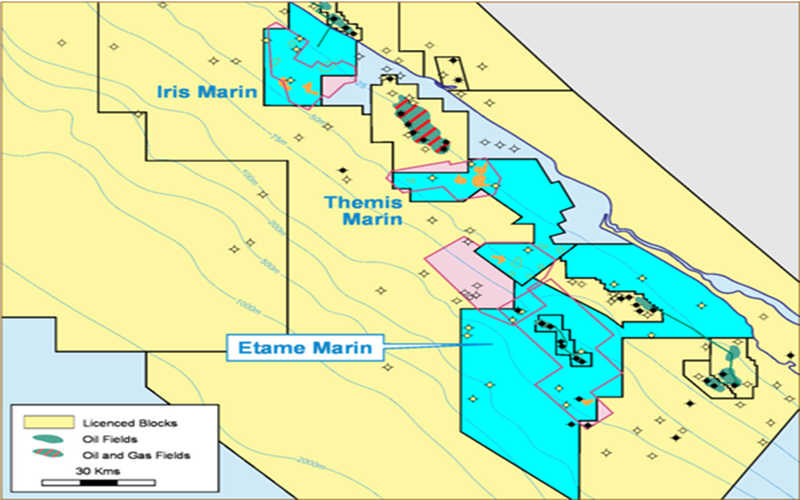

VAALCO Energy has announced the successful completion of the Etame 8H-ST development well that was drilled from the Etame platform in the Etame field, offshore Gabon. This sidetrack well targeted existing Gamba hydrocarbons in the field that have not previously been produced by prior wells and is the first well of VAALCO’s 2021/2022 drilling campaign. The rig has now moved to the Avouma platform and will begin drilling the Avouma 3H-ST development well, the first of two planned development wells on this platform. Additionally, VAALCO provided an operational and financial update for some key metrics for the fourth quarter and full year 2021.

The company has successfully drilled, completed and placed on production the Etame 8H-ST development well with a lateral of 162 meters in high quality Gamba sands near the top of the reservoir. Reports showed strong initial flow rate of approximately 5,000 gross barrels of oil per day (“BOPD”), 2,560 BOPD net revenue interest (“NRI”) to VAALCO, or 2,940 BOPD to VAALCO’s working interest (“WI”), above VAALCO’s internal expectations. There is further report of solid production for Q4 2021 of about 7,550 BOPD NRI, and full year 2021 production of 7,120 BOPD NRI, both above the midpoint of guidance.

There is Preparation for VAALCO to spud the next well in the drilling program, the Avouma 3H-ST1 development well, which is also targeting the Gamba reservoir and the disclosure of estimated revenue for Q4 2021 was strong at approximately $57 million and about $200 million for full year 2021.

VAALCO said that it will Continue to maintain a debt-free balance sheet and stated that the cash balance at December 31, 2021 was approximately $48.7 million which did not include the proceeds from the December lifting of $22.5 million which were received in January 2022 as its expects new production from 2021/2022 drilling campaign along with an increased pricing environment should help to drive additional cash flow in 2022.

“We continue to execute on our strategy and deliver strong operational and financial results, while growing our cash position to fund our organic capital expenditures, future strategic initiatives and return cash to shareholders through our dividend. We brought the Etame 8H-ST well online with very strong initial flow rates at an opportune time, with Brent selling near $90 per barrel. We are preparing to drill the next well in our 2021/2022 drilling campaign at Avouma, another development well targeting the Gamba reservoir. We continue to generate strong revenue which is allowing us to grow our cash position and fund our capital program with cash on hand and cash from operations. We are excited about the future for VAALCO with the continued development of our interests in offshore Gabon, upside opportunities in Equatorial Guinea and the potential to integrate accretive acquisitions aimed at further strengthening VAALCO and growing shareholder value, “George Maxwell, VAALCO’s Chief Executive Officer, commented.

Operations Summary

With the drilling of the Etame 8H-ST well, VAALCO began its 2021/2022 drilling campaign in December. The well had initial flow rates of approximately 5,000 gross BOPD, but has been choked back to about 4,200 BOPD for reservoir management purposes. VAALCO has moved the contracted jack-up rig to the Avouma platform to drill the Avouma 3H-ST1 development well. This is another development well targeting the Gamba reservoir and the first of two planned development wells to be drilled on the Avouma platform. The Company is currently planning to drill four wells as part of its 2021/2022 drilling campaign. VAALCO estimates the total cost of the 2021/2022 drilling campaign at Etame to be between $117.0 million and $143.0 million gross, or between $74.0 million and $91.0 million net to VAALCO’s 63.6% participating interest.

Production during the fourth quarter of 2021 was approximately 7,550 BOPD NRI, or 8,700 BOPD WI, slightly above the midpoint of guidance for the quarter. Additionally, production for the full year of 2021 was 7,120 BOPD NRI, or 8,200 BOPD WI, also above the midpoint of guidance.

At December 31, 2021, VAALCO had an unrestricted cash balance of approximately $48.7 million which did not include $22.5 million of proceeds attributable to the December lifting that were collected in January 2022. The Company continues to maintain a debt-free balance sheet.