Victoria Oil & Gas Plc subsidiary, Gaz du Cameroun S.A. (GDC), is the onshore gas producer and distributor with operations located in the port city of Douala, Cameroon, has announced that GDC has received US$5.1 million gross funds from Eneo in line with the final settlement agreement of 16 April 2021.

The company said it Has reached the end of the exclusivity period with a potential buyer of ZAO SeverGas-Invest (SGI), the Company’s fully owned subsidiary which owns the West Medvezhye (West Med) asset, discussions continue on the next steps and its pleased to report that the Environmental and Social Impact Assessment (ESIA) Report on its planned activities on the Matanda Block has been approved.

Further to the Company’s April 1 update, the Parties in the Kemerkol dispute have continued in the exchange of information and settlement discussions.

Eneo Settlement Funds Received

On 16 April 2021, GDC signed a settlement agreement with Eneo relating to the Take-or-Pay invoices for October, November and December 2019 plus associated interest. 2.7 billion FCFA (Central African CFA franc) (circa US$5.1 million) gross funds have now been received by GDC. This payment to GDC represents full and final settlement for all amounts invoiced to Eneo.

West Med

As announced on 1 April 2021, the Company signed a non-binding term sheet with a potential buyer of SGI. This buyer was granted a period of exclusivity to 31 May 2021. Further discussions with the counterparty about the next steps are taking place.

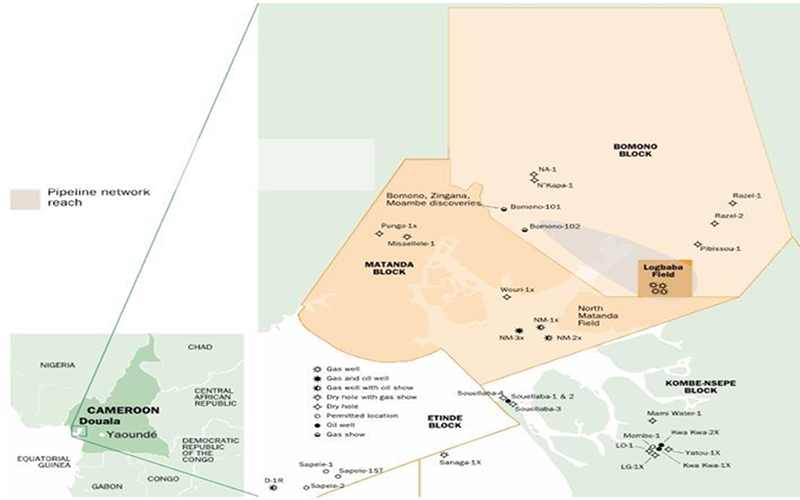

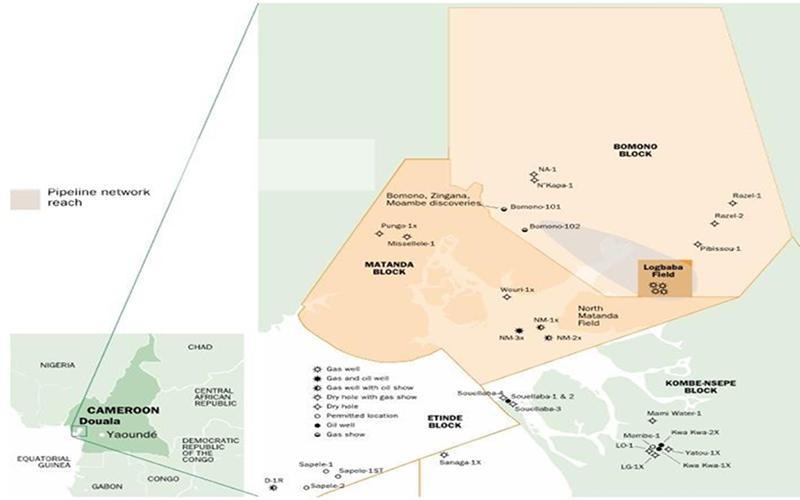

Matanda

GDC is pleased to report that the ESIA Report on its planned activities on the Matanda Block has been approved. The certificate of environmental conformity, as issued by an inter-ministerial committee between The Ministry of Environment, Protection of Nature and Sustainable Development (MINEPDED) and The Ministry of Mines, Industry and Technological Development (MINIMIDT) permits the progress of drilling activities subject to the implementation of an approved Environment and Social Management Plan (ESMP).

Roy Kelly, Chief Executive of the Company, commented:

“We are very pleased to bring the Eneo episode to a close, and the funds significantly strengthen GDC’s working capital position. In addition to the funds received, GDC gains valuable tax credits which will be used to enhance cashflow.

The potential buyer of SGI remains keen but we are carefully considering the next steps to avoid simply entering an open-ended phase.

We are particularly grateful to the relevant Ministries and SNH for their expeditious approval of our ESIA. Despite this being a lightly populated area, we thank the communities and their leaders for coming out to review the ESIA and for engaging constructively with GDC and State representatives. I am happy to add that we have added equal weight to ESG-related criteria as we do technical and commercial ones in our prospect ranking exercise and in the selection of a surface location as we seek to minimise our footprint in the area. Nonetheless, we remain very excited about the exploration prospects in a play that has been significantly derisked by adjacent, tested discoveries.”