VAALCO Energy has announced that it has entered into a sales and purchase agreement (SPA) to acquire Svenska Petroleum Exploration AB, a privately-held exploration and production company based in Stockholm, Sweden. Svenska’s primary asset is a 27.39% non-operated working interest in the deepwater producing Baobab field in Block CI-40, offshore Cote d’Ivoire in West Africa.

The gross consideration for the Acquisition is $66.5 million, subject to customary closing adjustments, with an effective date of October 1, 2023. The gross purchase price will be partially funded by a pre-closing dividend of cash on Svenska’s balance sheet to the Seller with the balance funded by a portion of VAALCO’s cash-on-hand with no issuance of debt or equity. Closing of the Acquisition is expected in the second quarter of 2024, with ultimate timing dependent on final receipt of all necessary approvals. VAALCO currently estimates that the net cash due at closing will be in the range of approximately $30 to $40 million, dependent on timing.

“Building a diversified portfolio of high performing assets is a key component of our strategic vision. We believe that this acquisition enhances all the key aspects of our strategy. It provides us with additional diversification, strong production and reserves from a proven producing asset, significant organic upside opportunity that is well defined, enhances our ability to generate sustainable cash flow and continue to return cash to shareholders.

“The Baobab field in Cote d’Ivoire has many parallels with Etame in terms of the historic production profile and how the upside is realized through development drilling campaigns meaning this is an asset type that we understand well. The field has been significantly de-risked through the drilling of 24 production wells, five injection wells and a near 20-year production history. The planned dry-docking and upgrading of the FPSO in 2025 will position us well for the expected production growth from the 2026 drilling program and for future drilling campaigns for many years to come.

“We are partnering with a great operator and believe our significant development experience offshore West Africa and the successful managing of our FPSO changeover in 2022 will provide insight and experience to help enhance future success at Baobab. We are adding an asset with strong current production and reserves at a very attractive price and using a portion of our cash on hand to fund the deal. This is highly accretive on key metrics to our shareholder base and provides another strong asset to support future growth.”

“Our strategic vision has proven highly successful and VAALCO is financially stronger, with more reserves and production, than at any other time in our history. We are in an even better position now to grow in 2024 and beyond. We continue to have no bank debt and we will use our strong cash position to fund organic and inorganic growth opportunities as we remain focused on growing the business. The diversity and strength of our assets are paramount and support our ability to sustainably grow our production and reserves, and generate cash flow while returning value to our shareholders,” George Maxwell, VAALCO’s Chief Executive Officer commented.

Svenska Acquisition Investor Presentation

Additional information regarding the acquisition and assets being acquired is available in an investor deck on VAALCO’s website in the Investor Relations section under Presentations.

Overview of the Acquisition

VAALCO will acquire 100% of the share capital of Svenska from Petroswede AB in the Acquisition with an effective date of October 1, 2023. Gross consideration for the Acquisition is $66.5 million, subject to customary closing adjustments, with the net cash payment to be made by VAALCO on closing expected to be approximately $30 to $40 million depending on a number of factors including the timing of closing. The Acquisition is subject to a number of customary closing conditions, including regulatory and government approvals.

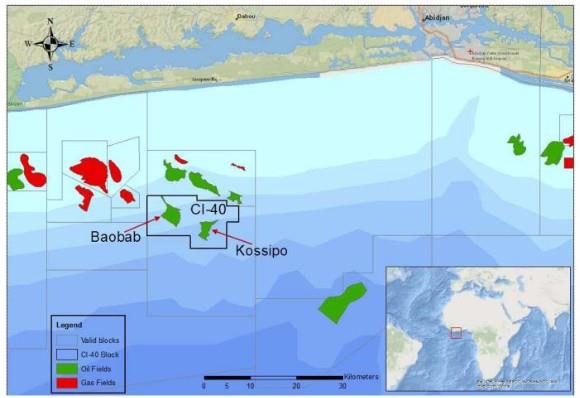

Svenska’s primary license interest is a 27.39% non-operated working interest (30.43% paying interest) in the CI-40 license, which includes the producing Baobab field, located in deepwater offshore Cote d’Ivoire. The field is operated by CNRL, which holds a 57.61% working interest in the project, with the national oil company, Petroci Holding, owning the remaining 15% working interest (10% of which is carried by the other license partners). The Baobab field is located 30 kilometers off the coast of Cote d’Ivoire in water depths ranging from 900 to 1,300 meters.

Baobab consists of five distinguishable reservoir units in Middle to Late Albian sequences. The field was discovered in March 2001 with the Baobab 1X well and a second well, the Baobab 2X, was drilled in 2002 to appraise the field. Commercial production from the field began in August 2005. There have been four drilling campaigns at Baobab to date, with the most recent including four production wells and two water injection wells. All wells are tied back to four subsea manifolds that are connected to an FPSO. Cumulative gross production from the field has been approximately 150 MMBOE, a portion of the estimated over one billion barrels of oil equivalent volumes initially in place.

Current production from the Baobab field is approximately 4,500 WI BOEPD, with 1P WI CPR reserves at the Effective Date of 13.0 MMBOE (99% oil), and 2P WI CPR reserves of 21.7 MMBOE (97% oil). These reserve figures reflect currently sanctioned development activities; however, CI-40 has a significant growth runway with incremental development potential on the Baobab field, as well as the nearby Kossipo field, expected to provide a material uplift to the reserve and production volumes, supporting long-term production of the asset into the late 2030s.

The Acquisition value represents an attractive valuation multiple at $5.12 per BOE 1P WI CPR reserves, or $3.06/BOE of 2P WI CPR reserves based on the full gross consideration. Adjusted to reflect the expected net cash due on closing from VAALCO, likely in the range of $30 to $40 million, these metrics could reduce to as low as $2.31/BOE and $1.38/BOE, respectively. On a value per flowing WI BOE, at the gross purchase price, this equates to about $14,800 per flowing WI BOE and as low as $6,700 per flowing WI BOE at the low end of the expected net cash payment range, substantially below VAALCO’s current implied market value as of February 28, 2024 of about $19,900 per flowing WI BOE.

CI-40 has a long history of production and significantly de-risked reservoirs. With almost 20 years of production to date, the FPSO is planned to come off station at the start of 2025 for planned maintenance and upgrade work to allow the FPSO to continue to produce through the end of the expected extended field license in 2038. The scope of work for the FPSO upgrade is currently being finalized. Production on Baobab is expected to re-start in 2026 following the FPSO work program.

In addition, a fully appraised development drilling program is expected to start in 2026, targeting the significant incremental probable reserve base on the field. VAALCO sees reduced geological risk relating to this drilling program and the joint venture partners have already commenced the ordering of certain long-lead drilling items. Further future drilling phases have not yet been sanctioned, but there is significant incremental potential in both the Baobab field itself, as well as the nearby Kossipo development, which has also been appraised by two wells drilled in 2002 and 2019.

The CI-40 license has an initial term through mid-2028 with the contractual option to extend the license term by 10 years to 2038. Given the development activities associated with the FPSO upgrade and future drilling program, the license partners are currently in discussion with the relevant government bodies in Cote d’Ivoire to secure early license extension on CI-40. The CI-40 license has an attractive fiscal regime, with a cost oil cap at 80% of revenues, a 25% uplift on development capex for cost recovery purposes and (at reasonably expected production levels) a 53% contractor profit oil take. There is no ring-fencing of activities within the CI-40 license, meaning any investment within the block (for example, the future Kossipo development) can be cost recovered from existing production across the wider license.

In addition to the CI-40 license in Cote d’Ivoire, Svenska currently owns a 21.05% working interest in the early stage Uge discovery in the OML 145 concession in Nigeria alongside partners ExxonMobil (21.05%), Chevron (21.05%), Oando (21.05%) and NPDC (15.80%). There are minimal commitments on this license interest and no drilling or development is currently planned.

Advisors

VAALCO has retained Stifel as sole financial advisor, and Mayer Brown International LLP as legal counsel. Svenska Petroleum Exploration AB has retained Evercore Partners International LLP and GKA Advisors LLP as financial advisers and Fieldfisher LLP as legal counsel.