASH-3 and ASD-1X wells that were drilled since the start of 2021.

Table 1. Reconciliation of Abu Sennan Reserves as at 31st December 2020 with Reserves as at 31st December 2019 on a Gross Field basis

Notes:

1. Revisions are due to production performance in 2020, the results of wells drilled in late 2019 and 2020, notably ASH-2 and El Salmiya-5, and the maturation of the ASH gas development from Contingent Resources to Reserves.

2. The exploration add is the AR-G reservoir at El Salmiya; in the 1P case, all potentially recoverable volumes fall beyond the economic limit given the current development plan

3. Totals may not exactly equal the sum of the individual entries due to rounding

4. United holds a 22% net working interest in the Abu Sennan concession

Prospective Resources

The report also included an evaluation of 21 exploration prospects located within the Abu Sennan concession, of which the largest has gross best estimate Prospective Resources of 5 MMboe and a 35% chance of success.

“It is really pleasing to see the Abu Sennan assets continuing to perform so strongly, and so consistently, with a reserves replacement ratio of over 190% for the second year in a row. We remain confident that the Licence has much more to offer, and indeed, these upgraded reserve numbers take no account of the successes already achieved so far during the 2021 drilling campaign.

This report significantly increases our understanding of the potential of this asset, pointing to 21 potential exploration targets. With further development drilling due to commence shortly at Al Jahraa, and further development and exploration targets identified across the licence, we are looking forward to further news flow and growth from Abu Sennan, both in the coming months and in the longer-term,” United’s Chief Executive Officer, Brian Larkin commented.

Oilfieldafricareview offers you reviews and news about the oil industry.

Get updates lastest happening in your industry.

©2024 Copyright - Oilfieldafricareview.com

Please wait....

Thank you for subscribing...