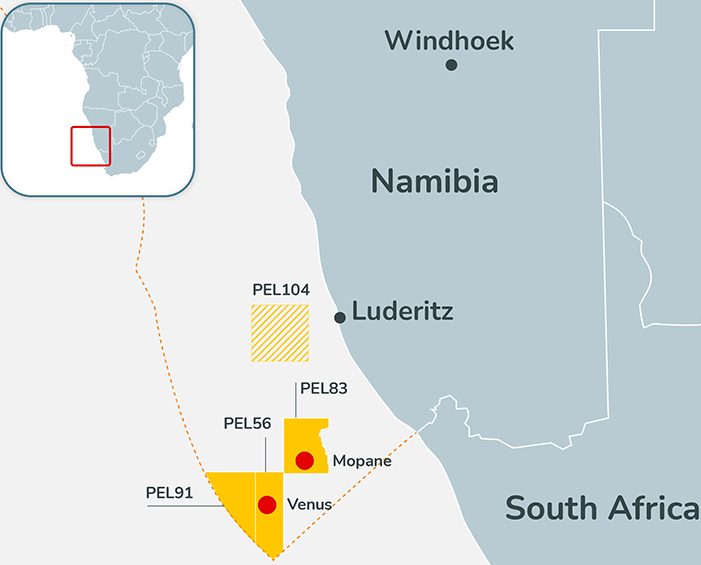

VAALCO Energy has announced that sequel to its former position on the acquisition from Sasol Gabon S.A. (“Sasol”) of Sasol’s 27.8% working interest(1) in the Etame Marin block offshore Gabon, the other joint owners in the Etame Marin block have not exercised their pre-emptive rights. As a result, VAALCO will now move forward with acquiring Sasol’s entire working interest in the field.

In regard to Block DE-8 offshore Gabon, the 60% operated participating interest owner, Perenco, has exercised its preferential rights. As a result, Perenco is acquiring Sasol’s 40% non-operated participating interest(1), releasing VAALCO from the potential obligation to drill an appraisal well. VAALCO will not be subject to any contingency payments due regarding Block DE-8. The terms of the sale and purchase agreement did not attribute a material value to the undeveloped resource at Block DE-8, as such, the purchase price for Sasol’s 27.8% working interest(1) of $44 million less customary post-effective date adjustments has not changed. The maximum future contingency payments have been reduced from $6 million to $5 million.

Additional details regarding the transaction were included in a news release issued on November 17, 2020. Since VAALCO currently owns and operates a 31.1% working interest(1) in Etame, the transaction will almost double VAALCO’s total production and reserves.

Cary Bounds, Chief Executive Officer, commented, “We are excited to move forward with this very attractive and value accretive acquisition. Based on production performance in November, our production capacity, including volumes acquired from Sasol, would be over 9,000 barrels of oil per day and with the recent increase in oil pricing, this should significantly boost our free cash flow profile in 2021. In addition, this transaction is lowering our breakeven cost per barrel by increasing production with minimal increases to G&A expense. While we are disappointed that we will not be participating in Block DE-8, this eliminates the cost to drill the appraisal well, thereby reducing our overall capital commitment in 2021 by between $7 million and $9 million and removes the $1 million potential contingency obligation. We are even more confident in the future for VAALCO and this acquisition coupled with the new proprietary 3-D seismic data we are processing over the entire Etame Marin block will allow us to maximize the value of our Gabon resources. We are well positioned to profitably grow and generate free cash flow in the near and long-term which should enhance value for our shareholders.”