Nigeria’s total average crude oil production currently stands at 1.18 million barrels per day, which slightly above Angola the current second place African crude oil producer with production stands at 1.12 million barrels per day. Penultimate to the Nigeria recent position as the leading African Hydrocarbon producer, the country has for long suffered declined in crude oil production output owing to incessant crude oil pipelines vandalism in the Niger Delta oil rich region

Nigeria has two major two crude oil trunk pipelines leading to her export terminals- the Escravos and Forcados Export Terminals. The incessant attack on the crude oil pipelines leading to these export terminals have been attributed to the age long youth restiveness in the region. The act of vandalism on this critical infrastructure has consequently affected the crude oil output of the mono-economic country whose major source of foreign exchange dwells basically on crude oil export.

In September 202 the Nigeria daily crude oil production noose dived to 900 million barrels per day. This unprecedented figure culminated to hard economic budgetary planning for Nigeria leading to the award of pipeline surveillance contract to the country’s former Niger Delta agitation henchman Mr. Ekpemupolo Government popularly known as Tom Polo. The N4 billion monthly pipeline surveillance contracts have in turn impacted positively to the recent uptick in the nation’s crude oil product.

The recent allegation leveled on the top hierarchy of the Nigerian military by another former Niger Delta militant warlord Alhaji Asari Dokunbo on being at the forefront of crude oil theft still remains unfathomable. The allegation which has not been proven is unconnected to the recent reshuffling of top military chiefs by the newly elected President Bola Ahmed Tinubu. President Tinubu has vowed to revitalize the decaying Nigeria Oil and Gas sector via strategic and drastic reforms in line with the Petroleum Industry Bill Act.

These presidential reforms include the removal of fuel subsidy, investment in frontier oil exploration and Nigerian Decade of Gas Actualization Target. All these oil and gas reforms were initiated by the immediate past administration of President Mohamadu Buhari and followed up assiduously by the present administration of Ahmed Tinubu. The Petroleum Industry Act is very clear on funding for frontier exploration. Section 9 specifically provides for 30% of profit from oil and gas to be set aside towards exploring and developing the frontier basins.

In the foregoing of the above PIA implementation level, many discoveries have been made and seismic activities currently going on in these frontier basins which are Gongola, Bida, Sokoto,Chad, Dahomey and Anambra basins. So the Petroleum Industrial Act should be seen by foreign investors as an enabler that guarantees solid government commitment and sustainability towards investment ventures in the energy sector. A tell-tale-sign of the PIA positive effect is the ability of the Nigeria National Petroleum Corporation Limited to liquidate its Joint Venture counterpart funding backlog standing at the tune of $30 Billion.

With The liquidation of the JV cash call, Multinational oil companies are now confident in executing fresh projects on a new financial optimism. TotalEnergies has since key in to this new exploration horizon ushered by the PIA as the company is venturing into new projects and spudding new wells. The company has recently made fresh oil discovery at OML 102 in the Southeastern part of Nigeria and The UBETA project is currently in the pipeline.

The Ntokon oil and gas discovery on OML102 offshore Nigeria is located in shallow waters, 60 km off the southeast coast of Nigeria, the Ntokon-1AX discovery well encountered 38 meters of net oil pay and 15 meters of net gas pay, while its side-track Ntokon-1G1 encountered 73 meters of net oil pay, in well-developed and excellent quality reservoirs. Ntokon-1G1 tested successfully up to a maximum rate of about 5,000 barrels per day of 40° API oil.The field is als0 located 20 km from the Ofon field facilities on OML102, Ntokon is planned to be developed through a tie-back to these existing facilities.

“The Ntokon discovery opens a promising outlook for a new tie-back development’’, said Nicolas Terraz, President, Exploration & Production at TotalEnergies. “After the start-up of production of the Ikike tie-back on OML 99 in 2022, this new success in the area further demonstrates the potential of nearby exploration to create value within our low cost, low emission strategy”.

Apparently, the recent uptick in the TotalEnergies exploration activities in Nigeria is being perceived as nexus that spurs other International Oil companies to key start both existing and fresh exploration activities which are believed to be in abeyance owing the delay previously encountered in the passage of the bill. So intuitively the recent visit by the Shell director of upstream is not far from the company’s expected plan to delve into new exploration activities in the Nigeria upstream sector.

Bonga North is a potential vibrate project that Shell is seriously looking into with a huge investment plan. The field is a conventional oil development area located deep offshore Nigeria. According to GlobalData , Bonga North was discovered in 2005, lies in block OML 118 (OPL 212P), with water depth of around 3,346 feet.

The project is currently in the feasibility stage and is expected to start commercial production in 2025. Final investment decision (FID) of the project will be approved in 2023. The development cost is expected to be $5,000 m. Streaming from the Bonga North conventional oil development project is expected to begin in 2025 and is forecast to peak in 2026, to approximately 94,560 bpd of crude oil and condensate and 58 Mmcfd of natural gas.

Another crucial project Shell might be seriously kick-starting in earnest is Bonga Southwest/Aparo. The field is a conventional oil development located in deepwater in Nigeria and was discovered in 2001. Bonga Southwest/Aparo lies in block OML 118 (OPL 212P), OML 140 (OPL 249), and OML 132 (OPL 213), with water depth of around 4,395 feet.

The project is currently in the approval stage and is expected to start commercial production in 2026. Final investment decision (FID) of the project was to be approved by 2022. The Bonga Southwest/Aparo conventional oil development will involve the drilling of approximately 24 wells and includes FPSO and subsea trees.

All these multibillion dollar potential investment projects awaiting take-off are not far from recent the visit of the Shell global upstream director to Nigeria. President Bola Ahmed Tinubu has assured the business community of his government’s commitment to policy consistency and a better business climate to attract investment. The president spoke while receiving the delegation of the Shell led by the Global Upstream Director, Zoe Yujnovic at the State House, Abuja. President Tinubu welcomed the SPDC’s offer for more investments in the Nigerian oil and gas sector, adding that such investments are needed now more than ever, to enable the government to meet its obligations.

The president recalled that attracting fresh investment was “a promise I made personally to Nigerians. Whatever it takes, I will fulfill that promise to Nigerians.”

President Tinubu reiterated that Nigeria is ready for business, assuring the Shell management and other investors of his administration’s willingness to maintain an open-door policy and address their concerns.

“We are open for business. We are serious. I give you the assurance of consistency in policy,” he said.

The president also assured that his government was removing all forms of bottlenecks in order to ensure Nigeria becomes an attractive investment destination.

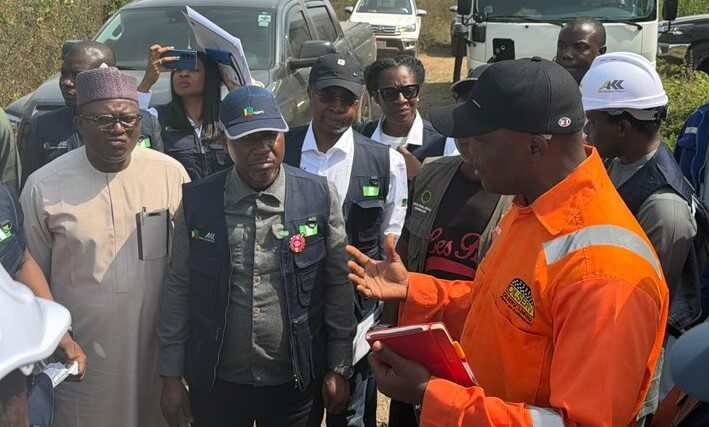

President Bola Tinubu meets delegation from Shell Petroleum Development Company (SPDC)

Addressing the president earlier, Ms Yujnock applauded what she described as an “incredibly strong start” of the Tinubu presidency and expressed optimism that the “bold” steps taken by the government would renew Nigeria’s pride of place as an investment destination.

Ms Yujnock said SPDC was willing to ramp up investment in the country especially in the areas of gas and deep-water assets by pumping in billions of dollars.

She said Nigeria remains a strategic investment country for the company in view of the long history between the two entities and the prospects held by the county’s oil and gas sector.