Upstream investment in Africa: what does the future hold as new investment hotspots replace legacy producers?

Upstream investment in Africa has been slower to recover from the pandemic compared to more agile regions with lower costs.

Upstream investment in Africa has been slow to recover after cuts of 40% during the pandemic. Investment of around US$40 billion annually, or 8% of global capex, may be the new normal. Over half of future investment on pre-sanctioned projects is earmarked for gas and LNG. African countries will undergo a changing of the guard, with new investment hotspots including Namibia and Mozambique replacing legacy producers.

In preparation for Africa Oil Week 2024, where our Head of West Africa Upstream Research, Mansur Mohammed, and SVP, Head of EMEA Consulting, Renaud Brimont, will be presenting, we explore the current challenges and opportunities in Africa’s upstream industry.

An expected increase in green field investment

In the last decade, Africa accounted for 12% of green field investment, and we expect this share to increase in the coming years. Over half of future investment on pre-sanctioned projects is earmarked for gas and liquefied natural gas (LNG).

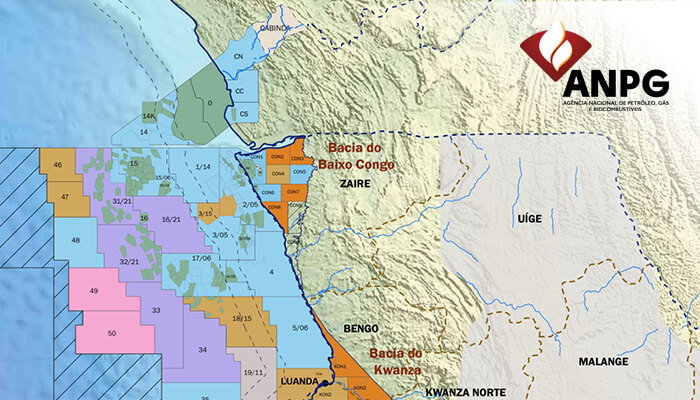

Legacy producers have dominated recent upstream spend in Africa. However, a changing of the guard will see Namibia, Mozambique and Cote d’Ivoire climb the ranks in the late 2020s to become new investment hotspots.

After years of underinvestment, Libya will also return to the fold, becoming a top investment destination. The increased spend in these countries will be driven by ultra-deepwater oil, shallow water gas, and giant onshore LNG projects.

A gradual decline in spending for traditional big players

Despite a predicted drop in spending for the big players: Nigeria, Angola, Algeria and Egypt, the decline will be gradual. We expect that only Egypt will fall from the top six this decade.

Total African upstream spend in 2015 was US$60 billion, which dropped to US$25 billion during the pandemic’s trough in 2020. Investment in deepwater and shelf was pared back aggressively. But we expect a recovery in these resource themes, combined with increased spend in LNG, to restore spending to pre pandemic level by 2025.

Recent fiscal reforms in Algeria and Egypt have increased competitiveness in Africa’s upstream industry. Namibia stands out with high prospectivity and attractive fiscal terms in our Upstream Competitive Index. And Mozambique has stable terms and good deepwater prospectivity. By 2027, Mozambique could become the top country for investment in Africa.

The need to optimise Africa’s resource potential

National oil companies (NOCs) and indigenous companies have been acquirers of mature assets which the Majors have divested. However, accessing capital has often proven difficult, and most assets the Majors have divested from have not seen an uptick in investment.

Companies and governments must work hard to optimise the continent’s resource potential as the Energy Transition gathers pace.

Recent finds in Namibia and Cote d’Ivoire demonstrate that exploration still has an important role to play, despite E&A budgets being smaller.

AOW50: Ministerial Symposium (The Official Meeting of Ministers)

Both Mansur and Renaud will attend the AOW Ministerial Symposium at Africa Oil Week 2024. This roundtable will bring together African governments and energy leaders to discuss the solutions and deals that will shape the future of the African energy sector.

This year’s Symposium is organised in cooperation with the African Union’s African Energy Commission (AU-AFREC) and focused on regional corridors and cross-border energy dialogue. It brings together governments and leading public and private sector players around the opportunities of developing and expanding African energy corridors.

Martijn Murphy, Principal Analyst, North Africa Upstream