VAALCO Energy has announced that it has now completed the previously announced acquisition of Sasol Gabon S.A.’s (“Sasol”) 27.8% working interest(1) in the Etame Marin block offshore Gabon, increasing the Company’s total working interest to 58.8%.

Key Highlights

- Nearly doubles VAALCO’s total net production and reserves;

- Expected to be immediately accretive to VAALCO, with minimal additional variable costs;

- Anticipated to materially increase free cash flow(2) in 2021 and beyond, particularly in the current increasing price environment;

- Paid $29.6 million in cash to Sasol, taking into account the agreed upon transaction price of $44 million, the deposit already paid and post-effective date adjustments, with a future contingent payment of up to $5 million; and

- Funded the closing of the acquisition entirely from cash on hand and cash from operations.

Cary Bounds, Chief Executive Officer, commented, “We are extremely pleased to close this transformational and accretive transaction in a rising price environment. All cash payments were funded entirely by cash on hand. With the additional production from the acquisition, we are forecasting significant cash flow generation in 2021. In addition, we believe the recently acquired 3D seismic will improve our subsurface interpretation at Etame and lead to another successful drilling campaign, starting late this year or early next year, funded from cash on hand and cash from operations. Sustained operational and robust financial performance at Etame serves as the foundation for growing the Company through future accretive acquisition opportunities in line with our strategy and operational expertise in West Africa.”

The transaction had an economic effective date of July 1, 2020. Taking into account the $4.3 million deposit, net cash flow from the Sasol interest through closing and other purchase price adjustments, VAALCO paid $29.6 million to Sasol at closing from cash on hand. VAALCO’s reserves, production and financial results for the Sasol interest being acquired will be included in the Company’s results for periods after the closing date of the transaction.

Contingent Payments

Under the terms of the agreement, a contingent payment of $5 million will be payable to Sasol by VAALCO if Brent oil pricing averages greater than $60 per barrel for 90 consecutive days during the period from July 1, 2020 to June 30, 2022.

(1) Prior to the

closing of the acquisition, VAALCO’s working interest in Etame was 31.1% and

its participating interest was 33.6%; Sasol’s working interest in Etame was

27.8% and its participating interest was 30%. All NRI production rates and

volumes are based on working interest less 13% royalty volumes.

(2) Free

cash flow is calculated as (i) revenues less production expenses, general and

administrative expense, annual abandonment funding and current income tax

expense divided by (ii) the number of NRI barrels of oil sold.

About VAALCO

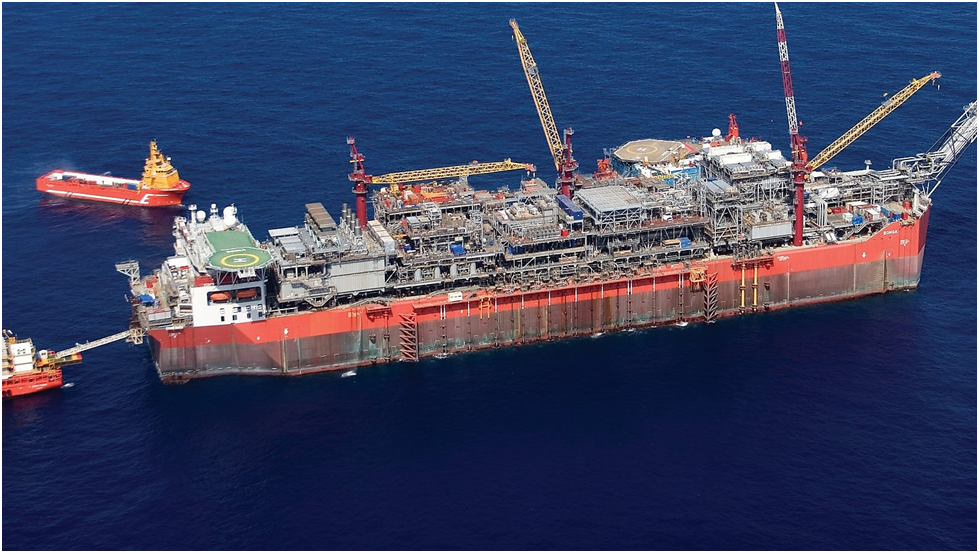

VAALCO, founded in 1985, is a Houston, USA based, independent energy company with production, development and exploration assets in the West African region.

The Company is an established operator within the region, holding a 63.6% participating interest in the Etame Marin block, located offshore Gabon, which to date has produced over 120 million barrels of crude oil and of which the Company is the operator.