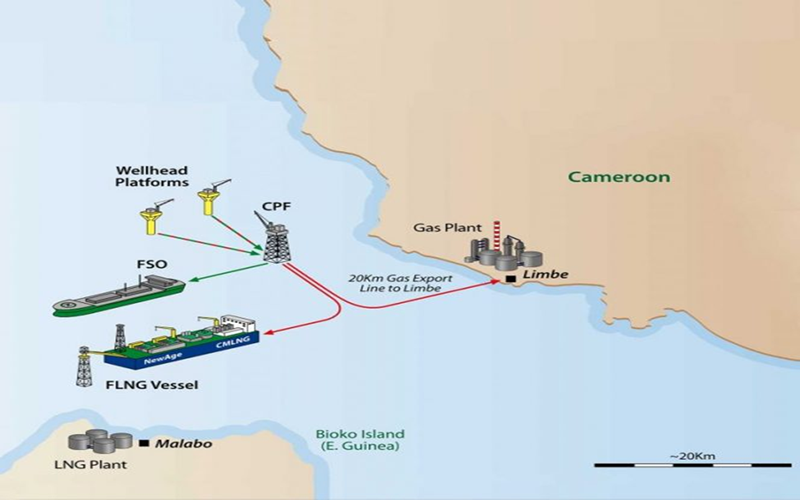

Victoria Oil & Gas ( VOG ), whose wholly owned subsidiary, Gaz du Cameroun S.A. (GDC), is the onshore gas producer and distributor with operations located in the port city of Douala, Cameroon has declared provisional provides update on its operations and corporate activities in various locations as stated below.

Logbaba

Gas production continued in July & August at strong levels of above 5.5 MMscf/d, including the usually slower month of August, which was 10% up on last year.

Matanda

Well site and access road civil works preparations continue with the primary focus on community engagement along the access road whilst contractors wait for the rainy season to come to an end. VOG have not yet been able to conclude a contract on acceptable terms with the rig owner of the Chad-based rig mentioned in earlier publications, so the Company is pursuing an alternate from the tendering exercise. The Company is still seeking a partner to share the cost and risk of the commitment well.

La-108 Insurance Claim

The Company continues to pursue the insurance claim for the well control incident that occurred in March, 2017.

RSM Litigation

Following the Partial Final Award in April and the Addendum in July, the Company continues its settlement discussions with RSM, including recent face-to-face discussions in the U.S. Such discussions have been cordial and constructive, and a framework for settlement has been proposed with a view to signing a term sheet this month, though there can be no guarantee of concluding this or subsequent legal documentation leading to an agreement. Meanwhile the parties, who are partners in the Logbaba project, continue to work together to maximise the value of the Logbaba field.

Consultant Litigation

The Company is in dispute with a former consultant (the “Counterparty”) regarding whether any remuneration is due for services allegedly provided in Cameroon from 2010 and directed at obtaining various licences and authorisations for the Company. This matter was first disclosed in the Annual Report and Accounts for the year ended 31 December 2016 (“2016 Accounts”).

In the 2016 Accounts, the Company reported that certain commercial royalties were subject to legal proceedings (“2017 legal proceedings”) which were initiated by the Company. The 2017 legal proceedings included a substantial counterclaim advanced against the Company. In 2019, the Company elected to withdraw its 2017 legal proceedings due to the apparent financial weakness of the respondent, as he was unable to pay his share of the deposit requested by the ICC ahead of the arbitral proceedings. Consequently, the counterclaim was not pursued by the Counterparty at that time.

In February 2021 the Counterparty initiated an ICC arbitration claim against the Company (“2021 legal proceedings”) in respect of the same subject matter and therefore in substantially the same terms as the counterclaim in the 2017 legal proceedings. In defending the 2021 legal proceedings, the Company noted that once again the Counterparty appeared to be unable to pay his share of the deposit on the dates prescribed by the ICC. The Counterparty was therefore at risk that the 2021 legal proceedings would be struck out. The Company notes that payment of the Counterparty’s outstanding deposit was made, and the virtual arbitration took place last week. The arbitration ruling is currently expected before the end of the year.

Arbitrations under the ICC Rules are subject to data protection and are confidential processes, so VOG is not permitted to provide details or comments on the issues beyond saying that it considers the claim against it in the 2021 legal proceedings to be without merit and that it continues to vigorously defend the claim. The amount under dispute in the arbitration is potentially significant such that an adverse finding could have a material impact upon the position of the Group.

Suspension

Owing to the financial uncertainty created by the ICC Award against GDC, the Company’s shares were suspended from trading on AIM as announced on 4th April 2022. The suspension of VOG’s shares remains in place whilst the Company attempts to finalise a settlement with RSM as noted above. A further announcement will be made later this month to update shareholders.

Funding

Until there is resolution with RSM, the Company is unable to raise funds via the equity markets. In addition, given the debt level and material uncertainty with respect to the ICC Award, it is practically impossible for the Company to raise debt financing. The parent company is therefore currently wholly reliant on internally generated funds, the receipt of which vary in quantum and timing. As a result, the financial position of the Company is precarious. The Company remains in regular communication with its creditors, including one of its major shareholders and loan note holders, Hadron Master Fund, whose Loan Note was due for repayment in April 2021 and who remains supportive of the management team’s efforts to resolve the financial situation of the Company and has re-confirmed its support as previously announced in May.