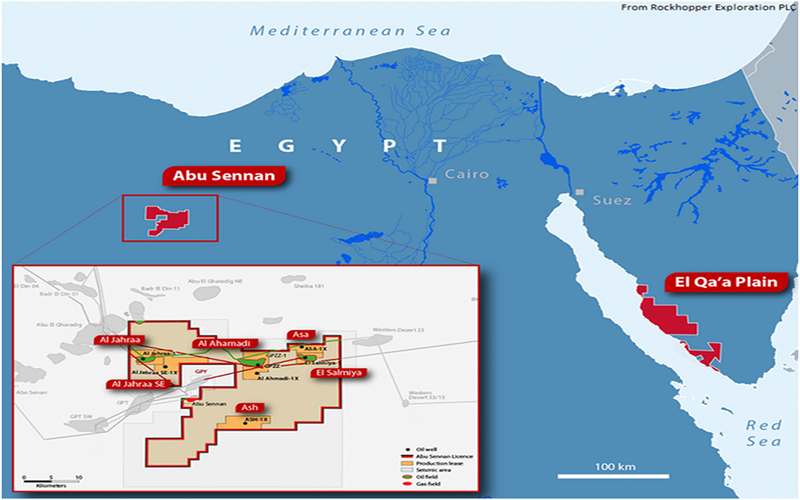

The United Oil & Gas an Africa focus exploration and production firm with interest on Abu Sennan licence (22% working interest) offshore Egypt has announced the First half (1H) 2022 Group working interest production averaged 1,552 boepd (1,290 bopd oil and 262 boepd gas). Second quarter (Q2) 2022 production averaged 1,537 boepd (1,313 bopd oil and 224 boepd gas). 1H and Q2 production was line with full-year 2022 production guidance of between 1,500-1,650 boepd, which remains unchanged. The full-year guidance includes production from the current wells and contributions from two 2022 development wells, AJ-14 (currently drilling) and ASH-4 (location optimised on recently reprocessed seismic data). No production additions have been included for 2022 exploration wells.

2022 Egypt work programme

The 2022 approved work programme consists of five firm wells (three development and two exploration wells) and eight workovers.

The drilling programme commenced in late January 2022 with the ASD-2 development well. The well encountered over 25.5 metres of net pay and was brought onstream less than six days after completion.

The second well, the ASV-1X exploration well, spud on the 14 April. The well was put on test, and although no hydrocarbons flowed, evidence for the migration of hydrocarbons observed in the ASV-1X structure has helped de-risk this element of the petroleum system in this area of the licence and will assist in optimising future well targets.

The third well, the AJ-14 development well, spud on 21 June and drilling is expected to take approx. 60 days.

Two further wells are planned for this year, including an ASH development well, and the ASF-1X exploration well.

The ASH-4 development well location has now been optimised from the recently completed reprocessing of the seismic data. This reprocessing has significantly improved the quality of the subsurface imaging over the ASH field, has increased the interpreted in-place volumes on the field (from 17 to 22 mmboe gross according to operator estimates), and has helped to identify at least seven additional potential development well locations.

Based on the latest interpretation of this reprocessed data, the ASH-4 development well, targeting 2.2 mmbbls gross recoverable oil, has been prioritised and is planned as the fourth well in the 2022 campaign.

The ASF-1X exploration well will be the fifth and final well in the 2022 drilling campaign. This well will target un-risked mean recoverable resources estimated by United at approx.8 mmbbls gross in the Alam El Bueib and Abu Roash reservoirs to the south-west of the ASH field.

Six workovers have so far been completed on the Abu Sennan licence in 2022, including the installation of two Electrical Submersible Pumps on the ASH field.

Financial Update

Revenues

Group Revenues for the six month period ending 30 June 2022 are expected to be circa. $10 million (1H 2021 $10.2 million), with increased commodity prices offsetting reduced average production. The entire revenue for the Group is generated from our 22% interest in the Abu Sennan concession in Egypt and is stated after accounting for government entitlements under the production sharing contract. The 1H 2022 average realised oil price per barrel achieved was $105.5/bbl (representing a discount to Brent of circa $2.37/bbl).

Cash

The company entered the year with cash balances of circa.$400,000. The cash balance as at 30 June 2022 was circa. $3.8 million, which reflects the strong cash collections in 1H of $8.7 million, proceeds from divestments of non-core assets and the improved working capital position. The impact of recent global macroeconomic volatility has resulted in both a devaluation of the Egyptian Pound and restrictions on outgoing US Dollar transfers by the Central Bank of Egypt, which have made it challenging to repatriate cash from Egyptian operations.

We have received USD remittances and have successfully repatriated funds as recently as mid-July. The Group continues to actively manage its working capital position to support our business operations.

Cash Expenditure The Group continues to engage in an active work programme across our portfolio of assets with forecast cash capital expenditure for 2022 of $7.2 million of which $2.9 million was incurred in 1H 2022, including $2.7 million on the drilling programme in Egypt and workover activity in addition to $0.2 million on Jamaica and UK assets.