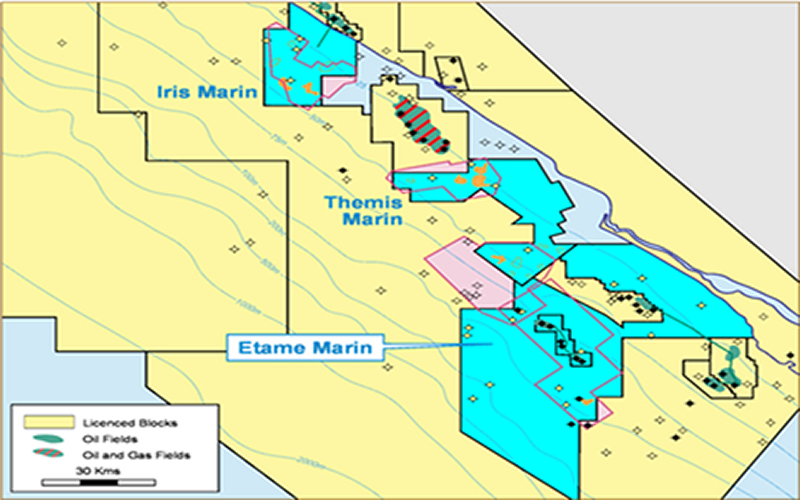

VAALCO Energy has announced the successful completion of the Avouma 3H-ST development well that was drilled from the Avouma platform in the Etame field, offshore Gabon. The initial flow rate of the well was approximately 3,100 gross barrels of oil per day (“BOPD”), which was above VAALCO’s internal expectations.

This sidetrack well targeted existing high-quality Gamba hydrocarbons at the top of a structure that have not previously been produced by prior wells. This is the second successful well of VAALCO’s 2021/2022 drilling campaign.

The company has successfully completed and placed on production the Avouma 3H-ST development well with a lateral of 268 meters in high quality Gamba sands near the top of the reservoir. It further confirmed the extension of Avouma reservoir and is forecasted to increase the overall recovery from the field, potentially allowing for additional wells at Avouma.

In the update, the company also reported well showing strong initial flow rate of approximately 3,100 gross BOPD, 1,586 BOPD net revenue interest (“NRI”) to VAALCO, or 1,823 BOPD to VAALCO’s working interest (“WI”), above VAALCO’s internal expectations.

The update also disclosed that drilling has commenced on the next well in the drilling program, the ETBSM 1HB-ST development well, also on the Avouma platform:

Targeting the Gamba reservoir and Testing the Dentale formation, which is productive in other areas in the Etame license, with the potential to complete and produce from the Dentale in this well.

“We are very excited with the initial results from another highly successful development well at Etame. The initial rates of 3,100 gross BOPD are exceeding our initial internal estimates and demonstrate the potential of this new extension reservoir at Avouma. We have now brought online two successful development wells in 2022 with very strong initial flow rates at an opportune time, with sustained higher Brent pricing.

We have begun drilling our third well, the ETBSM 1HB-ST development well, which will also target the Gamba reservoir, but just as importantly, allow us to test the deeper Dentale formation at South Tchibala which has not yet been delineated in this area.

The increasing revenue we are generating due to the higher pricing and higher production is allowing us to grow our cash position and fund all of our 2022 capital expenditures with cash on hand and cash from operations. We continue to execute on our strategy and deliver strong operational results allowing us to continue to return cash to shareholders through our dividend and increase overall value of our assets,” George Maxwell, VAALCO’s Chief Executive Officer, commented.